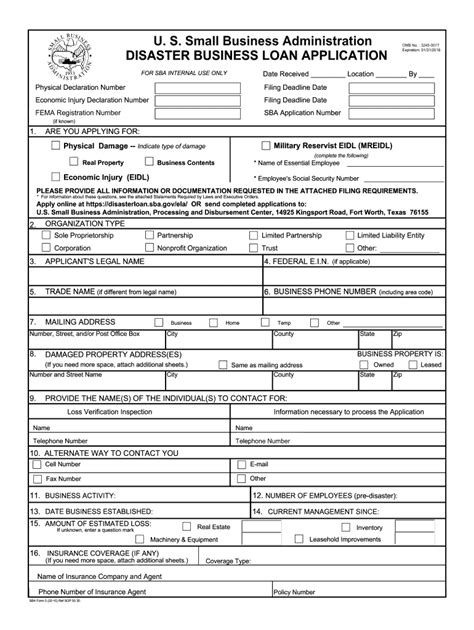

As a small business owner, navigating the world of government forms and applications can be daunting. One of the most important forms for entrepreneurs seeking financial assistance is the SBA Form 2128, also known as the Disaster Business Loan Application. This form is used to apply for disaster relief loans from the Small Business Administration (SBA). In this article, we will provide you with 5 valuable tips for filling out SBA Form 2128, helping you increase your chances of approval.

Understanding the SBA Form 2128

Before we dive into the tips, it's essential to understand the purpose of the SBA Form 2128. This form is used to apply for financial assistance from the SBA for businesses affected by a disaster. The SBA provides low-interest loans to help businesses recover from disasters, such as hurricanes, floods, and wildfires. The loan can be used to cover various expenses, including damaged property, inventory, and equipment.

Tip 1: Gather Required Documents

Before starting the application process, make sure you have all the required documents. These documents may include:

- Business tax returns

- Financial statements

- Business license

- Insurance policies

- Proof of business ownership

Having these documents ready will help you fill out the form accurately and efficiently.

**Eligibility Criteria**

To be eligible for an SBA disaster loan, your business must meet certain criteria. These criteria include:

- Your business must be located in a declared disaster area.

- Your business must have suffered physical damage or economic injury as a result of the disaster.

- Your business must be a small business, as defined by the SBA.

Tip 2: Provide Accurate Business Information

When filling out the form, make sure to provide accurate business information. This includes:

- Business name and address

- Business type (e.g., sole proprietorship, partnership, corporation)

- Business tax ID number

- Business owner's name and contact information

Inaccurate or incomplete information can delay the processing of your application.

**Business Financial Information**

You will also need to provide financial information about your business. This includes:

- Annual gross revenue

- Net profit or loss

- Total assets and liabilities

- Current cash flow

Be prepared to provide detailed financial statements, such as balance sheets and income statements.

Tip 3: Calculate Your Loan Amount

You will need to calculate the amount of the loan you are requesting. This amount should be based on the estimated cost of repairing or replacing damaged property, as well as any economic injury your business has suffered.

Make sure to provide a detailed breakdown of the loan amount, including:

- Estimated cost of repairs or replacement

- Economic injury (e.g., lost revenue, increased expenses)

- Other expenses (e.g., rental costs, equipment purchases)

**Loan Terms**

The SBA offers favorable loan terms, including:

- Low interest rates (as low as 3.75%)

- Long repayment terms (up to 30 years)

- No prepayment penalties

Keep in mind that the SBA may require collateral for loans over $25,000.

Tip 4: Review and Edit Your Application

Before submitting your application, review it carefully for errors or omissions. Make sure to edit your application to ensure it is complete and accurate.

Consider having a business advisor or accountant review your application to ensure it is accurate and complete.

**Submission**

Once you have completed and reviewed your application, submit it to the SBA. You can submit your application online, by mail, or in person at a disaster recovery center.

Tip 5: Follow Up

After submitting your application, follow up with the SBA to ensure it is being processed. You can check the status of your application online or by contacting the SBA directly.

If your application is approved, be prepared to provide additional documentation and information to finalize the loan.

**Conclusion**

Filling out SBA Form 2128 requires careful attention to detail and accuracy. By following these 5 tips, you can increase your chances of approval and receive the financial assistance you need to recover from a disaster.

If you have any questions or concerns about the application process, don't hesitate to reach out to the SBA or a business advisor for guidance.

What is the SBA Form 2128?

+The SBA Form 2128 is a disaster business loan application used to apply for financial assistance from the Small Business Administration (SBA).

What are the eligibility criteria for an SBA disaster loan?

+To be eligible for an SBA disaster loan, your business must be located in a declared disaster area, have suffered physical damage or economic injury as a result of the disaster, and meet the SBA's definition of a small business.

What is the interest rate for an SBA disaster loan?

+The interest rate for an SBA disaster loan is as low as 3.75%.