As a business owner, navigating the complexities of tax law can be overwhelming. One often-overlooked aspect of tax planning is the Qualified Subchapter S Subsidiary (QSub) election, which can provide significant benefits for certain businesses. In this article, we will delve into the world of IRS Form 8869, exploring what it is, how it works, and the benefits it can bring to eligible businesses.

What is a Qualified Subchapter S Subsidiary (QSub)?

A QSub is a subsidiary corporation that is wholly owned by an S corporation. The QSub election allows the subsidiary to be treated as a division of the parent S corporation for tax purposes, rather than as a separate taxable entity. This can simplify tax reporting and provide other benefits, which we will discuss later.

What is IRS Form 8869?

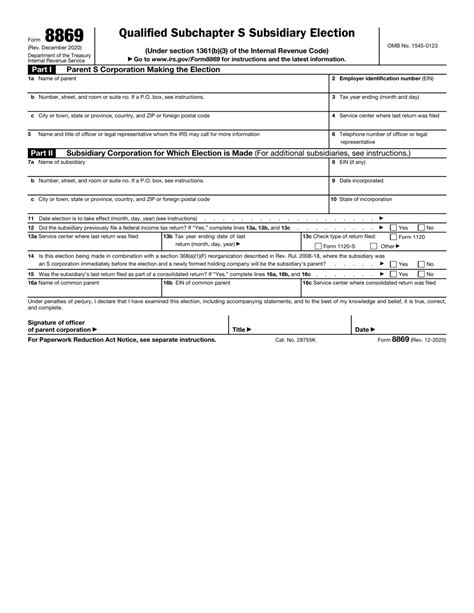

IRS Form 8869 is the form used to make the QSub election. The form is relatively straightforward, requiring the parent S corporation to provide basic information about the subsidiary, including its name, address, and Employer Identification Number (EIN). The form must be filed with the IRS and attached to the parent S corporation's tax return.

Benefits of the QSub Election

The QSub election can provide several benefits to eligible businesses, including:

- Simplified tax reporting: By treating the subsidiary as a division of the parent S corporation, the QSub election eliminates the need for separate tax returns for the subsidiary.

- Pass-through taxation: The QSub election allows the subsidiary's income to be passed through to the parent S corporation, avoiding double taxation.

- Increased flexibility: The QSub election can provide greater flexibility in structuring business operations and making decisions about the subsidiary.

Who is Eligible for the QSub Election?

To be eligible for the QSub election, the subsidiary must meet certain requirements, including:

- Wholly owned by an S corporation: The subsidiary must be wholly owned by an S corporation, meaning that the S corporation must own 100% of the subsidiary's stock.

- Domestic corporation: The subsidiary must be a domestic corporation, meaning that it must be incorporated in the United States.

- Not an ineligible corporation: The subsidiary cannot be an ineligible corporation, such as a financial institution or an insurance company.

How to Make the QSub Election

To make the QSub election, the parent S corporation must file IRS Form 8869 with the IRS and attach it to its tax return. The form must be filed on or before the 15th day of the third month following the end of the tax year in which the election is made.

Tax Implications of the QSub Election

The QSub election can have significant tax implications, including:

- Pass-through taxation: As mentioned earlier, the QSub election allows the subsidiary's income to be passed through to the parent S corporation, avoiding double taxation.

- Consolidated tax reporting: The QSub election requires the parent S corporation to report the subsidiary's income on its own tax return, using a consolidated reporting approach.

Consolidated Tax Reporting Example

Suppose an S corporation owns a wholly owned subsidiary that generates $100,000 in net income. If the QSub election is made, the parent S corporation would report the subsidiary's income on its own tax return, using a consolidated reporting approach. The parent S corporation would report $100,000 in net income, and the subsidiary's income would be passed through to the parent S corporation's shareholders.

Termination of the QSub Election

The QSub election can be terminated if certain events occur, including:

- Sale of subsidiary stock: If the parent S corporation sells any of the subsidiary's stock, the QSub election will terminate.

- Merger or consolidation: If the subsidiary merges or consolidates with another corporation, the QSub election will terminate.

- Failure to meet eligibility requirements: If the subsidiary fails to meet any of the eligibility requirements, the QSub election will terminate.

Conclusion and Next Steps

The QSub election can provide significant benefits to eligible businesses, including simplified tax reporting and pass-through taxation. To make the QSub election, the parent S corporation must file IRS Form 8869 with the IRS and attach it to its tax return. It is essential to carefully review the eligibility requirements and tax implications of the QSub election before making the election.

We hope this article has provided valuable insights into the world of QSub elections and IRS Form 8869. If you have any questions or need further guidance, please don't hesitate to comment below or reach out to a tax professional.

What is the QSub election?

+The QSub election is an election that allows a subsidiary corporation to be treated as a division of the parent S corporation for tax purposes.

What is IRS Form 8869?

+IRS Form 8869 is the form used to make the QSub election.

What are the benefits of the QSub election?

+The QSub election can provide simplified tax reporting, pass-through taxation, and increased flexibility.