Maintaining good credit health is crucial in today's financial landscape. It allows you to secure loans at favorable interest rates, obtain credit cards with attractive rewards, and even impacts your ability to rent an apartment or qualify for a mortgage. For many, managing debt and ensuring a positive credit score can be a daunting task. This is where Securus Credit Request Form comes into play, designed to help individuals navigate the complexities of credit management with ease.

In an era where financial decisions are increasingly based on credit scores, having a clear understanding of your credit standing is vital. Whether you're looking to repair damaged credit, build a credit history from scratch, or simply monitor your existing credit score, a streamlined approach can make all the difference. The Securus Credit Request Form is tailored to simplify this process, offering a straightforward and user-friendly way to apply for and manage credit.

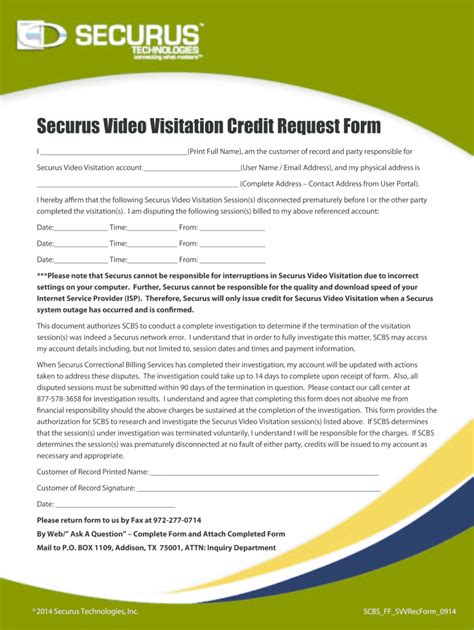

Understanding the Securus Credit Request Form

The Securus Credit Request Form is an innovative tool that aims to demystify the credit application process. It's designed with the user in mind, featuring a clear and concise layout that guides applicants through each step. By filling out this form, individuals can take the first crucial steps towards achieving their financial goals, whether that's consolidating debt, financing a large purchase, or simply improving their overall credit health.

Benefits of Using the Securus Credit Request Form

The benefits of utilizing the Securus Credit Request Form are multifaceted. Here are a few key advantages:

- Streamlined Application Process: The form is designed to be easy to fill out, reducing the complexity often associated with credit applications.

- Quick Response Times: After submission, applicants can expect a swift response regarding their credit request.

- Personalized Solutions: The form allows for a tailored approach, enabling individuals to specify their financial needs and goals.

- Educational Resources: Users gain access to valuable information and tools designed to enhance their understanding of credit management.

How to Apply With the Securus Credit Request Form

Applying with the Securus Credit Request Form involves a straightforward process. Here's a step-by-step guide to help you get started:

- Access the Form: Visit the official website or platform where the Securus Credit Request Form is hosted.

- Fill Out the Form: Carefully fill out the required fields, ensuring all information is accurate and up-to-date.

- Submit Your Application: Once completed, submit the form for review.

- Receive Your Response: Wait for a response regarding your credit request, which typically includes information on the next steps to take.

Tips for a Successful Application

- Ensure Accuracy: Double-check all information entered on the form for accuracy.

- Provide Complete Information: Make sure to fill out all required fields to avoid delays.

- Understand the Terms: Before submitting, take a moment to review the terms and conditions of your credit request.

FAQs About the Securus Credit Request Form

Is the Securus Credit Request Form secure?

+Yes, the form is designed with security in mind, ensuring your personal and financial information is protected.

How long does it take to receive a response after submitting the form?

+Response times can vary, but most applicants receive feedback within a few days of submission.

Can I use the Securus Credit Request Form if I have bad credit?

+Yes, the form is accessible to individuals with various credit backgrounds. However, approval and terms may vary based on your credit score.

As you embark on your journey to better manage your credit, remember that tools like the Securus Credit Request Form are designed to support you every step of the way. By applying with ease today, you're taking the first steps towards a healthier financial future.

We invite you to share your experiences or ask any questions you might have about the Securus Credit Request Form in the comments below. Your feedback is invaluable in helping others navigate the world of credit management.