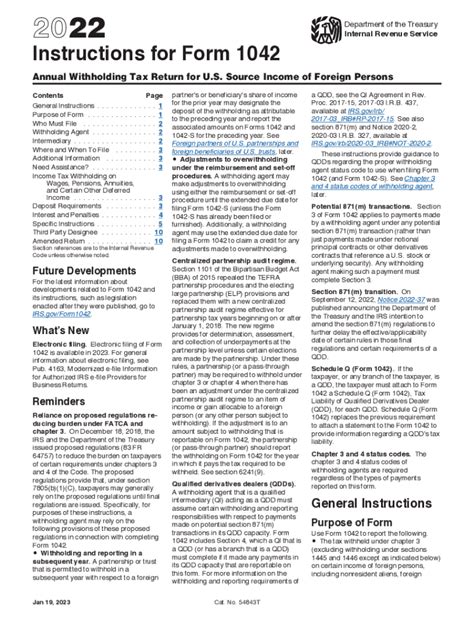

As a financial professional or individual dealing with international transactions, mastering Form 1042 instructions is crucial to ensure compliance with the IRS regulations. Form 1042, also known as the Annual Withholding Tax Return for U.S. Source Income of Foreign Persons, is a complex document that requires attention to detail and a thorough understanding of its instructions. In this article, we will break down the essential steps to master Form 1042 instructions, making it easier for you to navigate the process.

The importance of accurate Form 1042 instructions cannot be overstated. Failure to comply with the IRS regulations can result in penalties, fines, and even loss of business. Moreover, the IRS has been increasing its scrutiny of international transactions, making it more critical than ever to ensure accurate reporting. By mastering Form 1042 instructions, you can avoid costly mistakes, reduce the risk of audits, and maintain a good standing with the IRS.

To get started, it's essential to understand the purpose of Form 1042 and the types of income that are subject to reporting. Form 1042 is used to report U.S. source income earned by foreign persons, including interest, dividends, rents, and royalties. The form requires withholding agents to report the amount of tax withheld and the gross income earned by foreign persons.

Step 1: Understand the Types of Income Subject to Reporting

The first step to mastering Form 1042 instructions is to understand the types of income that are subject to reporting. The IRS requires withholding agents to report the following types of income:

- Interest earned on U.S. bank accounts and investments

- Dividends earned on U.S. stocks and mutual funds

- Rents earned on U.S. real estate and equipment

- Royalties earned on U.S. patents, copyrights, and trademarks

It's essential to note that not all types of income are subject to reporting on Form 1042. For example, wages earned by foreign persons are reported on Form W-2, not Form 1042.

Step 2: Determine the Withholding Agent's Responsibilities

The next step is to determine the withholding agent's responsibilities. A withholding agent is responsible for withholding tax on U.S. source income earned by foreign persons. The withholding agent is typically the payer of the income, such as a bank or a corporation.

The withholding agent's responsibilities include:

- Withholding tax on U.S. source income

- Reporting the amount of tax withheld on Form 1042

- Filing Form 1042 with the IRS by March 15th of each year

- Providing a copy of Form 1042 to the foreign person by March 15th of each year

Calculating the Withholding Tax

Calculating the withholding tax is a critical step in mastering Form 1042 instructions. The withholding tax rate depends on the type of income and the foreign person's tax status. The IRS provides a withholding tax table to help withholding agents determine the correct tax rate.

For example, the withholding tax rate for interest earned on U.S. bank accounts is 30%. However, if the foreign person is a resident of a country with a tax treaty with the U.S., the withholding tax rate may be reduced or eliminated.

Step 3: Complete Form 1042

Once you have determined the withholding agent's responsibilities and calculated the withholding tax, it's time to complete Form 1042. The form consists of several sections, including:

- Section 1: Withholding Agent's Information

- Section 2: Income Earned by Foreign Persons

- Section 3: Withholding Tax

- Section 4: Certification

It's essential to complete each section accurately and thoroughly. Any errors or omissions can result in penalties and fines.

Step 4: File Form 1042 with the IRS

The next step is to file Form 1042 with the IRS. The form must be filed by March 15th of each year. The IRS provides several options for filing Form 1042, including:

- Electronic filing through the IRS's online portal

- Paper filing by mail

- Filing through a tax professional or accounting firm

It's essential to ensure that the form is filed on time and accurately. Late filing or errors can result in penalties and fines.

Step 5: Provide a Copy of Form 1042 to the Foreign Person

The final step is to provide a copy of Form 1042 to the foreign person. The IRS requires withholding agents to provide a copy of the form to the foreign person by March 15th of each year.

It's essential to ensure that the copy is accurate and complete. Any errors or omissions can result in penalties and fines.

Conclusion

Mastering Form 1042 instructions requires attention to detail and a thorough understanding of the IRS regulations. By following the essential steps outlined in this article, you can ensure accurate reporting and avoid costly mistakes.

We invite you to share your thoughts and experiences with Form 1042 instructions in the comments section below. If you have any questions or need further clarification, please don't hesitate to ask.

What is Form 1042?

+Form 1042 is the Annual Withholding Tax Return for U.S. Source Income of Foreign Persons. It's used to report U.S. source income earned by foreign persons, including interest, dividends, rents, and royalties.

Who is responsible for filing Form 1042?

+The withholding agent is responsible for filing Form 1042. The withholding agent is typically the payer of the income, such as a bank or a corporation.

What is the deadline for filing Form 1042?

+The deadline for filing Form 1042 is March 15th of each year.