As a homebuyer, navigating the complex process of purchasing a property can be overwhelming. One crucial document that you'll encounter during this journey is the Form HUD-92544, also known as the Good Faith Estimate (GFE). In this article, we'll delve into the world of Form HUD-92544, explaining its significance, components, and benefits. By the end of this comprehensive guide, you'll be well-equipped to tackle the homebuying process with confidence.

The Importance of Form HUD-92544

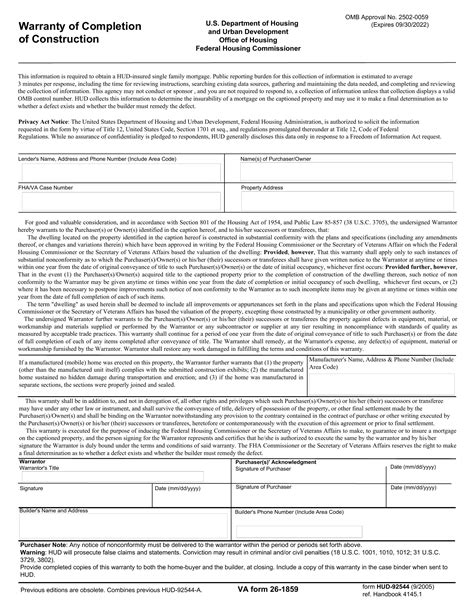

The Form HUD-92544 is a standardized document required by the Department of Housing and Urban Development (HUD) for all mortgage transactions. Its primary purpose is to provide homebuyers with a clear and transparent breakdown of the estimated costs associated with their loan. This document is a vital tool for homebuyers, as it helps them understand the terms of their mortgage and make informed decisions.

Components of Form HUD-92544

The Form HUD-92544 is divided into several sections, each providing essential information about the mortgage. The main components of this document include:

- Section 1: Origination Charges

- This section outlines the fees associated with originating the loan, such as the origination fee, discount points, and underwriting fee.

- Section 2: Title Charges and Escrow Fees

- This section breaks down the costs related to title insurance, escrow fees, and other title-related expenses.

- Section 3: Recording Fees and Other Charges

- This section details the fees associated with recording the deed and mortgage, as well as other charges such as appraisal fees and credit report fees.

- Section 4: Total Estimated Settlement Charges

- This section provides a comprehensive summary of all the estimated charges and fees associated with the loan.

- Section 5: Loan Terms

- This section outlines the essential terms of the loan, including the loan amount, interest rate, and repayment terms.

Benefits of Form HUD-92544

The Form HUD-92544 offers numerous benefits to homebuyers, including:

- Transparency: The document provides a clear and detailed breakdown of the estimated costs associated with the loan, enabling homebuyers to make informed decisions.

- Comparability: The standardized format of the Form HUD-92544 allows homebuyers to compare loan offers from different lenders, making it easier to choose the best option.

- Protection: The document helps protect homebuyers from unexpected fees and charges, ensuring that they're not caught off guard during the loan process.

How to Read and Understand Form HUD-92544

Reading and understanding the Form HUD-92544 can seem daunting, but with a little practice, you'll become proficient in no time. Here are some tips to help you navigate this document:

- Pay attention to the loan terms: Section 5 of the Form HUD-92544 outlines the essential terms of the loan, including the loan amount, interest rate, and repayment terms.

- Review the estimated charges: Sections 1-4 of the document provide a detailed breakdown of the estimated costs associated with the loan.

- Look for red flags: If you notice any unusual or excessive fees, be sure to question your lender and seek clarification.

Common Mistakes to Avoid

When reviewing the Form HUD-92544, it's essential to avoid common mistakes that can cost you money or lead to misunderstandings. Some common mistakes to avoid include:

- Failing to review the document carefully: Take the time to thoroughly review the Form HUD-92544, and don't hesitate to ask questions if you're unsure about any aspect of the loan.

- Ignoring the estimated charges: Make sure you understand the estimated costs associated with the loan, and factor them into your overall budget.

- Not comparing loan offers: Use the Form HUD-92544 to compare loan offers from different lenders, ensuring you choose the best option for your needs.

Conclusion

The Form HUD-92544 is a vital document in the homebuying process, providing homebuyers with a clear and transparent breakdown of the estimated costs associated with their loan. By understanding the components and benefits of this document, you'll be better equipped to navigate the complex world of mortgage lending. Remember to carefully review the Form HUD-92544, avoid common mistakes, and don't hesitate to seek clarification if you're unsure about any aspect of the loan.

Next Steps

Now that you've gained a deeper understanding of the Form HUD-92544, it's time to take the next step in your homebuying journey. Here are some actions you can take:

- Contact a lender: Reach out to a lender and request a Form HUD-92544 for your loan application.

- Review and compare loan offers: Use the Form HUD-92544 to compare loan offers from different lenders, ensuring you choose the best option for your needs.

- Seek professional advice: If you're unsure about any aspect of the loan or the Form HUD-92544, consider seeking advice from a qualified mortgage professional.

FAQ Section

What is the purpose of the Form HUD-92544?

+The Form HUD-92544 is a standardized document required by the Department of Housing and Urban Development (HUD) for all mortgage transactions. Its primary purpose is to provide homebuyers with a clear and transparent breakdown of the estimated costs associated with their loan.

What are the main components of the Form HUD-92544?

+The main components of the Form HUD-92544 include Section 1: Origination Charges, Section 2: Title Charges and Escrow Fees, Section 3: Recording Fees and Other Charges, Section 4: Total Estimated Settlement Charges, and Section 5: Loan Terms.

How can I use the Form HUD-92544 to compare loan offers?

+Use the Form HUD-92544 to compare loan offers from different lenders, paying attention to the estimated charges and loan terms. This will help you choose the best option for your needs.