A quitclaim deed form is a crucial document in Nevada, and across the United States, when it comes to transferring ownership of real property. While it may seem like a complex and intimidating process, understanding the ways to use a quitclaim deed form can help simplify the transaction. In this article, we will explore five ways to use a quitclaim deed form in Nevada, highlighting the benefits, requirements, and potential risks involved.

Understanding Quitclaim Deed Forms in Nevada

Before we dive into the five ways to use a quitclaim deed form in Nevada, it's essential to understand the basics. A quitclaim deed is a type of deed that transfers the grantor's (seller's) interest in a property to the grantee (buyer) without making any promises or guarantees about the property's title. This means that the grantor is only conveying their interest in the property, without ensuring that they have the right to do so.

Key Elements of a Quitclaim Deed Form in Nevada

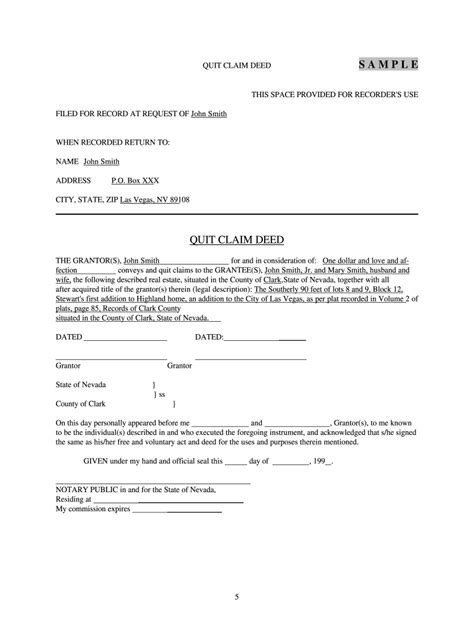

A quitclaim deed form in Nevada typically includes the following elements:

- The names and addresses of the grantor and grantee

- A description of the property being transferred

- The grantor's signature and notarization

- The grantee's acceptance of the deed

1. Transferring Property to a Family Member

One of the most common ways to use a quitclaim deed form in Nevada is to transfer property to a family member. This can be done for various reasons, such as:

- Gifting a property to a child or spouse

- Transferring ownership to a family member with better financial stability

- Simplifying estate planning

When using a quitclaim deed form to transfer property to a family member, it's essential to ensure that the grantor has the right to do so. This may involve researching the property's title and obtaining any necessary releases or approvals.

Benefits of Using a Quitclaim Deed Form for Family Transfers

Using a quitclaim deed form to transfer property to a family member can provide several benefits, including:

- Avoiding probate and reducing estate taxes

- Simplifying the transfer process and reducing costs

- Providing a clear and official record of the transfer

2. Correcting a Mistake in a Previous Deed

Another way to use a quitclaim deed form in Nevada is to correct a mistake in a previous deed. This can be done when:

- A previous deed contains errors or inaccuracies

- A grantor wants to clarify or update the property's description

- A grantor needs to resolve a dispute over the property's title

When using a quitclaim deed form to correct a mistake in a previous deed, it's essential to:

- Identify the error or inaccuracy in the previous deed

- Obtain any necessary releases or approvals from affected parties

- Ensure that the corrected deed is properly recorded

Benefits of Using a Quitclaim Deed Form to Correct a Mistake

Using a quitclaim deed form to correct a mistake in a previous deed can provide several benefits, including:

- Resolving disputes and avoiding costly litigation

- Providing a clear and official record of the correction

- Ensuring that the property's title is accurate and up-to-date

3. Adding or Removing a Co-Owner

A quitclaim deed form can also be used in Nevada to add or remove a co-owner of a property. This can be done when:

- A co-owner wants to transfer their interest in the property

- A new co-owner wants to join the existing ownership structure

- A co-owner wants to update their percentage of ownership

When using a quitclaim deed form to add or remove a co-owner, it's essential to:

- Ensure that all co-owners agree to the change

- Obtain any necessary releases or approvals from affected parties

- Update the property's title to reflect the changes

Benefits of Using a Quitclaim Deed Form to Add or Remove a Co-Owner

Using a quitclaim deed form to add or remove a co-owner can provide several benefits, including:

- Simplifying the ownership structure and reducing conflicts

- Providing a clear and official record of the changes

- Ensuring that the property's title is accurate and up-to-date

4. Transferring Property to a Trust

A quitclaim deed form can also be used in Nevada to transfer property to a trust. This can be done when:

- A grantor wants to transfer property to a living trust

- A grantor wants to transfer property to a special needs trust

- A grantor wants to transfer property to a charitable trust

When using a quitclaim deed form to transfer property to a trust, it's essential to:

- Ensure that the trust is properly established and funded

- Obtain any necessary releases or approvals from affected parties

- Update the property's title to reflect the transfer

Benefits of Using a Quitclaim Deed Form to Transfer Property to a Trust

Using a quitclaim deed form to transfer property to a trust can provide several benefits, including:

- Avoiding probate and reducing estate taxes

- Providing a clear and official record of the transfer

- Ensuring that the property is managed and distributed according to the grantor's wishes

5. Divorcing or Separating Spouses

Finally, a quitclaim deed form can be used in Nevada to transfer property between divorcing or separating spouses. This can be done when:

- A couple is getting divorced and needs to divide their property

- A couple is separating and needs to transfer property as part of their agreement

When using a quitclaim deed form to transfer property between divorcing or separating spouses, it's essential to:

- Ensure that the transfer is part of a larger agreement or settlement

- Obtain any necessary releases or approvals from affected parties

- Update the property's title to reflect the transfer

Benefits of Using a Quitclaim Deed Form for Divorcing or Separating Spouses

Using a quitclaim deed form to transfer property between divorcing or separating spouses can provide several benefits, including:

- Simplifying the division of property and reducing conflicts

- Providing a clear and official record of the transfer

- Ensuring that the property's title is accurate and up-to-date

We hope this article has provided you with a comprehensive understanding of the five ways to use a quitclaim deed form in Nevada. Whether you're transferring property to a family member, correcting a mistake in a previous deed, or dividing property between divorcing spouses, a quitclaim deed form can provide a clear and official record of the transfer.

If you have any questions or need further guidance, please don't hesitate to reach out. Share this article with others who may benefit from this information, and take the necessary steps to ensure that your property transfers are accurate, efficient, and stress-free.

What is a quitclaim deed form in Nevada?

+A quitclaim deed form in Nevada is a type of deed that transfers the grantor's interest in a property to the grantee without making any promises or guarantees about the property's title.

What are the benefits of using a quitclaim deed form in Nevada?

+The benefits of using a quitclaim deed form in Nevada include avoiding probate and reducing estate taxes, simplifying the transfer process and reducing costs, and providing a clear and official record of the transfer.

Can I use a quitclaim deed form to transfer property to a trust in Nevada?

+Yes, you can use a quitclaim deed form to transfer property to a trust in Nevada. However, it's essential to ensure that the trust is properly established and funded, and that you obtain any necessary releases or approvals from affected parties.