The M-2210 form is a crucial document for individuals and businesses in the United States, serving as a key component in the tax filing process. However, navigating the complexities of this form can be daunting, especially for those unfamiliar with tax terminology and procedures. In this comprehensive guide, we will delve into the world of the M-2210 form, providing a detailed, step-by-step explanation to help you better understand its purpose, requirements, and submission process.

What is the M-2210 Form?

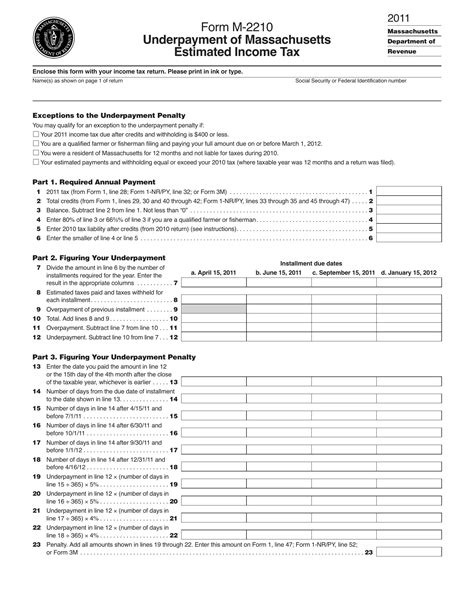

The M-2210 form, officially known as the "Underpayment of Estimated Tax by Individuals, Estates, and Trusts," is a document used by the Internal Revenue Service (IRS) to calculate and report underpayment penalties for individuals, estates, and trusts. This form is typically filed by taxpayers who have failed to make timely estimated tax payments or have underpaid their taxes throughout the year.

Why is the M-2210 Form Important?

The M-2210 form plays a vital role in the tax filing process, as it helps the IRS determine the amount of penalties and interest owed by taxpayers who have underpaid their taxes. By accurately completing and submitting this form, taxpayers can avoid additional penalties and ensure compliance with tax regulations.

Who Needs to File the M-2210 Form?

The M-2210 form is required for individuals, estates, and trusts that meet specific criteria, including:

- Individuals who are self-employed or have income that is not subject to withholding

- Estates and trusts with income that is not subject to withholding

- Taxpayers who have underpaid their taxes throughout the year

- Taxpayers who have failed to make timely estimated tax payments

Step-by-Step Guide to Completing the M-2210 Form

Completing the M-2210 form can be a complex process, but by following these steps, you can ensure accuracy and avoid errors.

Step 1: Gather Required Information

Before starting the M-2210 form, gather the following information:

- Your name, address, and taxpayer identification number (TIN)

- Your estimated tax liability for the year

- The amount of estimated tax payments made throughout the year

- The amount of taxes withheld from income

Step 2: Determine Your Underpayment Amount

Using the information gathered in Step 1, calculate your underpayment amount by subtracting the total estimated tax payments made from your estimated tax liability.

Step 3: Calculate the Penalty Amount

Using the underpayment amount calculated in Step 2, calculate the penalty amount by applying the applicable penalty rate.

Step 4: Complete the M-2210 Form

Using the information calculated in Steps 2 and 3, complete the M-2210 form by filling in the required fields, including:

- Your name, address, and TIN

- Your estimated tax liability and underpayment amount

- The penalty amount calculated in Step 3

Submitting the M-2210 Form

Once you have completed the M-2210 form, submit it to the IRS along with any required supporting documentation, including:

- A copy of your tax return (Form 1040, 1041, or 1120)

- Proof of estimated tax payments made throughout the year

Electronic Filing

The M-2210 form can be electronically filed through the IRS's Electronic Federal Tax Payment System (EFTPS). This method provides faster processing and reduced errors.

Paper Filing

Alternatively, the M-2210 form can be paper-filed by mailing it to the IRS address listed in the instructions.

Common Mistakes to Avoid

When completing and submitting the M-2210 form, avoid the following common mistakes:

- Inaccurate or incomplete information

- Failure to calculate the underpayment amount correctly

- Failure to calculate the penalty amount correctly

- Failure to submit required supporting documentation

By avoiding these common mistakes, you can ensure accurate and timely submission of the M-2210 form.

Conclusion

The M-2210 form is a critical component of the tax filing process, serving as a means of calculating and reporting underpayment penalties for individuals, estates, and trusts. By following the step-by-step guide outlined in this article, you can ensure accurate completion and submission of the M-2210 form, avoiding additional penalties and ensuring compliance with tax regulations.

We hope this comprehensive guide has provided valuable insights into the world of the M-2210 form. If you have any further questions or concerns, please do not hesitate to comment below.

What is the purpose of the M-2210 form?

+The M-2210 form is used to calculate and report underpayment penalties for individuals, estates, and trusts.

Who needs to file the M-2210 form?

+Individuals, estates, and trusts that meet specific criteria, including those who are self-employed or have income that is not subject to withholding.

How do I calculate the underpayment amount?

+The underpayment amount is calculated by subtracting the total estimated tax payments made from the estimated tax liability.