As the world becomes increasingly interconnected, international transactions have become more common. Whether you're sending money to a loved one abroad, paying for goods or services, or receiving funds from a foreign client, wire transfers have made it easier to move money across borders. For TD Bank customers, initiating a wire transfer is a straightforward process, but it requires some essential information and a clear understanding of the steps involved. In this article, we'll delve into the specifics of the TD Bank wire transfer form, providing a step-by-step guide to help you navigate the process with ease.

The Importance of Wire Transfers

In today's fast-paced, globalized economy, wire transfers have become a vital tool for both individuals and businesses. They offer a secure and efficient way to move large sums of money across the globe, often in a matter of minutes. Whether you're sending money to a friend, family member, or business partner, wire transfers provide a reliable means of transferring funds. For TD Bank customers, understanding the wire transfer process is crucial to ensure that your transactions are completed smoothly and efficiently.

Understanding the TD Bank Wire Transfer Form

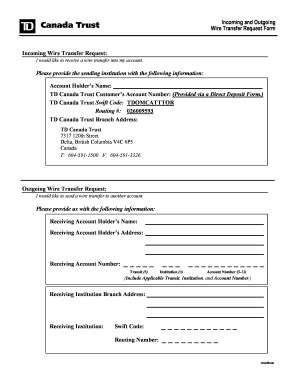

Before initiating a wire transfer, it's essential to familiarize yourself with the TD Bank wire transfer form. This form will require specific information, including:

- The recipient's name and address

- The recipient's bank name and address

- The recipient's account number and routing number (also known as the ABA number)

- The amount of the transfer

- The currency of the transfer (if international)

- Your name and address (as the sender)

- Your account number and routing number (if you're sending from a TD Bank account)

Step-by-Step Guide to Filling Out the TD Bank Wire Transfer Form

To ensure that your wire transfer is completed accurately and efficiently, follow these steps:

Step 1: Gather the Required Information

Before filling out the wire transfer form, make sure you have all the necessary information. This includes the recipient's name, address, bank name, bank address, account number, and routing number. If you're sending an international wire transfer, you'll also need to provide the recipient's IBAN (International Bank Account Number) and SWIFT code (Society for Worldwide Interbank Financial Telecommunication).

Step 2: Fill Out the Wire Transfer Form

Using the information gathered in Step 1, fill out the wire transfer form. Make sure to double-check all the details to avoid any errors. If you're unsure about any part of the form, you can always contact TD Bank's customer service for assistance.

Step 3: Review and Submit the Form

Once you've completed the wire transfer form, review it carefully to ensure that all the information is accurate. If everything looks good, submit the form to initiate the wire transfer.

Additional Tips and Considerations

When initiating a wire transfer, keep the following tips and considerations in mind:

- Make sure to verify the recipient's account information to avoid any errors or delays.

- Use a secure and trusted method to transmit the wire transfer form, such as TD Bank's online banking platform or a secure email.

- Keep a record of the wire transfer, including the transfer amount, recipient information, and any reference numbers.

- Be aware of any transfer fees associated with the wire transfer.

- If you're sending an international wire transfer, be aware of any exchange rate fees or conversion rates.

Common Errors to Avoid

When filling out the TD Bank wire transfer form, avoid the following common errors:

- Incorrect recipient information

- Inaccurate account numbers or routing numbers

- Insufficient funds in the sender's account

- Failure to provide required information (such as IBAN or SWIFT code for international transfers)

Conclusion

Initiating a wire transfer with TD Bank is a straightforward process, but it requires attention to detail and a clear understanding of the steps involved. By following this step-by-step guide and avoiding common errors, you can ensure that your wire transfer is completed accurately and efficiently. Whether you're sending money to a loved one or conducting international business, wire transfers provide a secure and reliable means of moving money across the globe.

If you have any questions or concerns about the TD Bank wire transfer form or process, don't hesitate to reach out to their customer service team. They're always available to provide assistance and ensure that your wire transfer is completed successfully.

What is the TD Bank wire transfer form?

+The TD Bank wire transfer form is a document used to initiate a wire transfer from a TD Bank account to a recipient's account. It requires specific information, including the recipient's name, address, bank name, bank address, account number, and routing number.

How long does it take to complete a wire transfer?

+The time it takes to complete a wire transfer can vary depending on the type of transfer and the recipient's location. Domestic wire transfers typically take a few hours, while international wire transfers may take several days.

What are the fees associated with wire transfers?

+The fees associated with wire transfers vary depending on the type of transfer and the recipient's location. TD Bank may charge a fee for wire transfers, and additional fees may be applied by the recipient's bank.