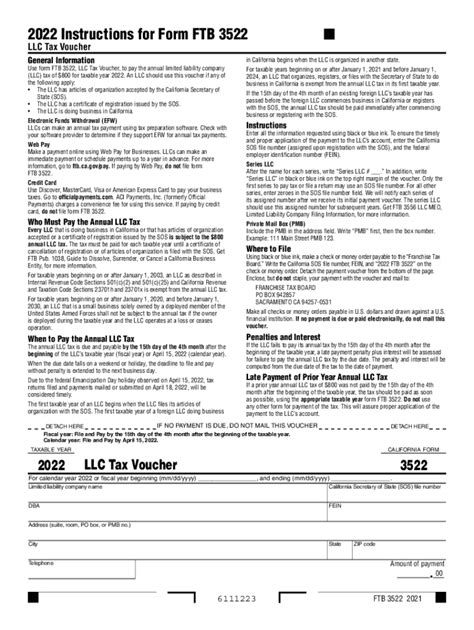

The California Form FTB 3522, also known as the Limited Liability Company (LLC) Tax Voucher, is a crucial document that LLCs operating in California need to file annually with the Franchise Tax Board (FTB). The form is used to report and pay the annual LLC tax, which is a minimum tax of $800 that every LLC in California must pay. In this article, we will provide you with 5 valuable tips for filing CA Form FTB 3522 accurately and efficiently.

Understanding the Purpose of CA Form FTB 3522

Before we dive into the tips, it's essential to understand the purpose of CA Form FTB 3522. The form is used to report the LLC's annual tax liability, which includes the minimum tax of $800. The form also requires the LLC to provide information about its income, deductions, and credits. The FTB uses this information to calculate the LLC's tax liability and to ensure that the LLC is in compliance with California tax laws.

Tip 1: Determine Your Filing Status

The first step in filing CA Form FTB 3522 is to determine your filing status. The FTB requires LLCs to file the form annually, but the filing deadline and requirements may vary depending on the LLC's tax year and filing status. You can check the FTB website to determine your filing status and to find out if you need to file any additional forms or schedules.

Filing Status Options

- Single-member LLCs: File as a sole proprietorship, using Form 540, California Resident Income Tax Return.

- Multi-member LLCs: File as a partnership, using Form 565, Partnership Return of Income.

- LLCs electing to be taxed as corporations: File as a corporation, using Form 100, California Corporation Franchise or Income Tax Return.

Tip 2: Gather Required Documents and Information

To file CA Form FTB 3522 accurately, you'll need to gather several documents and information. These include:

- Your LLC's name and address

- Your LLC's tax year and filing status

- Your LLC's income and deductions

- Your LLC's credits and tax liabilities

- Your LLC's federal tax return (Form 1040 or Form 1120)

- Any additional forms or schedules required by the FTB

Important Documents to Keep in Mind

- Form 540, California Resident Income Tax Return

- Form 565, Partnership Return of Income

- Form 100, California Corporation Franchise or Income Tax Return

- Schedule K-1, Partner's Share of Income, Deductions, Credits, etc.

Tip 3: Complete the Form Accurately

Once you have gathered all the required documents and information, you can start completing CA Form FTB 3522. Make sure to fill out the form accurately and completely, as any errors or omissions may result in delays or penalties.

Key Sections to Focus On

- Section 1: LLC Information

- Section 2: Tax Liability

- Section 3: Credits and Tax Liabilities

- Section 4: Payments and Balances Due

Tip 4: Pay the Minimum Tax Liability

One of the most important aspects of filing CA Form FTB 3522 is paying the minimum tax liability of $800. This tax is due annually, and the FTB requires LLCs to pay it even if they have no income or losses.

Payment Options

- Online payment through the FTB website

- Check or money order payable to the Franchise Tax Board

- Credit card payment through the FTB website

Tip 5: File the Form On Time

Finally, make sure to file CA Form FTB 3522 on time to avoid penalties and interest. The FTB requires LLCs to file the form annually, and the filing deadline is typically the 15th day of the 4th month after the close of the LLC's tax year.

Filing Deadline Extensions

- Automatic 6-month extension available for LLCs that file Form 7004, Application for Automatic Extension of Time To File Certain Business Income Tax, Information, and Other Returns.

By following these 5 tips, you can ensure that you file CA Form FTB 3522 accurately and efficiently. Remember to determine your filing status, gather required documents and information, complete the form accurately, pay the minimum tax liability, and file the form on time.

What is the minimum tax liability for LLCs in California?

+The minimum tax liability for LLCs in California is $800, which is due annually.

What is the filing deadline for CA Form FTB 3522?

+The filing deadline for CA Form FTB 3522 is typically the 15th day of the 4th month after the close of the LLC's tax year.

Can I file CA Form FTB 3522 online?

+Yes, you can file CA Form FTB 3522 online through the FTB website.