As a taxpayer, you're likely familiar with the process of filing your annual tax return. However, navigating the various forms and schedules can be overwhelming, especially for those who are new to tax preparation. One of the most critical forms for investors and individuals with various types of income is Schedule B, also known as the Interest and Dividend Income statement. In this article, we'll delve into the details of Schedule B, Form 1040, and provide a step-by-step guide on how to complete it accurately.

For many taxpayers, Schedule B is a straightforward form that requires minimal effort to complete. However, for those with multiple sources of interest and dividend income, it can become more complex. Whether you're a seasoned investor or just starting to explore the world of investing, understanding Schedule B is crucial to ensure you're reporting your income correctly and taking advantage of the deductions and credits available to you.

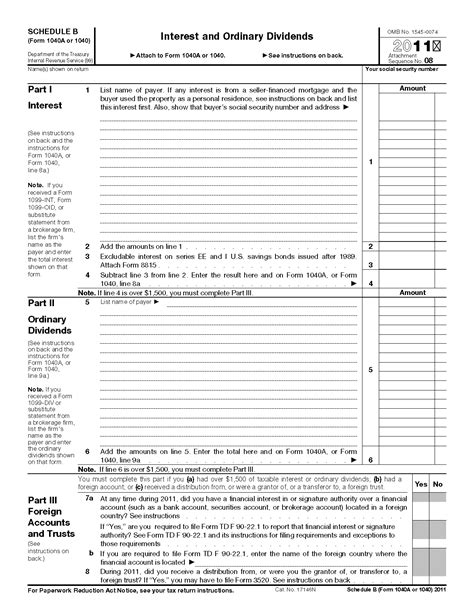

What is Schedule B, Form 1040?

Schedule B, also known as the Interest and Dividend Income statement, is a supplemental form to the standard Form 1040. Its primary purpose is to report interest and dividend income earned during the tax year. This includes income from various sources, such as:

- Interest from bank accounts, certificates of deposit (CDs), and bonds

- Dividends from stocks, mutual funds, and other investment vehicles

- Income from real estate investment trusts (REITs)

- Income from royalty-generating assets, such as intellectual property or natural resources

Who Needs to File Schedule B?

You'll need to file Schedule B if you have interest and dividend income that exceeds $1,500. This threshold applies to the total amount of interest and dividend income received during the tax year, not the individual sources of income. If you have multiple sources of interest and dividend income, you'll need to combine the amounts to determine if you meet the $1,500 threshold.

Step-by-Step Guide to Completing Schedule B

Completing Schedule B requires attention to detail and organization. Here's a step-by-step guide to help you navigate the process:

Part I: Interest Income

- List each source of interest income, including the payer's name, address, and the amount of interest earned.

- Report the total amount of interest income earned from all sources.

- If you have interest income from a foreign source, you'll need to complete Form 8938, Statement of Specified Foreign Financial Assets.

Part II: Dividend Income

- List each source of dividend income, including the payer's name, address, and the amount of dividend income earned.

- Report the total amount of dividend income earned from all sources.

- If you have dividend income from a foreign source, you'll need to complete Form 8938, Statement of Specified Foreign Financial Assets.

Part III: Investment Expenses

- List any investment expenses related to your interest and dividend income, such as investment management fees or safe deposit box fees.

- Report the total amount of investment expenses.

Step 4: Calculate Your Total Interest and Dividend Income

- Add the total amount of interest income from Part I and the total amount of dividend income from Part II.

- Subtract the total amount of investment expenses from Part III.

Step 5: Report Your Total Interest and Dividend Income on Form 1040

- Report your total interest and dividend income on Line 2a of Form 1040.

- If you have any foreign interest or dividend income, you'll need to complete Form 8938 and attach it to your Form 1040.

Common Mistakes to Avoid

When completing Schedule B, it's essential to avoid common mistakes that can lead to errors or even an audit. Here are a few mistakes to watch out for:

- Failing to report all sources of interest and dividend income

- Incorrectly calculating investment expenses

- Not completing Form 8938 for foreign interest or dividend income

- Not signing and dating the form

Tips for Completing Schedule B

To ensure you're completing Schedule B accurately and efficiently, here are a few tips to keep in mind:

- Keep accurate records of your interest and dividend income throughout the year.

- Use tax preparation software to help you calculate your investment expenses and total interest and dividend income.

- Consult with a tax professional if you're unsure about any aspect of the form.

Conclusion

Completing Schedule B, Form 1040, requires attention to detail and organization. By following the step-by-step guide outlined in this article, you'll be able to accurately report your interest and dividend income and take advantage of the deductions and credits available to you. Remember to avoid common mistakes and keep accurate records throughout the year to ensure a smooth tax preparation process.

FAQs

What is the purpose of Schedule B, Form 1040?

+Schedule B is used to report interest and dividend income earned during the tax year.

Who needs to file Schedule B?

+You'll need to file Schedule B if you have interest and dividend income that exceeds $1,500.

What types of income are reported on Schedule B?

+Schedule B reports interest income, dividend income, and income from real estate investment trusts (REITs) and royalty-generating assets.