As a taxpayer, you may be eligible to claim the Additional Child Tax Credit (ACTC) on your tax return. The ACTC is a refundable credit that can provide significant tax savings for families with qualifying children. To claim the ACTC, you will need to complete Form 8801 and attach it to your tax return. In this article, we will explain what Form 8801 is, who is eligible to claim the ACTC, and how to complete the form.

What is Form 8801?

Form 8801 is the Additional Child Tax Credit form that taxpayers use to claim the ACTC on their tax return. The ACTC is a refundable credit that is calculated based on the amount of the Child Tax Credit (CTC) that exceeds the taxpayer's tax liability. The form is used to calculate the amount of the ACTC that the taxpayer is eligible to claim.

Who is Eligible to Claim the ACTC?

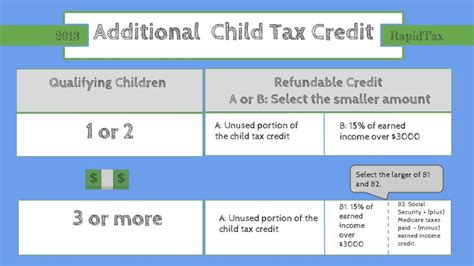

To be eligible to claim the ACTC, taxpayers must meet certain requirements. These requirements include:

- The taxpayer must have a qualifying child who is under the age of 17 at the end of the tax year.

- The taxpayer must have a tax liability that is less than the amount of the CTC.

- The taxpayer must have earned income from a job or self-employment.

- The taxpayer must be a U.S. citizen or resident.

Qualifying Children

A qualifying child is a child who meets certain tests. These tests include:

- The child must be the taxpayer's son, daughter, stepchild, foster child, brother, sister, or a descendant of any of these.

- The child must be under the age of 17 at the end of the tax year.

- The child must not have filed a joint return for the tax year.

- The child must be a U.S. citizen or resident.

How to Complete Form 8801

To complete Form 8801, taxpayers will need to follow these steps:

- Determine the amount of the CTC: The taxpayer will need to calculate the amount of the CTC by completing Form 8812. The CTC is calculated based on the number of qualifying children and the taxpayer's adjusted gross income.

- Calculate the tax liability: The taxpayer will need to calculate their tax liability by completing Form 1040.

- Calculate the ACTC: The taxpayer will need to subtract their tax liability from the amount of the CTC to determine the amount of the ACTC.

- Complete Form 8801: The taxpayer will need to complete Form 8801 by entering the amount of the ACTC and attaching the form to their tax return.

Line-by-Line Instructions

Here are line-by-line instructions for completing Form 8801:

- Line 1: Enter the amount of the CTC from Form 8812.

- Line 2: Enter the taxpayer's tax liability from Form 1040.

- Line 3: Subtract the tax liability from the amount of the CTC to determine the amount of the ACTC.

- Line 4: Enter the amount of the ACTC from line 3.

Example

Here is an example of how to complete Form 8801:

- Line 1: The taxpayer has a CTC of $2,000 from Form 8812.

- Line 2: The taxpayer has a tax liability of $1,000 from Form 1040.

- Line 3: The taxpayer subtracts their tax liability from the amount of the CTC to determine the amount of the ACTC: $2,000 - $1,000 = $1,000.

- Line 4: The taxpayer enters the amount of the ACTC on line 4: $1,000.

Common Errors to Avoid

Here are some common errors to avoid when completing Form 8801:

- Incorrectly calculating the CTC: Make sure to calculate the CTC correctly by completing Form 8812.

- Incorrectly calculating the tax liability: Make sure to calculate the tax liability correctly by completing Form 1040.

- Failing to attach Form 8801 to the tax return: Make sure to attach Form 8801 to the tax return to claim the ACTC.

Conclusion

Claiming the Additional Child Tax Credit can provide significant tax savings for families with qualifying children. To claim the ACTC, taxpayers must complete Form 8801 and attach it to their tax return. By following the line-by-line instructions and avoiding common errors, taxpayers can ensure that they receive the correct amount of the ACTC.

What's Next?

If you have any questions or need help completing Form 8801, consider consulting a tax professional or contacting the IRS. Additionally, you can find more information on the IRS website or by contacting your local tax authority.

What is the Additional Child Tax Credit?

+The Additional Child Tax Credit is a refundable credit that can provide significant tax savings for families with qualifying children.

Who is eligible to claim the ACTC?

+To be eligible to claim the ACTC, taxpayers must meet certain requirements, including having a qualifying child, a tax liability that is less than the amount of the CTC, and earned income from a job or self-employment.

How do I complete Form 8801?

+To complete Form 8801, taxpayers will need to determine the amount of the CTC, calculate the tax liability, calculate the ACTC, and complete the form by entering the amount of the ACTC.