Filing taxes for a trust or estate can be a complex and daunting task, especially when it comes to navigating the various forms and schedules required by the IRS. One of the most important forms for trusts and estates is Schedule I, which is used to report the income of the trust or estate. In this article, we will provide 5 tips for filing Schedule I Form 1041 to help you ensure accuracy and avoid costly mistakes.

Understanding Schedule I Form 1041

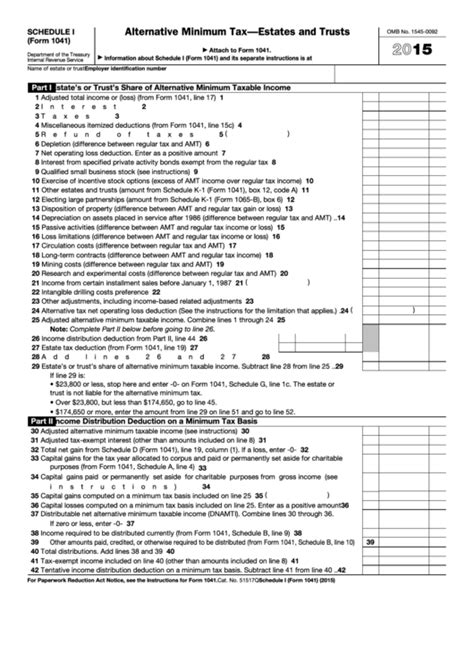

Before we dive into the tips, it's essential to understand the purpose of Schedule I Form 1041. This schedule is used to report the income of a trust or estate, including income from various sources such as dividends, interest, capital gains, and rents. The information reported on Schedule I is used to calculate the trust's or estate's taxable income, which is then reported on Form 1041, the U.S. Income Tax Return for Estates and Trusts.

Tip 1: Identify the Correct Filing Status

The first step in filing Schedule I Form 1041 is to identify the correct filing status of the trust or estate. This will determine which columns on the schedule to use when reporting income. The filing status of a trust or estate is determined by the type of trust or estate and the number of beneficiaries. For example, a grantor trust files as a single taxpayer, while a complex trust files as a separate taxpayer.

Reporting Income on Schedule I

Once the correct filing status has been determined, the next step is to report the income of the trust or estate on Schedule I. This includes income from various sources such as:

- Dividends and interest

- Capital gains and losses

- Rents and royalties

- Business income

Tip 2: Use the Correct Columns

When reporting income on Schedule I, it's essential to use the correct columns. The schedule has multiple columns for reporting different types of income, and using the wrong column can result in errors and delays. For example, dividends and interest are reported in column (a), while capital gains and losses are reported in column (e).

Distributions to Beneficiaries

Schedule I Form 1041 also requires the reporting of distributions to beneficiaries. This includes the amount of income distributed to each beneficiary and the type of income distributed. The information reported on Schedule I is used to calculate the beneficiary's taxable income, which is then reported on their individual tax return.

Tip 3: Report Distributions Correctly

When reporting distributions to beneficiaries, it's essential to report the correct amount and type of income. This includes reporting the amount of income distributed to each beneficiary and the type of income distributed. For example, if a trust distributes $10,000 of dividend income to a beneficiary, the trust must report this amount in column (a) of Schedule I.

Calculating Taxable Income

The final step in filing Schedule I Form 1041 is to calculate the trust's or estate's taxable income. This is done by adding up the income reported on Schedule I and subtracting any deductions and exemptions. The taxable income is then reported on Form 1041, the U.S. Income Tax Return for Estates and Trusts.

Tip 4: Use the Correct Tax Rates

When calculating taxable income, it's essential to use the correct tax rates. The tax rates for trusts and estates are different from those for individuals, and using the wrong tax rate can result in errors and delays. For example, the tax rate for trusts and estates ranges from 10% to 37%, depending on the amount of taxable income.

Common Mistakes to Avoid

Finally, it's essential to avoid common mistakes when filing Schedule I Form 1041. These mistakes can result in errors and delays, and can even lead to penalties and fines. Some common mistakes to avoid include:

- Using the wrong filing status

- Reporting income in the wrong column

- Failing to report distributions to beneficiaries

- Using the wrong tax rates

Tip 5: Seek Professional Help

If you're unsure about how to file Schedule I Form 1041 or need help with any of the steps outlined above, it's essential to seek professional help. A tax professional or accountant can help you navigate the complex rules and regulations surrounding trust and estate taxation, and can ensure that your return is accurate and complete.

In conclusion, filing Schedule I Form 1041 requires attention to detail and a thorough understanding of the rules and regulations surrounding trust and estate taxation. By following the tips outlined above, you can ensure accuracy and avoid costly mistakes.

We hope this article has been informative and helpful. If you have any questions or need further clarification, please don't hesitate to ask. Don't forget to share this article with others who may find it useful.

What is Schedule I Form 1041 used for?

+Schedule I Form 1041 is used to report the income of a trust or estate, including income from various sources such as dividends, interest, capital gains, and rents.

How do I determine the correct filing status for my trust or estate?

+The filing status of a trust or estate is determined by the type of trust or estate and the number of beneficiaries. For example, a grantor trust files as a single taxpayer, while a complex trust files as a separate taxpayer.

What are some common mistakes to avoid when filing Schedule I Form 1041?

+Some common mistakes to avoid include using the wrong filing status, reporting income in the wrong column, failing to report distributions to beneficiaries, and using the wrong tax rates.