Completing the SF 1199A form is a crucial step for federal employees who want to direct their federal payments, such as salary or benefits, to a financial institution. The SF 1199A form, also known as the "Direct Deposit Sign-Up Form," allows federal employees to authorize the U.S. Department of the Treasury's Bureau of the Fiscal Service to deposit their payments directly into their bank account.

Why is Direct Deposit Important?

Direct deposit is a convenient and secure way to receive federal payments. It eliminates the risk of lost or stolen checks, reduces the need for paper checks, and provides faster access to funds. Additionally, direct deposit helps reduce the environmental impact of paper checks and reduces the costs associated with processing and mailing paper checks.

Who Can Use the SF 1199A Form?

The SF 1199A form is available to all federal employees who receive payments from the U.S. Department of the Treasury's Bureau of the Fiscal Service. This includes:

- Federal civilian employees

- Military personnel

- Veterans

- Beneficiaries of federal programs, such as Social Security and Medicare

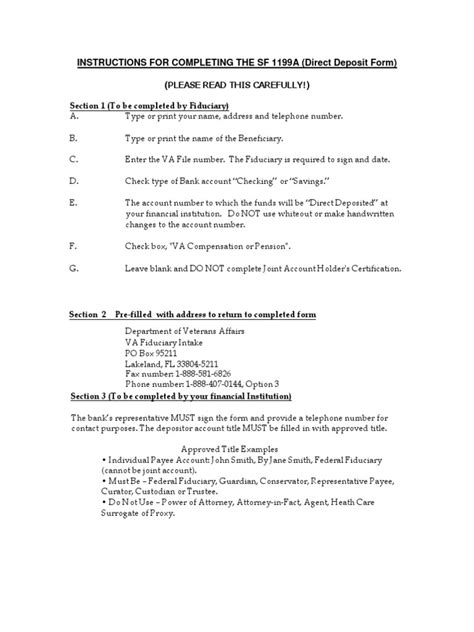

How to Complete the SF 1199A Form

Completing the SF 1199A form is a straightforward process. Here are the steps:

- Download the SF 1199A form: You can download the SF 1199A form from the U.S. Department of the Treasury's website or obtain a copy from your agency's payroll office.

- Fill out the form: Fill out the form with the required information, including:

- Your name and address

- Your Social Security number or taxpayer identification number

- The type of payment you want to direct deposit (e.g., salary, benefits, etc.)

- The routing transit number (RTN) of your bank or financial institution

- Your account number

- Sign the form: Sign the form in the designated area.

- Attach a voided check: Attach a voided check from your bank account to the form. This will help ensure that your payment is deposited into the correct account.

- Submit the form: Submit the completed form to your agency's payroll office or mail it to the address listed on the form.

Important Information

- Make sure to use black ink when filling out the form.

- Do not staple or tape the voided check to the form.

- Keep a copy of the completed form for your records.

Tips for Completing the SF 1199A Form

Here are some tips to help you complete the SF 1199A form:

- Use the correct routing transit number: Make sure to use the correct RTN for your bank or financial institution. You can find this number on the bottom left corner of your check or on your bank's website.

- Double-check your account number: Double-check your account number to ensure that it is accurate.

- Use a voided check: Use a voided check from your bank account to ensure that your payment is deposited into the correct account.

- Keep a copy of the form: Keep a copy of the completed form for your records.

Benefits of Direct Deposit

Direct deposit offers several benefits, including:

- Convenience: Direct deposit is a convenient way to receive federal payments.

- Security: Direct deposit eliminates the risk of lost or stolen checks.

- Faster access to funds: Direct deposit provides faster access to funds.

- Reduced environmental impact: Direct deposit reduces the environmental impact of paper checks.

Common Questions and Answers

Here are some common questions and answers about the SF 1199A form:

Q: What is the SF 1199A form used for?

A: The SF 1199A form is used to direct federal payments, such as salary or benefits, to a financial institution.Q: Who can use the SF 1199A form?

A: The SF 1199A form is available to all federal employees who receive payments from the U.S. Department of the Treasury's Bureau of the Fiscal Service.Q: How do I complete the SF 1199A form?

A: To complete the SF 1199A form, fill out the required information, sign the form, attach a voided check, and submit the form to your agency's payroll office or mail it to the address listed on the form.Q: What are the benefits of direct deposit?

A: The benefits of direct deposit include convenience, security, faster access to funds, and reduced environmental impact.What if I make a mistake on the SF 1199A form?

+If you make a mistake on the SF 1199A form, you can correct it and resubmit the form. However, if you have already submitted the form, you will need to contact your agency's payroll office to make the necessary corrections.

Can I use the SF 1199A form to direct deposit my payment to a credit union?

+How long does it take for my payment to be deposited into my account?

+The time it takes for your payment to be deposited into your account varies depending on the type of payment and the financial institution. However, most payments are deposited within 1-3 business days.

By following these instructions and tips, you can complete the SF 1199A form and start receiving your federal payments via direct deposit.