The 1099 NEC form is a crucial document for businesses and individuals who need to report non-employee compensation to the Internal Revenue Service (IRS). Filling out the form correctly is essential to avoid errors, penalties, and delays in processing. In this article, we will guide you through the process of filling out the 1099 NEC form correctly.

Understanding the 1099 NEC Form

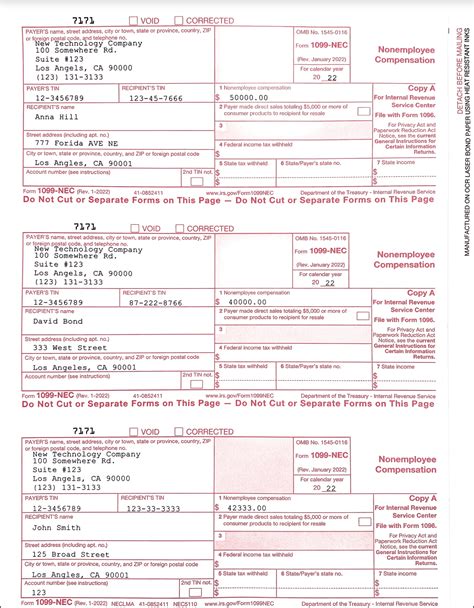

The 1099 NEC form is used to report non-employee compensation, such as payments made to independent contractors, freelancers, and consultants. The form is typically used by businesses, including corporations, partnerships, and sole proprietorships, to report payments made to non-employees who earned more than $600 in a calendar year.

5 Ways to Fill Out the 1099 NEC Form Correctly

Filling out the 1099 NEC form correctly requires attention to detail and a clear understanding of the form's requirements. Here are five ways to ensure you fill out the form correctly:

1. Gather Required Information

Before filling out the 1099 NEC form, gather all the required information, including:

- Payer's name, address, and taxpayer identification number (TIN)

- Recipient's name, address, and TIN

- Type of payment made (e.g., non-employee compensation)

- Amount of payment made

- Date of payment

Make sure to have all the necessary documents and information before starting to fill out the form.

2. Fill Out the Form Accurately

Fill out the 1099 NEC form accurately and completely, using black ink or a computer-generated form. Make sure to:

- Use the correct payer and recipient information

- Report the correct type of payment made

- Enter the correct amount of payment made

- Use the correct date of payment

Double-check your entries to avoid errors and ensure accuracy.

3. Use the Correct Payment Codes

The 1099 NEC form requires you to use specific payment codes to report the type of payment made. The most common payment codes are:

- NEC: Non-employee compensation

- RRB: Railroad retirement board payments

- MISC: Miscellaneous income

Use the correct payment code to report the type of payment made.

4. Report Payments Correctly

Report payments made to non-employees correctly, including:

- Payments made in cash, check, or direct deposit

- Payments made for services performed, such as consulting or freelance work

- Payments made for goods or merchandise sold

Make sure to report all payments made to non-employees, regardless of the amount.

5. File the Form on Time

File the 1099 NEC form on time to avoid penalties and delays in processing. The form is typically due on January 31st of each year, but the deadline may vary depending on the type of payment made.

File the form on time to avoid penalties and ensure timely processing.

Additional Tips

- Use a 1099 NEC software or a professional tax preparer to ensure accuracy and compliance.

- Keep a copy of the form for your records.

- Make sure to provide a copy of the form to the recipient by January 31st of each year.

Conclusion

Filling out the 1099 NEC form correctly is crucial to avoid errors, penalties, and delays in processing. By following these five ways to fill out the form correctly, you can ensure accuracy and compliance with IRS regulations. Remember to gather required information, fill out the form accurately, use the correct payment codes, report payments correctly, and file the form on time.

Share Your Experience

Have you ever filled out a 1099 NEC form? Share your experience and tips in the comments below. If you have any questions or need further guidance, feel free to ask.

Frequently Asked Questions

What is the deadline for filing the 1099 NEC form?

+The deadline for filing the 1099 NEC form is typically January 31st of each year, but the deadline may vary depending on the type of payment made.

Who needs to file the 1099 NEC form?

+Businesses, including corporations, partnerships, and sole proprietorships, need to file the 1099 NEC form to report non-employee compensation.

What payments need to be reported on the 1099 NEC form?

+Payments made to non-employees, including independent contractors, freelancers, and consultants, need to be reported on the 1099 NEC form.