The W-2 form is one of the most important documents you'll receive from your employer each year. It's more than just a piece of paper; it's a wealth of information that can help you navigate the world of taxes, benefits, and financial planning. In this article, we'll delve into the five ways the W-2 form tells you everything you need to know.

Understanding the W-2 Form

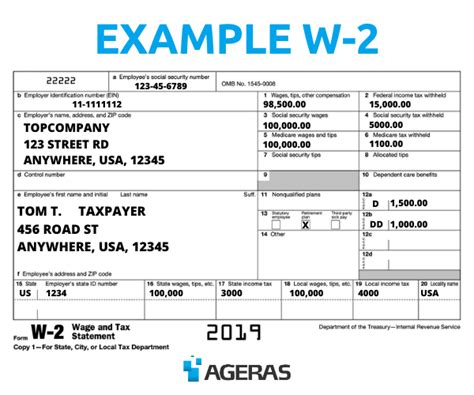

The W-2 form, also known as the Wage and Tax Statement, is a document that your employer is required to provide to you by January 31st of each year. It outlines your income, taxes withheld, and other benefits you've received from your employer. The form is divided into several sections, each providing valuable information that can help you with your taxes, benefits, and financial planning.

Section 1: Employee Information

The first section of the W-2 form contains your personal information, including your name, address, and Social Security number. This information is crucial for tax purposes, as it ensures that the IRS has the correct information to process your tax return.

5 Ways the W-2 Form Tells You Everything

The W-2 form provides a wealth of information that can help you with your taxes, benefits, and financial planning. Here are five ways the W-2 form tells you everything:

1. Income and Taxes Withheld

The W-2 form shows your total income from your employer, including your gross income, federal income tax withheld, and state and local taxes withheld. This information is essential for filing your tax return, as it ensures that you're reporting the correct income and taxes withheld.

2. Benefits and Deductions

The W-2 form also outlines your benefits and deductions, including health insurance premiums, 401(k) contributions, and other pre-tax deductions. This information can help you understand how much you've contributed to your benefits and deductions, and how they impact your taxable income.

3. Social Security and Medicare Taxes

The W-2 form shows the amount of Social Security and Medicare taxes withheld from your paycheck. This information is essential for understanding how much you've contributed to these programs and how they impact your taxable income.

4. State and Local Taxes

The W-2 form also outlines your state and local taxes withheld, including any state income tax, local income tax, or other state and local taxes. This information can help you understand how much you've contributed to these taxes and how they impact your taxable income.

5. Retirement Plan Contributions

The W-2 form shows your contributions to retirement plans, including 401(k), 403(b), and other retirement plans. This information can help you understand how much you've contributed to your retirement plan and how it impacts your taxable income.

What to Do with Your W-2 Form

Now that you understand the importance of the W-2 form, it's essential to know what to do with it. Here are a few steps to take:

- Review your W-2 form carefully to ensure that all the information is accurate.

- Use the information on your W-2 form to file your tax return.

- Keep a copy of your W-2 form for your records.

- Use the information on your W-2 form to plan for your benefits and deductions.

Conclusion

The W-2 form is a valuable document that provides a wealth of information about your income, taxes, benefits, and financial planning. By understanding the five ways the W-2 form tells you everything, you can make informed decisions about your taxes, benefits, and financial planning. Remember to review your W-2 form carefully, use the information to file your tax return, and keep a copy for your records.

What is a W-2 form?

+A W-2 form is a document that your employer provides to you by January 31st of each year, outlining your income, taxes withheld, and other benefits you've received from your employer.

What information is included on the W-2 form?

+The W-2 form includes your personal information, income, taxes withheld, benefits, and other deductions.

What do I do with my W-2 form?

+Review your W-2 form carefully, use the information to file your tax return, keep a copy for your records, and use the information to plan for your benefits and deductions.