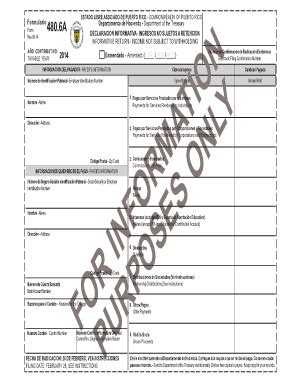

Puerto Rico, a US territory in the northeastern Caribbean, has a unique tax system that combines elements of both the United States and Latin America. One of the most important tax forms in Puerto Rico is the Form 480.6A, also known as the "Informative Return for Individuals and Estates". This form is used by individuals and estates to report their income and claim deductions and credits. In this article, we will explore five essential facts about Puerto Rico Form 480.6A that you need to know.

What is Puerto Rico Form 480.6A?

Puerto Rico Form 480.6A is an informative return that individuals and estates must file with the Puerto Rico Treasury Department (Hacienda) to report their income and claim deductions and credits. The form is similar to the US Form 1040, but it has some unique features that are specific to Puerto Rico.

Who Must File Form 480.6A?

Individuals and estates that are required to file a tax return with Hacienda must also file Form 480.6A. This includes:

- Residents of Puerto Rico who have income that is subject to taxation

- Non-residents who have income that is sourced in Puerto Rico

- Estates that have income that is subject to taxation

What is the Purpose of Form 480.6A?

The purpose of Form 480.6A is to provide information to Hacienda about an individual's or estate's income, deductions, and credits. The form is used to calculate the individual's or estate's tax liability and to determine whether they are eligible for any tax credits or deductions.

What Information is Reported on Form 480.6A?

Form 480.6A requires individuals and estates to report the following information:

- Income from all sources, including wages, salaries, tips, and self-employment income

- Deductions, including charitable donations, medical expenses, and mortgage interest

- Credits, including the earned income tax credit and the child tax credit

- Tax withholding, including withholding from wages and self-employment income

How to File Form 480.6A

Form 480.6A can be filed electronically or by mail. Individuals and estates who file electronically must use a certified tax software provider, such as TurboTax or H&R Block. Those who file by mail must submit the form and any required attachments to the Hacienda.

What are the Consequences of Not Filing Form 480.6A?

Failure to file Form 480.6A can result in penalties and interest. Individuals and estates who do not file the form may be subject to a penalty of up to 20% of the tax due, plus interest on the unpaid tax.

Additional Tips and Reminders

- Individuals and estates must keep accurate records of their income, deductions, and credits to ensure accurate reporting on Form 480.6A.

- The deadline for filing Form 480.6A is typically April 15th of each year.

- Individuals and estates can request an extension of time to file Form 480.6A by submitting Form 480.6A-1.

We hope this article has provided you with a comprehensive understanding of Puerto Rico Form 480.6A. If you have any questions or need further clarification, please don't hesitate to ask.

Call to Action If you're an individual or estate with tax obligations in Puerto Rico, it's essential to understand your responsibilities and obligations. Don't risk penalties and interest by not filing Form 480.6A. Consult with a tax professional or seek guidance from Hacienda to ensure you're in compliance with Puerto Rico's tax laws. Share your experiences or ask questions in the comments below.

FAQ Section

Who is required to file Form 480.6A?

+Individuals and estates who are required to file a tax return with Hacienda must also file Form 480.6A.

What is the deadline for filing Form 480.6A?

+The deadline for filing Form 480.6A is typically April 15th of each year.

Can I file Form 480.6A electronically?

+Yes, individuals and estates can file Form 480.6A electronically using a certified tax software provider.