As the world of tax reporting continues to evolve, the need for streamlined processes and simplified paperwork has become increasingly important. One key aspect of this evolution is the reporting agent authorization, which plays a crucial role in facilitating the exchange of tax-related information between the Internal Revenue Service (IRS) and tax professionals. This is where Form 8655 comes into play, serving as a vital tool for reporting agents to obtain the necessary authorization to perform their duties.

The importance of Form 8655 cannot be overstated. By providing a standardized and straightforward way for reporting agents to obtain authorization, the IRS has created a more efficient and effective system for tax reporting. This, in turn, has numerous benefits for both tax professionals and taxpayers alike. For instance, it enables reporting agents to quickly and easily access the information they need to prepare accurate tax returns, while also helping to reduce errors and minimize delays.

In this article, we will delve into the world of Form 8655, exploring its purpose, benefits, and key components. We will also discuss the process of completing and submitting the form, as well as provide practical examples and insights to help readers better understand its significance.

What is Form 8655?

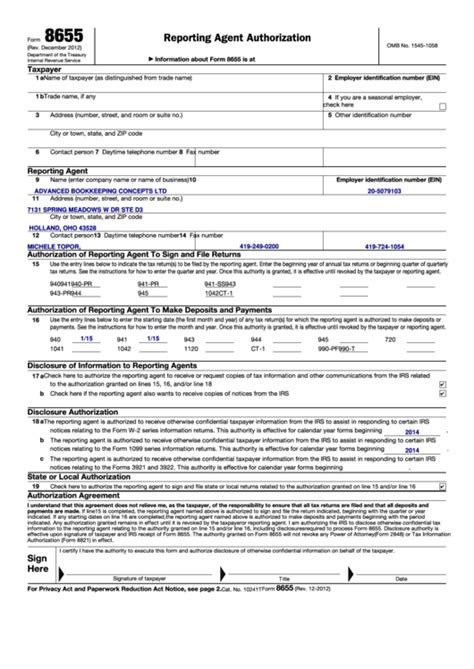

Form 8655: Reporting Agent Authorization

Form 8655 is a critical document used by reporting agents to obtain authorization from taxpayers to access their tax-related information. The form serves as a written consent, allowing reporting agents to act on behalf of taxpayers in matters related to tax reporting, such as obtaining transcripts, making account inquiries, and resolving issues.

Benefits of Form 8655

Streamlining Tax Reporting with Form 8655

The benefits of Form 8655 are numerous, making it an essential tool for reporting agents and taxpayers alike. Some of the key advantages include:

- Increased Efficiency: Form 8655 simplifies the authorization process, allowing reporting agents to quickly and easily obtain the necessary consent to perform their duties.

- Improved Accuracy: By providing a standardized way for reporting agents to obtain authorization, Form 8655 helps reduce errors and minimize delays.

- Enhanced Security: The form serves as a written consent, ensuring that taxpayers' sensitive information is protected and only accessed by authorized personnel.

Key Components of Form 8655

Understanding the Key Components of Form 8655

Form 8655 consists of several key components, including:

- Taxpayer Information: The form requires taxpayers to provide their name, address, and taxpayer identification number (TIN).

- Reporting Agent Information: Reporting agents must provide their name, address, and employer identification number (EIN).

- Authorization: Taxpayers must sign and date the form, authorizing the reporting agent to access their tax-related information.

Completing and Submitting Form 8655

A Step-by-Step Guide to Completing and Submitting Form 8655

Completing and submitting Form 8655 is a straightforward process. Here are the steps to follow:

- Obtain the form: Reporting agents can obtain Form 8655 from the IRS website or by contacting the IRS directly.

- Complete the form: Taxpayers and reporting agents must complete the form, providing the necessary information and signatures.

- Submit the form: The completed form must be submitted to the IRS, either electronically or by mail.

Practical Examples and Insights

Real-World Examples of Form 8655 in Action

To illustrate the significance of Form 8655, let's consider a few real-world examples:

- Tax Preparation: A tax preparation company uses Form 8655 to obtain authorization from clients to access their tax-related information, enabling the company to prepare accurate tax returns.

- Accounting Services: An accounting firm uses Form 8655 to obtain authorization from clients to make account inquiries and resolve issues related to their tax accounts.

Conclusion: Simplifying Tax Reporting with Form 8655

Takeaway: Form 8655 Simplifies Tax Reporting

In conclusion, Form 8655 plays a vital role in simplifying tax reporting by providing a standardized way for reporting agents to obtain authorization from taxpayers. By understanding the key components and benefits of the form, tax professionals and taxpayers can work together to streamline the tax reporting process, reducing errors and minimizing delays.

Take Action: Share Your Thoughts and Experiences

We invite you to share your thoughts and experiences with Form 8655 in the comments section below. Have you used the form to obtain authorization for tax reporting purposes? What benefits or challenges have you encountered? Your insights will help others better understand the significance of Form 8655 in simplifying tax reporting.

What is Form 8655 used for?

+Form 8655 is used by reporting agents to obtain authorization from taxpayers to access their tax-related information.

What are the benefits of using Form 8655?

+The benefits of using Form 8655 include increased efficiency, improved accuracy, and enhanced security.

How do I complete and submit Form 8655?

+To complete and submit Form 8655, taxpayers and reporting agents must provide the necessary information and signatures, and then submit the form to the IRS electronically or by mail.