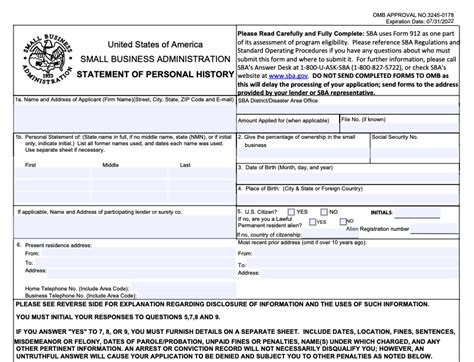

The Small Business Administration (SBA) has made a significant change that affects the application process for SBA loans. As of recent updates, the SBA Form 912, also known as the "Statement of Personal History," is no longer required for most SBA loan applications. This change aims to streamline the application process, reduce paperwork, and make it easier for small businesses to access the capital they need.

The SBA Form 912 was previously a mandatory part of the loan application process for many SBA loan programs, including the popular 7(a) loan program. The form required applicants to disclose personal history information, including past arrests, convictions, and other personal details. While the intention behind the form was to assess the creditworthiness and character of the applicant, it often added unnecessary complexity and delays to the application process.

In this article, we will delve into the details of the SBA Form 912, its previous requirements, and the implications of its removal. We will also discuss the benefits of this change for small business owners and provide guidance on what to expect during the updated application process.

What was the SBA Form 912, and why was it required?

The SBA Form 912, or Statement of Personal History, was a mandatory form that applicants had to complete as part of the SBA loan application process. The form required applicants to disclose personal history information, including:

- Past arrests and convictions

- Pending charges or lawsuits

- Past bankruptcies or foreclosures

- Other personal details that could impact creditworthiness

The SBA used this information to assess the character and creditworthiness of the applicant, as well as to ensure that the applicant was not a high risk for loan default. While the intention behind the form was to protect the SBA and its lenders, it often added unnecessary complexity and delays to the application process.

What are the benefits of removing the SBA Form 912?

The removal of the SBA Form 912 has several benefits for small business owners, including:

- Streamlined application process: With one less form to complete, the application process is now faster and more efficient.

- Reduced paperwork: The removal of the SBA Form 912 reduces the overall amount of paperwork required for the loan application process.

- Increased accessibility: The updated application process makes it easier for small businesses to access the capital they need to grow and succeed.

What does the updated application process look like?

While the SBA Form 912 is no longer required, the SBA still requires applicants to provide certain information as part of the loan application process. This includes:

- Business financial statements: Applicants must provide financial statements, including balance sheets and income statements.

- Business tax returns: Applicants must provide business tax returns for the past three years.

- Personal financial statements: Applicants must provide personal financial statements, including personal tax returns.

The SBA will also conduct a credit check on the applicant and review their credit history as part of the application process.

What are the implications for small business owners?

The removal of the SBA Form 912 has significant implications for small business owners, including:

- Easier access to capital: The updated application process makes it easier for small businesses to access the capital they need to grow and succeed.

- Increased efficiency: The streamlined application process saves time and reduces the administrative burden on small business owners.

- Improved customer experience: The updated application process provides a better customer experience for small business owners, with fewer forms to complete and less paperwork required.

What's next for small business owners?

If you're a small business owner looking to apply for an SBA loan, here are the next steps to take:

- Review the updated application process: Familiarize yourself with the updated application process and the required documents.

- Gather required documents: Gather the required financial statements, tax returns, and other documents needed for the application process.

- Submit your application: Submit your application and supporting documents to the SBA.

By understanding the updated application process and the implications of the SBA Form 912 removal, small business owners can take advantage of the streamlined process and access the capital they need to grow and succeed.

Conclusion

The removal of the SBA Form 912 marks a significant change in the SBA loan application process. By streamlining the process and reducing paperwork, the SBA aims to make it easier for small businesses to access the capital they need. As a small business owner, it's essential to understand the updated application process and the implications of the SBA Form 912 removal. By doing so, you can take advantage of the streamlined process and access the capital you need to grow and succeed.

We encourage you to share your thoughts and experiences with the updated SBA loan application process. Have you applied for an SBA loan recently? How has your experience been? Share your comments below!

FAQ Section:

What is the SBA Form 912?

+The SBA Form 912, also known as the "Statement of Personal History," was a mandatory form that applicants had to complete as part of the SBA loan application process. The form required applicants to disclose personal history information, including past arrests and convictions, pending charges or lawsuits, past bankruptcies or foreclosures, and other personal details that could impact creditworthiness.

Why was the SBA Form 912 removed?

+The SBA Form 912 was removed to streamline the application process, reduce paperwork, and make it easier for small businesses to access the capital they need. The SBA aims to provide a more efficient and customer-friendly experience for small business owners.

What are the benefits of removing the SBA Form 912?

+The removal of the SBA Form 912 has several benefits for small business owners, including a streamlined application process, reduced paperwork, and increased accessibility. The updated application process makes it easier for small businesses to access the capital they need to grow and succeed.