Unlocking the Secrets of the SF 428 Form

The SF 428 Form is a crucial document in the realm of government contracting, particularly in the context of federal procurement. It serves as a critical tool for tracking and reporting the financial performance of government contracts. If you're involved in government contracting, understanding the intricacies of the SF 428 Form is essential to ensure compliance and avoid potential pitfalls. In this article, we'll delve into five essential facts about the SF 428 Form, providing you with a comprehensive overview of its significance, functionality, and importance in government contracting.

Fact #1: What is the SF 428 Form?

The SF 428 Form, also known as the "Financial Status Report," is a standardized form used by government contractors to report their financial performance on federal contracts. The form is designed to provide the government with a snapshot of the contractor's financial status, including costs incurred, payments received, and remaining funds. This information is crucial for the government to monitor contract performance, manage risks, and make informed decisions about contract modifications or terminations.

Understanding the Purpose and Scope of the SF 428 Form

The SF 428 Form serves several purposes, including:

- Providing the government with a comprehensive view of the contractor's financial performance

- Facilitating contract management and oversight

- Identifying potential risks and issues related to contract performance

- Informing contract modifications or terminations

- Ensuring compliance with federal regulations and policies

The SF 428 Form is typically used in conjunction with other contract management tools, such as the SF 1442 Form (Solicitation, Offer, and Award) and the SF 1443 Form (Contractor's Request for Progress Payment).

Fact #2: Who is Required to Use the SF 428 Form?

The SF 428 Form is mandatory for contractors performing federal contracts, including:

- Prime contractors

- Subcontractors

- Vendors

- Suppliers

Contractors must submit the SF 428 Form on a regular basis, usually quarterly or annually, depending on the contract terms and conditions.

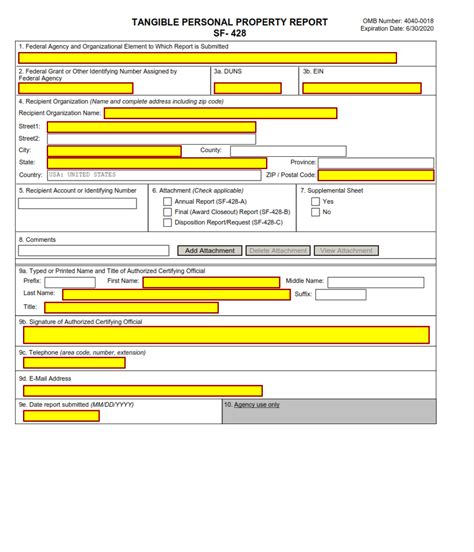

Breaking Down the SF 428 Form: Sections and Requirements

The SF 428 Form consists of several sections, including:

- Section A: Contractor Information

- Section B: Contract Information

- Section C: Financial Status Report

- Section D: Certification

Contractors must provide detailed information about their financial performance, including:

- Costs incurred

- Payments received

- Remaining funds

- Contract modifications or changes

The SF 428 Form also requires contractors to certify the accuracy and completeness of the information provided.

Fact #3: How to Complete the SF 428 Form

Completing the SF 428 Form requires careful attention to detail and accuracy. Contractors should:

- Review the contract terms and conditions

- Gather all necessary financial information

- Complete the form accurately and thoroughly

- Certify the information provided

- Submit the form on time

Contractors can use various resources, such as the Federal Acquisition Regulation (FAR) and the Contract Pricing Reference Guide, to ensure compliance with federal regulations and policies.

Common Challenges and Pitfalls Associated with the SF 428 Form

Contractors may encounter several challenges and pitfalls when completing the SF 428 Form, including:

- Inaccurate or incomplete information

- Failure to certify the information provided

- Late or untimely submissions

- Non-compliance with federal regulations and policies

To avoid these pitfalls, contractors should carefully review the contract terms and conditions, ensure accuracy and completeness, and submit the form on time.

Fact #4: Consequences of Non-Compliance

Failure to comply with the SF 428 Form requirements can have serious consequences, including:

- Contract termination

- Suspension or debarment

- Financial penalties

- Damage to reputation and credibility

Contractors must take the SF 428 Form seriously and ensure compliance with federal regulations and policies to avoid these consequences.

Best Practices for Managing the SF 428 Form

To manage the SF 428 Form effectively, contractors should:

- Establish a robust contract management system

- Ensure accurate and complete information

- Certify the information provided

- Submit the form on time

- Monitor and track contract performance

By following these best practices, contractors can ensure compliance, avoid pitfalls, and maintain a positive reputation in the federal contracting community.

Fact #5: Resources and Support for Contractors

Contractors can access various resources and support to help navigate the SF 428 Form, including:

- Federal Acquisition Regulation (FAR)

- Contract Pricing Reference Guide

- Federal Procurement Data System (FPDS)

- Small Business Administration (SBA)

- General Services Administration (GSA)

Contractors should take advantage of these resources to ensure compliance and success in federal contracting.

What is the purpose of the SF 428 Form?

+The SF 428 Form is used to provide the government with a comprehensive view of the contractor's financial performance, facilitating contract management and oversight.

Who is required to use the SF 428 Form?

+The SF 428 Form is mandatory for contractors performing federal contracts, including prime contractors, subcontractors, vendors, and suppliers.

What are the consequences of non-compliance with the SF 428 Form?

+Failure to comply with the SF 428 Form requirements can result in contract termination, suspension or debarment, financial penalties, and damage to reputation and credibility.

In conclusion, the SF 428 Form is a critical tool in government contracting, and understanding its significance, functionality, and importance is essential for contractors to ensure compliance and success. By following best practices, accessing resources and support, and avoiding common pitfalls, contractors can effectively manage the SF 428 Form and maintain a positive reputation in the federal contracting community.