As a business owner or investor, navigating the complexities of tax laws and regulations can be overwhelming. One crucial aspect of tax compliance is accurately reporting deductions on your tax return. For partnerships, limited liability companies (LLCs), and S corporations, Form 1065 is a critical component of the tax filing process. In this article, we will delve into the world of Form 1065 other deductions, providing a comprehensive guide to help you understand and navigate this complex topic.

The Importance of Accurate Deductions on Form 1065

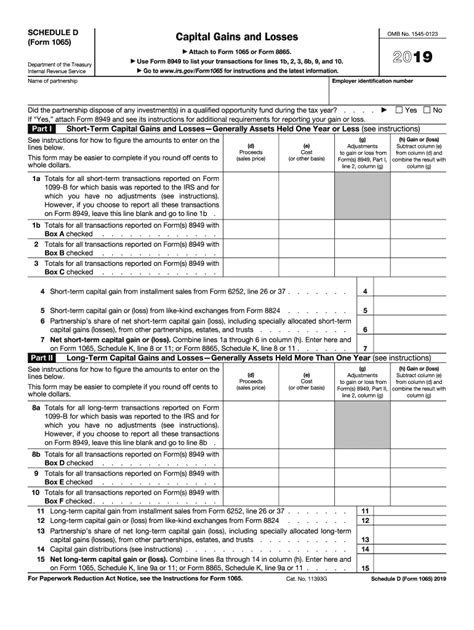

Form 1065, also known as the U.S. Return of Partnership Income, is a tax form used by partnerships, LLCs, and S corporations to report their income, deductions, and credits. Accurate reporting of deductions on Form 1065 is essential to ensure compliance with tax laws and regulations. Failure to properly report deductions can result in penalties, fines, and even audits. Furthermore, accurate deductions can help reduce your tax liability, ultimately saving you money.

Common Other Deductions on Form 1065

Other deductions on Form 1065 refer to expenses that are not specifically listed on the form, but are still eligible for deduction. These deductions can be reported on Schedule K (Partners' Distributive Share Items) and Schedule L (Balance Sheets per Books). Some common other deductions on Form 1065 include:

- Charitable contributions

- Amortization and depreciation expenses

- Interest expenses

- Rent and utility expenses

- Travel and entertainment expenses

- Education and training expenses

Understanding the Requirements for Other Deductions

To qualify as an other deduction on Form 1065, the expense must meet specific requirements. The expense must be:

- Ordinary and necessary for the business

- Paid or incurred during the tax year

- Not a capital expenditure

- Not a personal expense

The expense must also be properly documented and recorded in the business's accounting records.

How to Report Other Deductions on Form 1065

To report other deductions on Form 1065, you will need to complete Schedule K and Schedule L. Schedule K is used to report each partner's distributive share of income, deductions, and credits. Schedule L is used to report the partnership's balance sheet.

On Schedule K, you will report the other deductions in the "Other Deductions" section. You will need to list each deduction separately and include a description of the expense.

On Schedule L, you will report the other deductions in the "Other Assets" or "Other Liabilities" section, depending on the nature of the expense.

Common Mistakes to Avoid When Reporting Other Deductions

When reporting other deductions on Form 1065, it is essential to avoid common mistakes that can result in penalties and fines. Some common mistakes to avoid include:

- Failing to properly document and record expenses

- Reporting personal expenses as business expenses

- Failing to report all other deductions

- Incorrectly calculating the amount of other deductions

Best Practices for Reporting Other Deductions

To ensure accurate and compliant reporting of other deductions on Form 1065, follow these best practices:

- Maintain accurate and detailed accounting records

- Consult with a tax professional or accountant

- Review and update your accounting records regularly

- Ensure all partners are aware of their distributive share of income, deductions, and credits

Conclusion and Next Steps

In conclusion, accurately reporting other deductions on Form 1065 is crucial for compliance with tax laws and regulations. By understanding the requirements for other deductions, how to report them, and avoiding common mistakes, you can ensure accurate and compliant reporting.

If you are unsure about how to report other deductions on Form 1065 or have questions about the tax filing process, consult with a tax professional or accountant. They can provide guidance and support to ensure you meet your tax obligations.

Final Checklist for Reporting Other Deductions on Form 1065

Before submitting your Form 1065, review this final checklist to ensure accurate and compliant reporting of other deductions:

- Maintain accurate and detailed accounting records

- Consult with a tax professional or accountant

- Review and update your accounting records regularly

- Ensure all partners are aware of their distributive share of income, deductions, and credits

- Properly document and record expenses

- Report all other deductions

- Avoid reporting personal expenses as business expenses

Tips for a Smooth Tax Filing Process

To ensure a smooth tax filing process, follow these tips:

- Start early and gather all necessary documents and records

- Consult with a tax professional or accountant

- Review and update your accounting records regularly

- Ensure all partners are aware of their distributive share of income, deductions, and credits

- Properly document and record expenses

Additional Resources

For additional information and resources on reporting other deductions on Form 1065, visit the IRS website or consult with a tax professional or accountant.

What is Form 1065?

+Form 1065 is a tax form used by partnerships, LLCs, and S corporations to report their income, deductions, and credits.

What are other deductions on Form 1065?

+Other deductions on Form 1065 refer to expenses that are not specifically listed on the form, but are still eligible for deduction.

How do I report other deductions on Form 1065?

+To report other deductions on Form 1065, you will need to complete Schedule K and Schedule L.