As a taxpayer, understanding and complying with tax regulations can be overwhelming, especially when it comes to specific forms like the Form 15112. The Form 15112, also known as the "Revocation of Election" form, is a crucial document used by taxpayers to revoke certain elections made on their tax returns. In this article, we will provide a step-by-step guide to help taxpayers navigate the complexities of Form 15112.

Understanding the Purpose of Form 15112

Before we dive into the instructions, it's essential to understand the purpose of Form 15112. This form is used by taxpayers to revoke certain elections made on their tax returns, such as the election to be treated as a real estate investment trust (REIT) or the election to be treated as a regulated investment company (RIC). By revoking these elections, taxpayers can avoid certain tax implications or penalties associated with these elections.

Step 1: Determine If You Need to File Form 15112

The first step is to determine if you need to file Form 15112. This form is typically required when a taxpayer wants to revoke an election made on their tax return. To determine if you need to file Form 15112, review your previous tax returns and check if you made any elections that you now want to revoke. If you're unsure, consult with a tax professional or the IRS.

Step 2: Gather Required Information

Once you've determined that you need to file Form 15112, gather all the required information. This includes:

- Your name and taxpayer identification number (TIN)

- The type of election you're revoking (e.g., REIT or RIC)

- The tax year and period for which you're revoking the election

- The reason for revoking the election

Step 3: Complete Form 15112

With all the required information gathered, complete Form 15112. The form consists of several sections, including:

- Section 1: Taxpayer Information

- Section 2: Election Information

- Section 3: Reason for Revocation

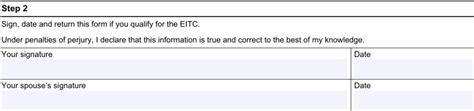

- Section 4: Signature

Make sure to fill out each section accurately and completely.

Step 4: Attach Supporting Documentation

Depending on the type of election you're revoking, you may need to attach supporting documentation to Form 15112. This can include:

- A copy of the original election form (e.g., Form 1120-REIT or Form 1120-RIC)

- A letter explaining the reason for revoking the election

- Any other relevant documentation

Step 5: File Form 15112

Once you've completed Form 15112 and attached all supporting documentation, file the form with the IRS. You can file the form electronically or by mail. If you're filing electronically, use the IRS's Electronic Filing System. If you're filing by mail, send the form to the address listed in the instructions.

Step 6: Follow Up

After filing Form 15112, follow up with the IRS to ensure that your revocation is processed correctly. You can check the status of your revocation by contacting the IRS or checking your account online.

Benefits of Filing Form 15112

Filing Form 15112 can have several benefits, including:

- Avoiding tax implications or penalties associated with certain elections

- Changing your tax status to reflect your current situation

- Correcting errors or inaccuracies on previous tax returns

Common Mistakes to Avoid

When filing Form 15112, there are several common mistakes to avoid, including:

- Failing to attach supporting documentation

- Inaccurately completing the form

- Filing the form too late or too early

Tips for Filing Form 15112

Here are some tips for filing Form 15112:

- Consult with a tax professional if you're unsure about the process

- Use the IRS's Electronic Filing System for faster processing

- Keep a copy of the form and supporting documentation for your records

Conclusion

Filing Form 15112 can be a complex process, but by following these step-by-step instructions, you can ensure that your revocation is processed correctly. Remember to gather all required information, complete the form accurately, and attach supporting documentation. By avoiding common mistakes and following these tips, you can successfully revoke your election and avoid tax implications or penalties.

We hope this article has been helpful in guiding you through the process of filing Form 15112. If you have any further questions or concerns, please don't hesitate to comment below.

What is Form 15112 used for?

+Form 15112 is used to revoke certain elections made on tax returns, such as the election to be treated as a real estate investment trust (REIT) or the election to be treated as a regulated investment company (RIC).

Do I need to file Form 15112 if I'm not revoking an election?

+No, you only need to file Form 15112 if you're revoking an election made on your tax return.