The Automated Clearing House (ACH) payment authorization form is a crucial document that enables businesses to debit payments directly from a customer's checking account. As a business owner, it's essential to have a comprehensive understanding of this form and its significance in streamlining payment processing.

ACH payment authorization forms are widely used in various industries, including e-commerce, subscription-based services, and utility companies. By using this form, businesses can reduce the risk of late payments, minimize transaction fees, and improve cash flow management. In this article, we will delve into the world of ACH payment authorization forms, exploring their benefits, key components, and best practices for implementation.

Understanding ACH Payment Authorization Forms

An ACH payment authorization form is a document that grants permission to a business to debit payments from a customer's checking account. This form is typically used for recurring payments, such as subscription services, utility bills, or loan payments. By signing the form, the customer authorizes the business to initiate ACH transactions, which are then processed through the Automated Clearing House network.

Benefits of ACH Payment Authorization Forms

The use of ACH payment authorization forms offers numerous benefits for both businesses and customers. Some of the key advantages include:

- Reduced risk of late payments: By automating payment processing, businesses can minimize the risk of late payments and associated fees.

- Cost savings: ACH transactions are often less expensive than credit card transactions, resulting in cost savings for businesses.

- Improved cash flow management: ACH payment authorization forms enable businesses to predict and manage cash flow more effectively.

- Convenience: Customers can enjoy the convenience of automatic payments, eliminating the need to worry about missed payments.

Key Components of an ACH Payment Authorization Form

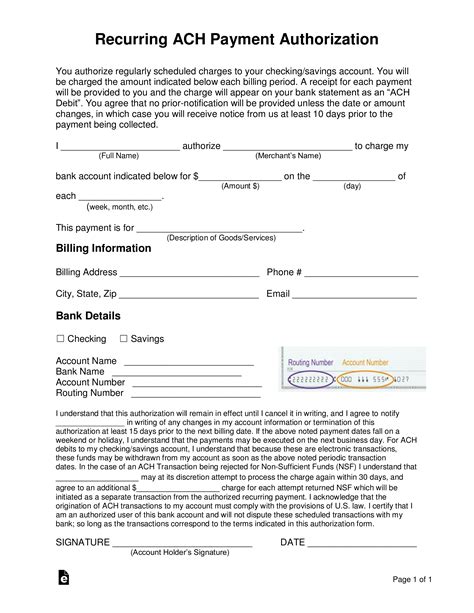

A comprehensive ACH payment authorization form should include the following key components:

- Customer information: Name, address, phone number, and email address.

- Bank account information: Bank name, account number, and routing number.

- Payment details: Payment amount, frequency, and duration.

- Authorization statement: A clear statement granting permission to debit payments from the customer's account.

- Revocation clause: A clause explaining how the customer can revoke the authorization.

- Signatory section: A section for the customer to sign and date the form.

Best Practices for Implementing ACH Payment Authorization Forms

To ensure the effective implementation of ACH payment authorization forms, businesses should follow these best practices:

- Clearly explain the payment terms and conditions to customers.

- Provide customers with a copy of the signed form for their records.

- Store the forms securely to protect customer data.

- Establish a clear revocation process for customers to cancel the authorization.

- Regularly review and update the forms to ensure compliance with changing regulations.

Common Mistakes to Avoid When Using ACH Payment Authorization Forms

When using ACH payment authorization forms, businesses should be aware of common mistakes to avoid, including:

- Insufficient customer information: Failing to collect necessary customer data can lead to payment processing errors.

- Incomplete payment details: Omitting critical payment information, such as payment amount or frequency, can cause confusion and delays.

- Unclear authorization language: Using ambiguous language in the authorization statement can lead to disputes and compliance issues.

- Inadequate storage and security: Failing to store the forms securely can compromise customer data and expose the business to risk.

Conclusion

In conclusion, ACH payment authorization forms are a valuable tool for businesses seeking to streamline payment processing and reduce the risk of late payments. By understanding the benefits, key components, and best practices for implementation, businesses can effectively utilize these forms to improve cash flow management and customer convenience.

We invite you to share your thoughts and experiences with ACH payment authorization forms in the comments below. Have you encountered any challenges or benefits when using these forms? Your insights can help others navigate the world of ACH payment processing.

What is an ACH payment authorization form?

+An ACH payment authorization form is a document that grants permission to a business to debit payments from a customer's checking account.

What are the benefits of using ACH payment authorization forms?

+The benefits of using ACH payment authorization forms include reduced risk of late payments, cost savings, improved cash flow management, and convenience for customers.

What are the key components of an ACH payment authorization form?

+The key components of an ACH payment authorization form include customer information, bank account information, payment details, authorization statement, revocation clause, and signatory section.