Completing a NEBF 1099 form accurately is crucial for individuals who receive benefits from the National Education Association (NEA) Member Benefits (NEAMB) or the National Education Association (NEA) Retirement Program. The form reports the total amount of benefits paid to an individual in a calendar year, which is essential for tax purposes. Inaccurate or incomplete forms can lead to delays in processing tax returns or even result in penalties. Here are five ways to complete a NEBF 1099 form accurately.

Understanding the NEBF 1099 Form

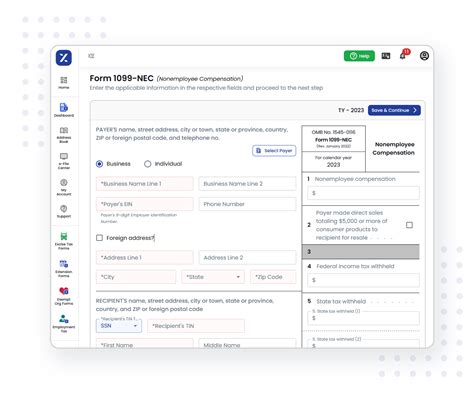

The NEBF 1099 form is a simple, one-page document that requires basic information about the recipient and the benefits paid. It's essential to understand the different sections of the form to complete it accurately.

Section 1: Recipient Information

The first section of the form requires the recipient's name, address, and social security number or tax identification number. Ensure that this information is accurate and matches the information on file with the NEA.

Gathering Required Documents and Information

Before completing the form, gather all required documents and information, including:

- Social security number or tax identification number

- Date of birth

- Address

- Benefit payment statements

- Tax withholding information

Section 2: Benefit Payments

The second section of the form reports the total amount of benefits paid to the recipient in the calendar year. This information can be found on the benefit payment statements. Ensure that the amounts are accurate and match the statements.

Reporting Tax Withholding

If taxes were withheld from the benefits, report the amount withheld in the designated section of the form. This information can be found on the benefit payment statements.

Section 3: State and Local Tax Information

The third section of the form requires information about state and local taxes withheld. If applicable, report the amount withheld and the state or local tax identification number.

Reviewing and Verifying the Form

Before submitting the form, review and verify all information to ensure accuracy. Check for any errors or omissions, and make corrections as needed.

Common Errors to Avoid

Common errors to avoid when completing the NEBF 1099 form include:

- Inaccurate or missing recipient information

- Incorrect benefit payment amounts

- Failure to report tax withholding

- Incomplete or missing state and local tax information

Seeking Assistance

If you're unsure about completing the NEBF 1099 form or need assistance, contact the NEA or a tax professional. They can provide guidance and help ensure that the form is completed accurately.

By following these five ways to complete a NEBF 1099 form accurately, individuals can ensure that their tax returns are processed smoothly and avoid any potential penalties.

What is the purpose of the NEBF 1099 form?

+The NEBF 1099 form reports the total amount of benefits paid to an individual in a calendar year, which is essential for tax purposes.

What information is required to complete the NEBF 1099 form?

+The form requires recipient information, benefit payment amounts, tax withholding information, and state and local tax information.

What are common errors to avoid when completing the NEBF 1099 form?

+Common errors to avoid include inaccurate or missing recipient information, incorrect benefit payment amounts, failure to report tax withholding, and incomplete or missing state and local tax information.