Managing client payments can be a time-consuming and frustrating task for many businesses. One way to simplify the process is by using a QuickBooks recurring payment authorization form. This form allows clients to grant permission for automatic payments, ensuring timely and hassle-free transactions.

Implementing a recurring payment system can significantly benefit businesses, especially those with subscription-based models or regular service contracts. By automating payments, companies can reduce administrative burdens, minimize late payment issues, and improve cash flow. In this article, we will explore the benefits, working mechanisms, and steps to create a QuickBooks recurring payment authorization form.

Benefits of Recurring Payment Authorization

Using a recurring payment authorization form in QuickBooks can bring numerous advantages to businesses, including:

- Reduced administrative tasks: Automating payments eliminates the need for manual invoicing and payment tracking.

- Improved cash flow: Regular, automatic payments ensure a steady stream of revenue.

- Enhanced customer experience: Clients appreciate the convenience and flexibility of recurring payments.

- Increased security: Electronic payments reduce the risk of lost or stolen checks.

How Recurring Payment Authorization Works

To set up a recurring payment authorization in QuickBooks, follow these steps:

- Create a recurring payment template: Design a template that outlines the payment terms, including the amount, frequency, and duration.

- Obtain client authorization: Have clients sign the recurring payment authorization form, granting permission for automatic payments.

- Set up automatic payments: Configure QuickBooks to process payments according to the agreed-upon schedule.

- Monitor and adjust: Regularly review payment activity and make adjustments as needed.

Creating a QuickBooks Recurring Payment Authorization Form

To create a recurring payment authorization form in QuickBooks, follow these steps:

- Go to the QuickBooks "Company" menu and select "Manage Company Files."

- Click on "Templates" and then "Payment Templates."

- Choose the "Recurring Payment" template and customize it according to your business needs.

- Save the template and have clients sign the authorization form.

Best Practices for Recurring Payment Authorization

To ensure smooth and secure recurring payments, follow these best practices:

- Clearly communicate payment terms: Ensure clients understand the payment schedule, amount, and duration.

- Obtain explicit authorization: Have clients sign the recurring payment authorization form to avoid any disputes.

- Monitor payment activity: Regularly review payment records to detect any issues or discrepancies.

- Provide transparent records: Maintain accurate and detailed payment records for clients and internal reference.

Common Mistakes to Avoid

When implementing a recurring payment authorization system, avoid the following common mistakes:

- Inadequate authorization: Failing to obtain explicit client authorization can lead to disputes and payment issues.

- Insufficient communication: Not clearly communicating payment terms can cause confusion and errors.

- Inaccurate record-keeping: Failing to maintain accurate payment records can lead to discrepancies and compliance issues.

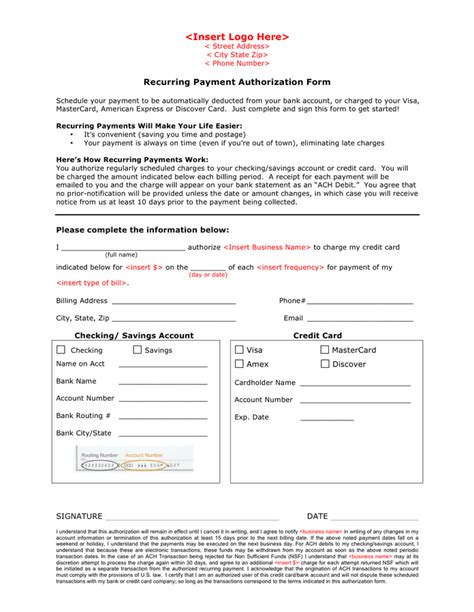

Recurring Payment Authorization Form Template

Here is a sample recurring payment authorization form template:

Recurring Payment Authorization Form

Client Information:

- Name: _____________

- Address: _____________

- Phone: ____________

- Email: _____________

Payment Information:

- Payment amount: $ ____________

- Payment frequency: ____________ (e.g., monthly, quarterly)

- Payment duration: ____________ (e.g., 12 months, ongoing)

Authorization:

I, ____________, hereby authorize ____________ to automatically charge my payment method for the agreed-upon amount on the scheduled dates.

Signature: ____________

Date: ____________

Conclusion

Implementing a recurring payment authorization system in QuickBooks can significantly streamline client payments, reducing administrative burdens and improving cash flow. By following the steps outlined in this article and avoiding common mistakes, businesses can create an efficient and secure payment process that benefits both parties. Take the first step towards simplifying your payment process today.

Do you have any questions or concerns about implementing a recurring payment authorization system in QuickBooks? Share your thoughts in the comments below.

What is a recurring payment authorization form?

+A recurring payment authorization form is a document that allows clients to grant permission for automatic payments, ensuring timely and hassle-free transactions.

How do I create a recurring payment template in QuickBooks?

+To create a recurring payment template in QuickBooks, go to the "Company" menu, select "Manage Company Files," click on "Templates," and then choose the "Recurring Payment" template.

What are some common mistakes to avoid when implementing a recurring payment authorization system?

+Common mistakes to avoid include inadequate authorization, insufficient communication, and inaccurate record-keeping.