If you're one of the millions of Americans who trade stocks, options, or cryptocurrencies on the popular platform Robinhood, you're likely to receive a 1099-B tax form each year. This form is crucial for reporting your investment income to the Internal Revenue Service (IRS), but deciphering it can be a daunting task. In this article, we'll delve into the world of Robinhood 1099-B tax forms, explaining what they are, how to read them, and what you need to do with the information.

What is a Robinhood 1099-B Tax Form?

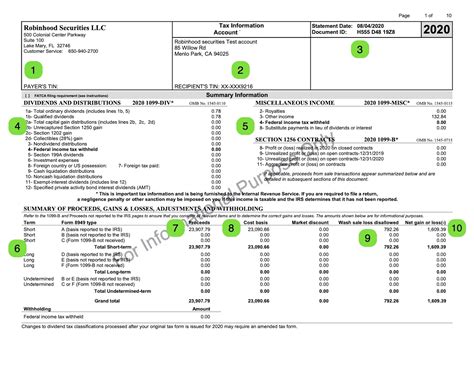

A 1099-B tax form is a document that brokerage firms like Robinhood are required to send to their customers and the IRS each year. The form reports the proceeds from the sale of stocks, options, and other securities, as well as the cost basis of those sales. This information is essential for calculating your capital gains and losses, which are then reported on your tax return.

Why Do I Need a 1099-B Tax Form?

The 1099-B tax form serves several purposes:

- It helps you accurately report your investment income to the IRS.

- It provides a record of your sales proceeds and cost basis, which are necessary for calculating capital gains and losses.

- It helps you identify any wash sales, which can affect your ability to claim losses.

How to Read Your Robinhood 1099-B Tax Form

The 1099-B tax form can be overwhelming, but it's essential to understand the different sections and what they mean. Here's a breakdown of the key components:

- Box 1a: Description of property: This section lists the securities you sold, including stocks, options, and cryptocurrencies.

- Box 1b: Date sold: The date you sold the security.

- Box 1c: Proceeds: The amount of money you received from the sale.

- Box 1d: Cost basis: The amount you paid for the security, which is used to calculate capital gains and losses.

- Box 1e: Code: A code that indicates the type of sale, such as a short-term or long-term sale.

Understanding Capital Gains and Losses

Capital gains and losses are a crucial part of your tax return. Here's how they work:

- Short-term gains: If you sell a security within one year of buying it, the gain is considered short-term and is taxed as ordinary income.

- Long-term gains: If you sell a security after holding it for more than one year, the gain is considered long-term and is taxed at a lower rate.

- Losses: If you sell a security for less than you paid for it, you can claim a loss, which can offset gains from other sales.

What to Do with Your Robinhood 1099-B Tax Form

Now that you have your 1099-B tax form, here's what you need to do:

- Review the form for accuracy: Check the form for any errors or discrepancies.

- Use the information to complete your tax return: Report the proceeds and cost basis on your tax return, using the information from the 1099-B form.

- Claim losses: If you have losses, claim them on your tax return to offset gains from other sales.

Tips for Managing Your Investment Income

Here are some tips for managing your investment income:

- Keep accurate records: Keep a record of your sales proceeds and cost basis, as well as any losses.

- Consider tax-loss harvesting: If you have losses, consider selling securities that have gains to offset the losses.

- Consult a tax professional: If you're unsure about how to report your investment income, consult a tax professional.

By understanding your Robinhood 1099-B tax form, you can accurately report your investment income and minimize your tax liability. Remember to review the form carefully, use the information to complete your tax return, and claim losses to offset gains.

We hope this article has been informative and helpful in understanding your Robinhood 1099-B tax form. If you have any further questions or concerns, please don't hesitate to comment below.

Share your experiences or ask questions in the comments below!

Related Topics:

What is a 1099-B tax form?

+A 1099-B tax form is a document that brokerage firms like Robinhood are required to send to their customers and the IRS each year. It reports the proceeds from the sale of stocks, options, and other securities, as well as the cost basis of those sales.

How do I read my Robinhood 1099-B tax form?

+The 1099-B tax form can be overwhelming, but it's essential to understand the different sections and what they mean. The key components include the description of property, date sold, proceeds, cost basis, and code.

What are capital gains and losses?

+Capital gains and losses are a crucial part of your tax return. Short-term gains are taxed as ordinary income, while long-term gains are taxed at a lower rate. Losses can be claimed to offset gains from other sales.