The Schedule K-1 Form 1120-S is a crucial document for S corporations, providing essential information to shareholders about their share of income, deductions, and credits. Understanding the intricacies of this form is vital for taxpayers to accurately report their income and claim their rightful deductions. In this article, we will delve into six essential facts about Schedule K-1 Form 1120-S, exploring its purpose, contents, and implications for shareholders.

What is Schedule K-1 Form 1120-S?

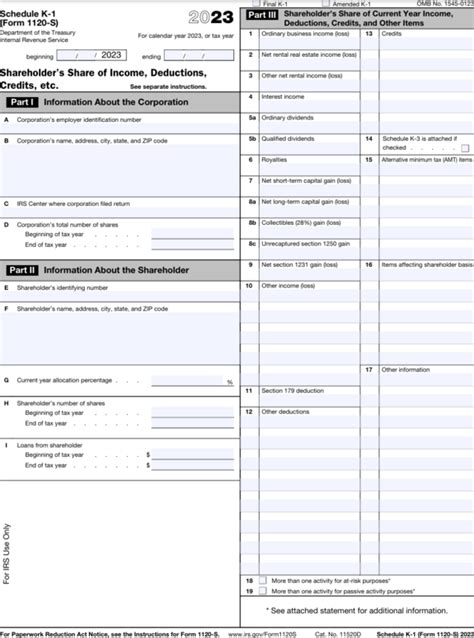

Schedule K-1 Form 1120-S is an attachment to the Form 1120-S, which is the income tax return for S corporations. The K-1 form provides a detailed breakdown of each shareholder's pro rata share of income, losses, deductions, and credits. This information is essential for shareholders to accurately report their income and claim their rightful deductions on their individual tax returns.

Who is Required to File Schedule K-1 Form 1120-S?

S corporations are required to file Schedule K-1 Form 1120-S for each shareholder who owns a share of the corporation's stock. This includes both resident and non-resident shareholders. The corporation must provide each shareholder with a copy of the K-1 form by the tax filing deadline, which is typically March 15th for calendar-year S corporations.

What Information is Reported on Schedule K-1 Form 1120-S?

The Schedule K-1 Form 1120-S reports a wide range of information, including:

- Shareholder's name, address, and tax identification number

- Shareholder's percentage of ownership

- Share of ordinary business income (loss)

- Share of separately stated items, such as:

- Interest income

- Dividend income

- Capital gains (losses)

- Depreciation and amortization

- Charitable contributions

- Share of credits, such as:

- Foreign tax credit

- General business credit

- Low-income housing credit

How is the Information on Schedule K-1 Form 1120-S Used?

Shareholders use the information reported on Schedule K-1 Form 1120-S to complete their individual tax returns. The K-1 form provides the necessary information for shareholders to report their share of income, deductions, and credits on their personal tax returns. This information is typically reported on Schedule E (Supplemental Income and Loss) of the shareholder's Form 1040.

Consequences of Failing to File or Inaccurate Reporting

Failure to file or inaccurate reporting on Schedule K-1 Form 1120-S can result in severe consequences, including:

- Penalties and fines for the S corporation and its shareholders

- Delayed or denied refunds

- Increased scrutiny from the IRS

- Potential loss of S corporation status

Best Practices for Filing Schedule K-1 Form 1120-S

To ensure accurate and timely filing of Schedule K-1 Form 1120-S, S corporations should:

- Maintain accurate and detailed records of shareholder information and financial data

- Consult with a tax professional or accountant to ensure compliance with IRS regulations

- File the K-1 form electronically, if possible, to reduce errors and improve processing time

- Provide shareholders with a copy of the K-1 form by the tax filing deadline

In conclusion, Schedule K-1 Form 1120-S is a critical document for S corporations and their shareholders. Understanding the purpose, contents, and implications of this form is essential for accurate reporting and compliance with IRS regulations. By following best practices and seeking professional guidance, S corporations can ensure timely and accurate filing of the K-1 form and avoid potential consequences.

We hope this article has provided valuable insights into the world of Schedule K-1 Form 1120-S. If you have any questions or comments, please feel free to share them below. Don't forget to share this article with your colleagues and friends who may benefit from this information.

What is the deadline for filing Schedule K-1 Form 1120-S?

+The deadline for filing Schedule K-1 Form 1120-S is typically March 15th for calendar-year S corporations.

Who is required to file Schedule K-1 Form 1120-S?

+S corporations are required to file Schedule K-1 Form 1120-S for each shareholder who owns a share of the corporation's stock.

What happens if I fail to file or inaccurately report on Schedule K-1 Form 1120-S?

+Failure to file or inaccurate reporting on Schedule K-1 Form 1120-S can result in severe consequences, including penalties and fines, delayed or denied refunds, and increased scrutiny from the IRS.