As an employer, it's crucial to stay compliant with the latest tax regulations and filing requirements. One of the key forms you need to be familiar with is the Form IL-1000-E, which is used to report Illinois withholding income. In this article, we will delve into the essential facts about Form IL-1000-E, its importance, and how to file it accurately.

Illinois withholding income is a critical aspect of tax compliance, and understanding the intricacies of Form IL-1000-E is vital to avoid penalties and fines. In this article, we will cover the five essential facts about Form IL-1000-E, including its purpose, who needs to file, and the filing requirements.

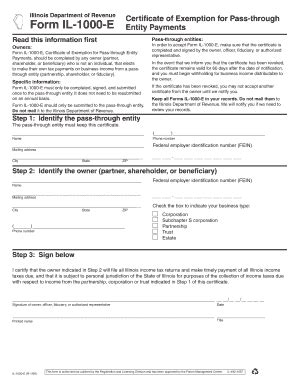

What is Form IL-1000-E?

Form IL-1000-E is an annual withholding income return used by employers to report the amount of Illinois income tax withheld from employee wages. The form is used to reconcile the amount of tax withheld and reported on employee W-2 forms with the amount of tax actually paid to the state. This form is essential for employers who have Illinois withholding income obligations.

Who Needs to File Form IL-1000-E?

Employers who have Illinois withholding income obligations are required to file Form IL-1000-E. This includes employers who:

- Have Illinois employees and withhold Illinois income tax from their wages

- Have a presence in Illinois and withhold Illinois income tax from non-resident employees

- Make payments to Illinois residents that are subject to withholding, such as rent, interest, or dividends

If you're an employer with Illinois withholding income obligations, you need to file Form IL-1000-E annually.

What Information is Required on Form IL-1000-E?

Form IL-1000-E requires employers to report the following information:

- The total amount of Illinois income tax withheld from employee wages

- The total amount of Illinois income tax paid to the state

- The reconciliation of the amount of tax withheld and reported on employee W-2 forms with the amount of tax actually paid to the state

- The employer's identification number and contact information

Employers must also attach supporting documentation, such as employee W-2 forms and withholding tax payment vouchers.

Filing Requirements for Form IL-1000-E

Form IL-1000-E is typically due on February 28th of each year, covering the preceding calendar year. Employers can file the form electronically or by mail.

- Electronic filing: Employers can file Form IL-1000-E electronically through the Illinois Department of Revenue's website.

- Paper filing: Employers can also file Form IL-1000-E by mail, using the address listed on the form.

Penalties for Late or Inaccurate Filing

Employers who fail to file Form IL-1000-E on time or accurately may be subject to penalties and fines. The Illinois Department of Revenue may assess penalties for:

- Late filing: Employers who file Form IL-1000-E after the due date may be subject to a penalty of up to 10% of the tax due.

- Inaccurate filing: Employers who file Form IL-1000-E with inaccurate information may be subject to a penalty of up to 20% of the tax due.

In addition to penalties, employers who fail to file Form IL-1000-E may also be subject to interest charges on the unpaid tax amount.

Best Practices for Filing Form IL-1000-E

To avoid penalties and fines, employers should follow best practices when filing Form IL-1000-E:

- File electronically: Electronic filing is faster and more accurate than paper filing.

- Verify information: Ensure that all information on the form is accurate and complete.

- Attach supporting documentation: Attach all required supporting documentation, such as employee W-2 forms and withholding tax payment vouchers.

- File on time: File Form IL-1000-E by the due date to avoid late filing penalties.

By following these best practices, employers can ensure accurate and timely filing of Form IL-1000-E.

Conclusion

Form IL-1000-E is an essential part of tax compliance for employers with Illinois withholding income obligations. By understanding the purpose, who needs to file, and the filing requirements, employers can ensure accurate and timely filing. Don't hesitate to reach out to a tax professional if you need assistance with filing Form IL-1000-E.

What are your thoughts on Form IL-1000-E? Share your experiences and tips for filing this form in the comments below!

What is the purpose of Form IL-1000-E?

+Form IL-1000-E is used by employers to report the amount of Illinois income tax withheld from employee wages.

Who needs to file Form IL-1000-E?

+Employers with Illinois withholding income obligations need to file Form IL-1000-E.

What is the due date for filing Form IL-1000-E?

+Form IL-1000-E is typically due on February 28th of each year, covering the preceding calendar year.