Maryland Form Mw507: Understanding The Tax Withholding Certificate

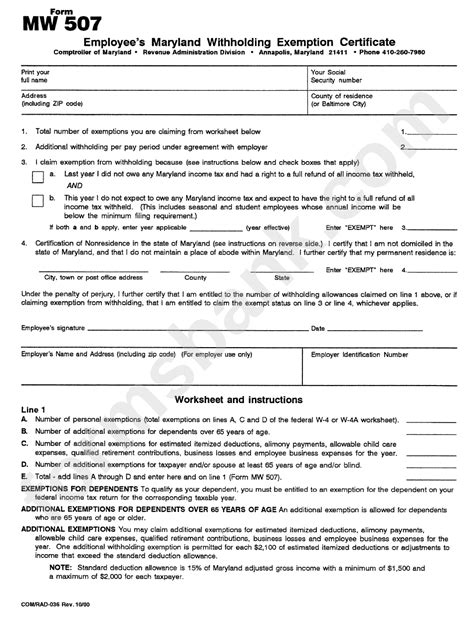

The Maryland Form MW507, also known as the Employee's Maryland Tax Withholding Exemption Certificate, is a crucial document for both employees and employers in the state of Maryland. The primary purpose of this form is to certify the amount of Maryland state income tax to be withheld from an employee's wages. Understanding the ins and outs of this form is essential for ensuring compliance with Maryland tax laws and avoiding potential penalties.

The Maryland Form MW507 is similar to the federal Form W-4, which is used to determine federal income tax withholding. However, the MW507 is specific to Maryland state income tax withholding. The form requires employees to provide information about their income, filing status, and number of exemptions claimed, which determines the amount of state income tax to be withheld from their wages.

Why is the Maryland Form MW507 Important?

The Maryland Form MW507 is crucial for several reasons:- Tax Compliance: The form ensures that employees and employers comply with Maryland tax laws and regulations. Failure to comply can result in penalties and fines.

- Accurate Withholding: The form helps employers withhold the correct amount of state income tax from an employee's wages, which prevents underpayment or overpayment of taxes.

- Employee Benefits: The form allows employees to claim exemptions and deductions, which can reduce the amount of state income tax withheld from their wages.

Who Needs to Complete the Maryland Form MW507?

All Maryland employees who earn wages subject to state income tax withholding are required to complete the Maryland Form MW507. This includes:

- New Employees: New employees must complete the form as part of the hiring process.

- Existing Employees: Existing employees may need to complete a new form if their tax status changes, such as getting married or having children.

- Employees with Multiple Jobs: Employees who have multiple jobs may need to complete multiple forms to ensure accurate withholding.

How to Complete the Maryland Form MW507

Completing the Maryland Form MW507 is a straightforward process that requires employees to provide basic information about their income, filing status, and number of exemptions claimed. Here's a step-by-step guide:- Section 1: Employee Information: Provide your name, address, and social security number.

- Section 2: Filing Status: Choose your filing status, such as single, married, or head of household.

- Section 3: Number of Exemptions: Claim the number of exemptions you are eligible for, such as personal exemptions or dependent exemptions.

- Section 4: Additional Withholding: Specify if you want to withhold an additional amount of state income tax from your wages.

Maryland Form MW507 Exemptions and Deductions

The Maryland Form MW507 allows employees to claim exemptions and deductions, which can reduce the amount of state income tax withheld from their wages. Here are some common exemptions and deductions:

- Personal Exemption: Claim a personal exemption for yourself and your spouse.

- Dependent Exemption: Claim an exemption for each dependent you claim on your tax return.

- Standard Deduction: Claim the standard deduction, which is a fixed amount that reduces your taxable income.

Common Mistakes to Avoid When Completing the Maryland Form MW507

When completing the Maryland Form MW507, it's essential to avoid common mistakes that can result in penalties or fines. Here are some mistakes to avoid:- Inaccurate Information: Ensure that the information you provide is accurate and up-to-date.

- Insufficient Exemptions: Claim all the exemptions you are eligible for to minimize state income tax withholding.

- Failure to Update: Update your form if your tax status changes, such as getting married or having children.

Maryland Form MW507 Deadlines and Penalties

The Maryland Form MW507 must be completed and submitted to your employer within a specific timeframe to avoid penalties. Here are the deadlines and penalties to keep in mind:

- New Employees: New employees must complete the form within 30 days of starting work.

- Existing Employees: Existing employees must update their form within 30 days of a change in tax status.

- Penalties: Failure to complete or update the form can result in penalties and fines.

Conclusion

The Maryland Form MW507 is a crucial document for both employees and employers in the state of Maryland. Understanding the ins and outs of this form is essential for ensuring compliance with Maryland tax laws and avoiding potential penalties. By following the guidelines outlined in this article, you can ensure that you complete the form accurately and on time.We hope this article has provided you with a comprehensive understanding of the Maryland Form MW507. If you have any questions or concerns, please don't hesitate to comment below. Share this article with your friends and colleagues to help them understand the importance of this form.

What is the purpose of the Maryland Form MW507?

+The Maryland Form MW507 is used to certify the amount of Maryland state income tax to be withheld from an employee's wages.

Who needs to complete the Maryland Form MW507?

+All Maryland employees who earn wages subject to state income tax withholding are required to complete the form.

What are the common mistakes to avoid when completing the Maryland Form MW507?

+Inaccurate information, insufficient exemptions, and failure to update the form are common mistakes to avoid.