The SBA Form 1919 is a crucial document for businesses seeking financial assistance from the Small Business Administration (SBA). As a business owner, understanding the purpose and contents of this form is essential to ensure a smooth application process. In this article, we will delve into the world of SBA Form 1919, providing a comprehensive guide on its importance, requirements, and instructions for completion.

What is SBA Form 1919?

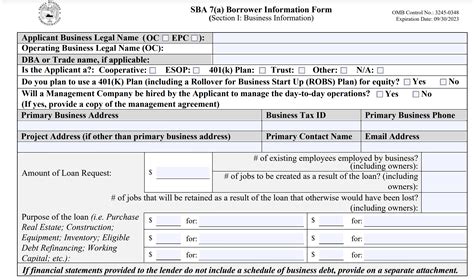

SBA Form 1919, also known as the "Borrower Information Form," is a required document for businesses applying for SBA-guaranteed loans. The form collects essential information about the borrower, including business and personal data, to facilitate the loan application process.

Why is SBA Form 1919 important?

The SBA Form 1919 serves several purposes:

- It helps the SBA to evaluate the creditworthiness of the borrower and assess the risk associated with the loan.

- It provides the lender with necessary information to determine the borrower's eligibility for the loan.

- It ensures compliance with SBA regulations and requirements.

What information is required on SBA Form 1919?

The SBA Form 1919 requires the following information:

- Business information:

- Business name and address

- Business type (sole proprietorship, partnership, corporation, etc.)

- Business structure (LLC, S-Corp, C-Corp, etc.)

- Employer Identification Number (EIN)

- Personal information:

- Name and address of the business owner(s)

- Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN)

- Date of birth

- Financial information:

- Business income and expenses

- Personal income and expenses

- Assets and liabilities

- Loan information:

- Loan amount and purpose

- Interest rate and repayment terms

How to complete SBA Form 1919?

To complete the SBA Form 1919, follow these steps:

- Download the form from the SBA website or obtain it from your lender.

- Read the instructions carefully and ensure you understand the requirements.

- Fill out the form accurately and completely, using black ink or typing.

- Attach supporting documentation, such as financial statements and tax returns.

- Review and sign the form, ensuring that all information is accurate and complete.

Free Download of SBA Form 1919

You can download the SBA Form 1919 from the SBA website or obtain it from your lender. It is essential to use the most recent version of the form to ensure compliance with SBA regulations.

Instructions for SBA Form 1919

The SBA provides instructions for completing the form, which can be found on their website or by contacting your lender. It is crucial to follow these instructions carefully to ensure that your application is processed efficiently.

Common mistakes to avoid when completing SBA Form 1919

To avoid delays or rejection of your loan application, avoid the following common mistakes:

- Incomplete or inaccurate information

- Failure to attach supporting documentation

- Not signing the form

- Using an outdated version of the form

Conclusion

In conclusion, the SBA Form 1919 is a critical document for businesses seeking financial assistance from the SBA. Understanding the purpose and requirements of this form is essential to ensure a smooth application process. By following the instructions carefully and avoiding common mistakes, you can increase your chances of a successful loan application.

What is the purpose of SBA Form 1919?

+SBA Form 1919 is used to collect essential information about the borrower, including business and personal data, to facilitate the loan application process.

Where can I download SBA Form 1919?

+You can download the SBA Form 1919 from the SBA website or obtain it from your lender.

What are the common mistakes to avoid when completing SBA Form 1919?

+Common mistakes to avoid include incomplete or inaccurate information, failure to attach supporting documentation, not signing the form, and using an outdated version of the form.