Taking control of your retirement savings is a significant milestone, and navigating the process can be daunting. If you're a Sentry 401(k) plan participant, understanding the withdrawal process is crucial to making informed decisions about your financial future. In this comprehensive guide, we'll walk you through the Sentry 401k withdrawal form, providing a step-by-step breakdown to help you navigate the process with confidence.

Understanding the Sentry 401(k) Plan

Before diving into the withdrawal process, it's essential to understand the basics of the Sentry 401(k) plan. A 401(k) plan is a tax-deferred retirement savings plan offered by employers to their employees. The Sentry 401(k) plan is designed to help you save for retirement by contributing a portion of your salary to a retirement account on a pre-tax basis. The funds in your account grow tax-free until you withdraw them in retirement.

Eligibility for Withdrawal

To be eligible for withdrawal, you must meet certain conditions. Typically, you can withdraw funds from your Sentry 401(k) account if you:

- Are 59 1/2 years old or older

- Have separated from your employer

- Are disabled or terminally ill

- Need to take a hardship withdrawal (subject to plan rules and IRS regulations)

It's essential to review your plan documents or consult with your plan administrator to determine the specific eligibility requirements for your Sentry 401(k) plan.

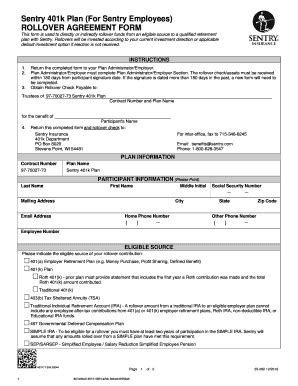

The Sentry 401k Withdrawal Form

The Sentry 401k withdrawal form is a crucial document that you'll need to complete to initiate the withdrawal process. The form will typically ask for the following information:

- Your name and Social Security number

- Your account number and plan name

- The type of withdrawal you're requesting (e.g., lump sum, installment, or loan)

- The amount you wish to withdraw

- Your reason for withdrawal (if required by the plan)

You may be able to access the withdrawal form online through your plan's website or by contacting your plan administrator.

Steps to Complete the Withdrawal Form

- Gather required documents: Before starting the withdrawal process, make sure you have all necessary documents, including your plan documents, identification, and tax-related information.

- Choose your withdrawal type: Determine the type of withdrawal that best suits your needs. You may be able to choose from a lump sum, installment, or loan.

- Calculate your withdrawal amount: Decide how much you want to withdraw, keeping in mind any applicable taxes, penalties, or plan restrictions.

- Complete the withdrawal form: Fill out the withdrawal form accurately and thoroughly, ensuring you provide all required information.

- Submit the form: Return the completed form to your plan administrator, either online or by mail, depending on the plan's requirements.

Taxes and Penalties

When withdrawing from your Sentry 401(k) plan, you'll need to consider the tax implications. Withdrawals are typically subject to income tax, and you may be required to pay a 10% penalty if you're under 59 1/2 years old. However, there are some exceptions to the penalty, such as:

- Separation from service

- Disability or terminal illness

- First-time home purchase

- Qualified education expenses

It's essential to consult with a tax professional or financial advisor to understand the specific tax implications of your withdrawal.

Alternatives to Withdrawal

Before withdrawing from your Sentry 401(k) plan, consider alternative options that may help you achieve your financial goals without tapping into your retirement savings:

- Loan: You may be able to take a loan from your 401(k) plan, which allows you to borrow a portion of your account balance.

- Installment payments: Instead of taking a lump sum, you may be able to receive installment payments over a set period.

- Leave the funds in the plan: If you're not in immediate need of the funds, you can leave them in the plan to continue growing tax-free.

Conclusion

Withdrawing from your Sentry 401(k) plan can be a complex process, but by understanding the eligibility requirements, completion of the withdrawal form, and tax implications, you'll be better equipped to make informed decisions about your retirement savings. Remember to consider alternative options and consult with a financial advisor or tax professional to ensure you're making the best choice for your financial future.

Call to Action

We hope this comprehensive guide has helped you navigate the Sentry 401k withdrawal form process. If you have any questions or concerns, please don't hesitate to reach out to your plan administrator or a financial advisor. Share your thoughts and experiences with us in the comments below, and don't forget to share this article with others who may benefit from this information.

What is the Sentry 401(k) plan?

+The Sentry 401(k) plan is a tax-deferred retirement savings plan offered by employers to their employees.

How do I initiate the withdrawal process?

+You can initiate the withdrawal process by completing the Sentry 401k withdrawal form, which can typically be accessed online or by contacting your plan administrator.

Are there any penalties for withdrawing from my Sentry 401(k) plan?

+Yes, withdrawals from a 401(k) plan are typically subject to a 10% penalty if you're under 59 1/2 years old, unless you meet certain exceptions.