Tax season can be a daunting time for many Californians, with numerous forms and schedules to navigate. One crucial form for California residents is the CA 540 form, also known as the California Resident Income Tax Return. In this article, we will delve into the world of CA 540 forms, exploring their purpose, the benefits of timely filing, and providing a step-by-step guide on how to file.

Understanding the CA 540 Form

The CA 540 form is used by California residents to report their annual income and pay state income tax. The form is typically filed by April 15th of each year, and it's essential to submit it on time to avoid penalties and interest. The California Franchise Tax Board (FTB) uses the information provided on the CA 540 form to calculate the taxpayer's state income tax liability.

Benefits of Timely Filing

Filing your CA 540 form on time can have several benefits, including:

- Avoiding penalties and interest: Late filers may be subject to penalties and interest on the amount of tax owed.

- Receiving a refund: If you're due a refund, filing your CA 540 form on time ensures you receive it promptly.

- Reducing the risk of audit: Filing your tax return on time can reduce the likelihood of an audit.

Step-by-Step Guide to Filing CA 540 Form

Filing your CA 540 form can be a straightforward process if you follow these steps:

Gather Required Documents

Before starting the filing process, gather the necessary documents, including:

- W-2 forms from your employer(s)

- 1099 forms for freelance work or self-employment income

- Interest statements from banks and investments

- Dividend statements

- Charitable donation receipts

Choose Your Filing Status

Your filing status will determine which CA 540 form you need to file. The options include:

- Single

- Married/RDP filing jointly

- Married/RDP filing separately

- Head of household

- Qualifying widow(er)

Complete the CA 540 Form

Once you've gathered your documents and chosen your filing status, complete the CA 540 form. You can file electronically or by mail. The form will ask for information about your income, deductions, and credits.

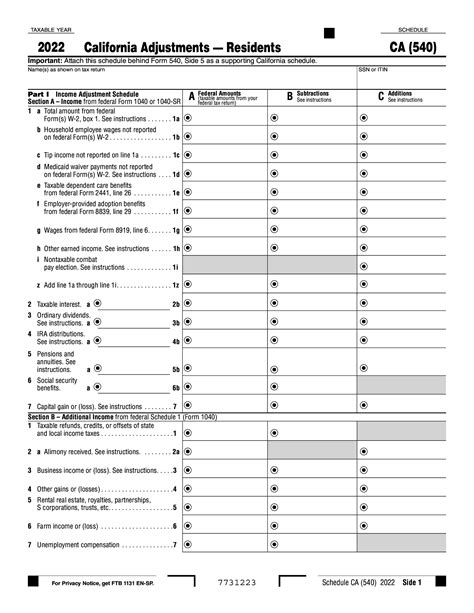

- Part I: Income: Report your income from all sources, including employment, self-employment, and investments.

- Part II: Adjustments to Income: Claim deductions for items like mortgage interest, charitable donations, and medical expenses.

- Part III: Credits: Claim credits for items like child care expenses, education expenses, and the California Earned Income Tax Credit (CalEITC).

Submit Your CA 540 Form

Once you've completed the form, submit it to the FTB. You can file electronically through the FTB's website or by mail using the address listed on the form.

Common Errors to Avoid

When filing your CA 540 form, avoid common errors that can delay processing or result in penalties:

- Inaccurate social security numbers

- Incorrect filing status

- Math errors

- Failure to sign the form

CA 540 Form Schedule

The CA 540 form schedule is as follows:

- Form 540: California Resident Income Tax Return

- Schedule CA: California Adjustments

- Schedule D: Capital Gains and Losses

- Schedule E: Supplemental Income and Loss

Conclusion

Filing your CA 540 form is a crucial step in fulfilling your tax obligations as a California resident. By understanding the purpose of the form, the benefits of timely filing, and following the step-by-step guide, you can ensure a smooth and stress-free filing process. Remember to avoid common errors and take advantage of the FTB's resources to ensure you're taking advantage of all the credits and deductions available to you.

What is the deadline for filing the CA 540 form?

+The deadline for filing the CA 540 form is typically April 15th of each year.

Can I file my CA 540 form electronically?

+Yes, you can file your CA 540 form electronically through the FTB's website.

What is the penalty for late filing of the CA 540 form?

+The penalty for late filing of the CA 540 form is typically 5% of the unpaid tax, plus interest.