Filing Rut 25 Form In Illinois: A Comprehensive Overview

In the state of Illinois, the Illinois Department of Revenue requires that certain individuals and businesses file specific forms to report their vehicle usage. One such form is the Rut 25 Form, which is used to report and pay the Motor Fuel Tax (MFT) and the Use Tax on vehicles that do not have an Illinois registration. In this article, we will delve into the world of Rut 25 Form filing, exploring its importance, benefits, and a step-by-step guide on how to file it correctly.

Why Filing Rut 25 Form is Crucial in Illinois

Filing the Rut 25 Form is essential for individuals and businesses that operate vehicles in Illinois without an Illinois registration. Failure to file this form can result in penalties, fines, and even the revocation of your vehicle's registration. By filing the Rut 25 Form, you ensure compliance with Illinois tax laws and regulations, avoiding any potential consequences.

Benefits of Filing Rut 25 Form

Filing the Rut 25 Form comes with several benefits, including:

- Compliance with Illinois tax laws and regulations

- Avoidance of penalties and fines

- Ability to operate your vehicle in Illinois without any restrictions

- Potential refund of Use Tax paid on fuel purchases

Who Needs to File Rut 25 Form?

The following individuals and businesses need to file the Rut 25 Form:

- Non-Illinois residents who operate a vehicle in Illinois

- Illinois residents who operate a vehicle with an out-of-state registration

- Businesses that operate vehicles in Illinois without an Illinois registration

Step-by-Step Guide to Filing Rut 25 Form

Filing the Rut 25 Form can be a straightforward process if you follow these steps:

Step 1: Gather Required Documents

Before you start filing the Rut 25 Form, make sure you have the following documents:

- Vehicle registration (out-of-state or Illinois)

- Proof of fuel purchases (receipts or invoices)

- Proof of Use Tax paid on fuel purchases (receipts or invoices)

- Business license (if applicable)

Step 2: Determine Your Tax Liability

Calculate your tax liability by multiplying the total number of gallons of fuel purchased by the applicable tax rate. You can find the tax rates on the Illinois Department of Revenue's website.

Motor Fuel Tax Rates

- Gasoline: $0.38 per gallon

- Diesel fuel: $0.45 per gallon

Use Tax Rates

- 6.25% of the total fuel purchase price

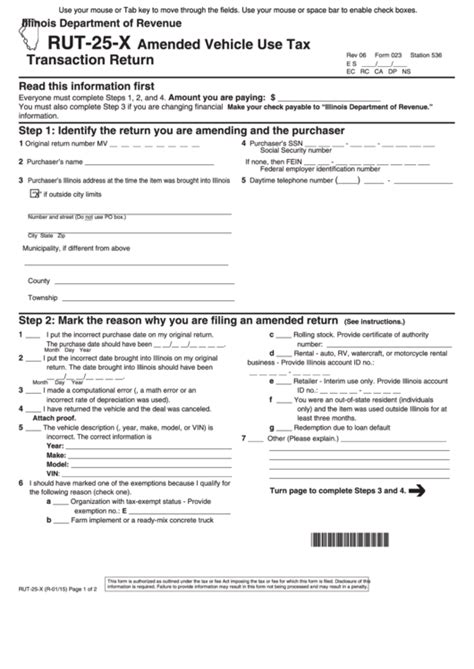

Step 3: Complete the Rut 25 Form

Fill out the Rut 25 Form accurately and completely. Make sure to provide all required information, including:

- Vehicle registration information

- Fuel purchase information

- Use Tax paid information

- Business license information (if applicable)

Step 4: Submit the Rut 25 Form

Submit the completed Rut 25 Form to the Illinois Department of Revenue, either by mail or electronically through their website.

Mailing Address:

Illinois Department of Revenue P.O. Box 71207 Springfield, IL 62794-1207

Electronic Filing:

Visit the Illinois Department of Revenue's website and follow the instructions for electronic filing.

Step 5: Pay Any Tax Due

Pay any tax due by the filing deadline to avoid penalties and fines. You can pay online, by phone, or by mail.

Tips and Reminders

- File the Rut 25 Form quarterly, by the 20th day of the month following the end of the quarter.

- Keep accurate records of fuel purchases and Use Tax paid.

- Consult with a tax professional or the Illinois Department of Revenue if you have any questions or concerns.

Conclusion and Call to Action

Filing the Rut 25 Form is a crucial step in ensuring compliance with Illinois tax laws and regulations. By following the step-by-step guide outlined in this article, you can ensure accurate and timely filing of the Rut 25 Form. If you have any questions or concerns, don't hesitate to reach out to the Illinois Department of Revenue or a tax professional.

Share your experiences and tips for filing the Rut 25 Form in the comments below. Don't forget to share this article with others who may find it helpful.

FAQ Section

What is the Rut 25 Form used for?

+The Rut 25 Form is used to report and pay the Motor Fuel Tax (MFT) and the Use Tax on vehicles that do not have an Illinois registration.

Who needs to file the Rut 25 Form?

+Non-Illinois residents who operate a vehicle in Illinois, Illinois residents who operate a vehicle with an out-of-state registration, and businesses that operate vehicles in Illinois without an Illinois registration need to file the Rut 25 Form.

What is the deadline for filing the Rut 25 Form?

+The deadline for filing the Rut 25 Form is the 20th day of the month following the end of the quarter.