As a student, you're likely no stranger to the financial burdens that come with pursuing higher education. Between tuition fees, textbooks, and living expenses, it can be challenging to make ends meet. However, there are ways to alleviate some of this financial stress, and one of them is by claiming tax benefits. If you're a Penn Foster student, you may be eligible to receive a 1098-T form, which can help you claim these benefits. In this article, we'll delve into the world of tax benefits for students, explain the Penn Foster 1098-T form, and provide you with a comprehensive guide on how to claim these benefits.

Understanding Tax Benefits for Students

The US government offers various tax benefits to help students and their families offset the costs of higher education. These benefits can be claimed on your tax return, and they can significantly reduce your taxable income. There are two primary tax credits available to students: the American Opportunity Tax Credit (AOTC) and the Lifetime Learning Credit (LLC). Both credits can help you save up to $2,500 on your taxes, but they have different eligibility requirements and benefits.

American Opportunity Tax Credit (AOTC)

The AOTC is a refundable tax credit worth up to $2,500 per eligible student. To qualify, you must:

- Be pursuing a degree at an eligible educational institution

- Be enrolled at least half-time for at least one academic period

- Not have completed four years of post-secondary education before the beginning of the tax year

- Not have claimed the AOTC or the former Hope Credit for more than four tax years

- Not have a felony conviction

Lifetime Learning Credit (LLC)

The LLC is a non-refundable tax credit worth up to $2,000 per tax return. To qualify, you must:

- Be enrolled in a course at an eligible educational institution

- Be taking the course to acquire or improve your job skills

- Not have completed four years of post-secondary education before the beginning of the tax year

- Not have claimed the LLC for more than four tax years

- Not have a felony conviction

Penn Foster 1098-T Form: What You Need to Know

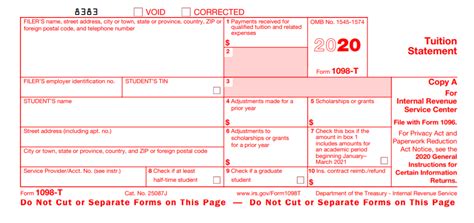

The 1098-T form is an informational return that colleges and universities are required to provide to students and the IRS. The form reports the amount of qualified tuition and related expenses (QTRE) paid by the student during the tax year. Penn Foster, as an eligible educational institution, is required to provide this form to its students.

The 1098-T form will typically include the following information:

- Student's name, address, and taxpayer identification number

- Amount of QTRE paid by the student

- Amount of scholarships and grants received by the student

- Amount of other forms of financial aid received by the student

How to Obtain Your Penn Foster 1098-T Form

To obtain your 1098-T form from Penn Foster, you can follow these steps:

- Log in to your Penn Foster student account

- Click on the "My Account" or "My Finances" tab

- Look for the "1098-T Form" or "Tax Information" link

- Download or print your 1098-T form

If you're unable to access your 1098-T form online, you can contact Penn Foster's student services department for assistance.

Claiming Tax Benefits with Your 1098-T Form

To claim tax benefits with your 1098-T form, you'll need to follow these steps:

- Gather your tax documents, including your 1098-T form, W-2 forms, and any other relevant tax documents

- Determine which tax credit you're eligible for (AOTC or LLC)

- Complete Form 8863, which is the Education Credits form

- Attach Form 8863 to your tax return (Form 1040)

- Claim the tax credit on your tax return

It's essential to note that you can only claim one tax credit per student, per tax year. You should also be aware that tax laws and regulations can change, so it's crucial to stay informed and consult with a tax professional if you're unsure about any aspect of the tax benefits process.

Frequently Asked Questions

Here are some frequently asked questions about tax benefits for students and the Penn Foster 1098-T form:

What is the deadline for claiming tax benefits?

The deadline for claiming tax benefits is typically April 15th of each year. However, this deadline may vary depending on your individual circumstances, so it's essential to check with the IRS or a tax professional for specific guidance.

Can I claim tax benefits if I'm a part-time student?

Yes, part-time students may be eligible to claim tax benefits. However, you must meet the eligibility requirements for the AOTC or LLC, which include being enrolled at least half-time for at least one academic period.

How do I know if I'm eligible for the AOTC or LLC?

To determine which tax credit you're eligible for, you should review the eligibility requirements for each credit. You can also consult with a tax professional or contact Penn Foster's student services department for guidance.

What is the 1098-T form, and why do I need it?

+The 1098-T form is an informational return that reports the amount of qualified tuition and related expenses (QTRE) paid by the student during the tax year. You need this form to claim tax benefits, such as the American Opportunity Tax Credit (AOTC) or the Lifetime Learning Credit (LLC).

How do I obtain my Penn Foster 1098-T form?

+To obtain your 1098-T form from Penn Foster, log in to your student account, click on the "My Account" or "My Finances" tab, and look for the "1098-T Form" or "Tax Information" link. You can also contact Penn Foster's student services department for assistance.

Can I claim tax benefits if I'm a part-time student?

+Yes, part-time students may be eligible to claim tax benefits. However, you must meet the eligibility requirements for the AOTC or LLC, which include being enrolled at least half-time for at least one academic period.

We hope this article has provided you with a comprehensive guide to understanding tax benefits for students and the Penn Foster 1098-T form. Remember to stay informed, consult with a tax professional if needed, and take advantage of the tax benefits available to you. Share your thoughts and experiences with tax benefits in the comments below, and don't forget to share this article with your fellow students who may be eligible for these benefits.