As a resident of Missouri, understanding your tax obligations is crucial to avoid any penalties or fines. The Missouri tax form 1040A is a simplified version of the standard 1040 form, designed for individuals with straightforward tax situations. In this article, we will guide you through the process of filling out the Missouri tax form 1040A, making it easier for you to file your state taxes accurately and efficiently.

Who Can Use the Missouri Tax Form 1040A?

The Missouri tax form 1040A is intended for residents with simple tax situations. You can use this form if you meet the following criteria:

- Your filing status is single, married filing jointly, married filing separately, head of household, or qualifying widow(er).

- You have only one source of income, such as a job or retirement account.

- You do not claim any dependents.

- You do not itemize deductions.

- You do not have any self-employment income or investments.

Benefits of Using the Missouri Tax Form 1040A

Using the Missouri tax form 1040A offers several benefits, including:

- Simplified filing process: The 1040A form has fewer lines and schedules to complete, making it easier to file your state taxes.

- Reduced paperwork: You do not need to attach additional schedules or forms, unless you have a specific situation that requires it.

- Faster processing: The 1040A form is typically processed faster than the standard 1040 form, which means you may receive your refund sooner.

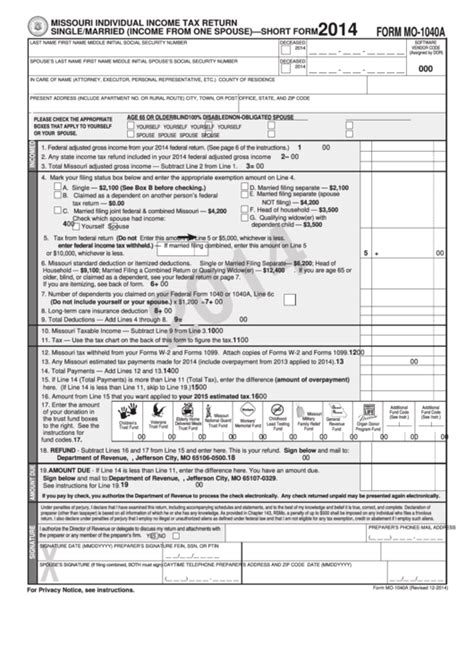

How to Fill Out the Missouri Tax Form 1040A

Filling out the Missouri tax form 1040A involves several steps. Here's a step-by-step guide to help you complete the form accurately:

Step 1: Gather Required Documents

Before starting to fill out the form, make sure you have the following documents:

- Your federal tax return (Form 1040)

- Your W-2 forms from all employers

- Your 1099 forms for interest, dividends, and capital gains

- Your Social Security number or Individual Taxpayer Identification Number (ITIN)

Step 2: Fill Out the Header Section

The header section includes your name, address, and Social Security number or ITIN. Make sure to fill out this section accurately, as any errors may delay processing.

Step 3: Report Your Income

Report your income from all sources, including:

- W-2 income from employers

- 1099 income from interest, dividends, and capital gains

- Retirement account income

Step 4: Claim Your Deductions

The Missouri tax form 1040A allows you to claim the standard deduction, which is a fixed amount that reduces your taxable income. You can also claim additional deductions, such as:

- Charitable contributions

- Medical expenses

- Mortgage interest

Step 5: Calculate Your Tax

Use the tax tables or calculator to determine your Missouri state tax liability. You can also use tax software to help with this step.

Tips and Reminders

Here are some tips and reminders to keep in mind when filling out the Missouri tax form 1040A:

- Make sure to sign and date the form.

- Attach any required supporting documents, such as W-2 forms.

- If you owe taxes, include a check or money order with your return.

- Consider e-filing your return for faster processing and a faster refund.

Common Mistakes to Avoid

When filling out the Missouri tax form 1040A, avoid the following common mistakes:

- Incorrect Social Security number or ITIN

- Incomplete or missing information

- Math errors or incorrect calculations

- Failure to sign and date the form

What to Do If You Need Help

If you need help filling out the Missouri tax form 1040A, consider the following resources:

- Missouri Department of Revenue website: Visit the Missouri Department of Revenue website for instructions, forms, and FAQs.

- Tax professionals: Consider hiring a tax professional to help with your return.

- Tax software: Use tax software to guide you through the filing process.

Conclusion and Next Steps

Filling out the Missouri tax form 1040A is a straightforward process, but it requires attention to detail and accuracy. By following these steps and tips, you can ensure a smooth and efficient filing experience. If you have any questions or concerns, consider seeking help from a tax professional or the Missouri Department of Revenue.

Now that you've completed the Missouri tax form 1040A, you're one step closer to filing your state taxes. Remember to stay organized, keep records, and plan for next year's tax season. Share your experiences and tips in the comments below, and help others navigate the world of state taxes.

What is the deadline for filing the Missouri tax form 1040A?

+The deadline for filing the Missouri tax form 1040A is typically April 15th, but it may vary depending on your specific situation. Check with the Missouri Department of Revenue for more information.

Can I e-file my Missouri tax form 1040A?

+Yes, you can e-file your Missouri tax form 1040A through the Missouri Department of Revenue website or through tax software. E-filing is faster and more convenient than mailing a paper return.

What if I owe taxes on my Missouri tax form 1040A?

+If you owe taxes on your Missouri tax form 1040A, you can pay online, by phone, or by mail. Make sure to include your payment with your return to avoid penalties and interest.