The world of international taxation can be complex and overwhelming, especially for individuals and businesses with foreign investments or operations. One crucial aspect of navigating this landscape is understanding the requirements for filing Schedule Q (Form 5471), a critical component of the IRS's reporting framework for foreign corporations. In this article, we will delve into the intricacies of Schedule Q, exploring its purpose, filing requirements, and key considerations to ensure compliance.

Understanding Schedule Q (Form 5471)

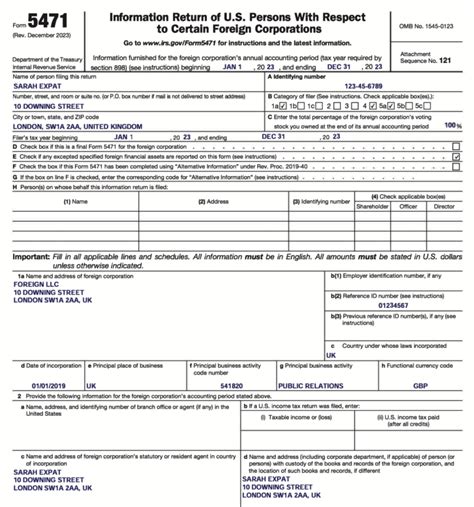

Schedule Q (Form 5471) is a supplemental form used by the Internal Revenue Service (IRS) to gather information about the activities of foreign corporations. The form is filed as part of the annual reporting requirement for certain U.S. taxpayers with interests in foreign corporations. Its primary purpose is to provide the IRS with a comprehensive picture of a foreign corporation's operations, including its income, assets, and distributions.

Who Needs to File Schedule Q?

To determine whether you need to file Schedule Q, you must first understand the filing requirements for Form 5471. Generally, a U.S. taxpayer is required to file Form 5471 if they have a certain level of ownership or control in a foreign corporation. The specific filing requirements depend on the taxpayer's category, which is determined by their level of ownership and control.

- Category 1 filers: These include U.S. shareholders who own at least 10% of the total voting power of a foreign corporation.

- Category 2 filers: These include U.S. shareholders who own at least 10% of the total value of a foreign corporation.

- Category 3 filers: These include U.S. shareholders who own at least 10% of the total voting power or value of a foreign corporation and are required to file Form 5471 under Section 6038.

Filing Requirements for Schedule Q

To file Schedule Q, you must first complete Form 5471 and attach the required schedules. Schedule Q is specifically designed for Category 1 and Category 2 filers, who must provide detailed information about the foreign corporation's activities. The schedule requires the following information:

- A description of the foreign corporation's business activities

- A list of the foreign corporation's assets and liabilities

- A statement of the foreign corporation's income and expenses

- Information about the foreign corporation's distributions and dividends

Key Considerations for Filing Schedule Q

When filing Schedule Q, it is essential to ensure accuracy and completeness. Here are some key considerations to keep in mind:

- Use the correct category: Ensure you are filing as the correct category, as this will determine the required information and schedules.

- Provide detailed information: Schedule Q requires detailed information about the foreign corporation's activities, including financial statements and descriptions of business operations.

- Attach required schedules: Ensure you attach all required schedules, including Schedule P (Previously Taxed Earnings and Profits) and Schedule O (Organization or Reorganization of Foreign Corporation).

Penalties for Failure to File Schedule Q

Failure to file Schedule Q or providing inaccurate information can result in significant penalties. The IRS may impose penalties, including:

- A penalty of up to $10,000 for failure to file Form 5471

- A penalty of up to $10,000 for each failure to file Schedule Q

- Additional penalties for failure to provide accurate information or for intentional disregard of filing requirements

Conclusion and Next Steps

Filing Schedule Q (Form 5471) is a critical requirement for U.S. taxpayers with interests in foreign corporations. By understanding the purpose, filing requirements, and key considerations for Schedule Q, you can ensure compliance and avoid potential penalties. If you are unsure about your filing requirements or need assistance with preparing Schedule Q, consult with a qualified tax professional or seek guidance from the IRS.

Who is required to file Schedule Q?

+U.S. taxpayers who own at least 10% of the total voting power or value of a foreign corporation are required to file Schedule Q.

What information is required on Schedule Q?

+Schedule Q requires detailed information about the foreign corporation's activities, including financial statements and descriptions of business operations.

What are the penalties for failure to file Schedule Q?

+Failure to file Schedule Q can result in penalties, including a penalty of up to $10,000 for failure to file Form 5471 and additional penalties for intentional disregard of filing requirements.