The Public Service Loan Forgiveness (PSLF) program has been a beacon of hope for many borrowers who have dedicated their careers to public service. However, the application process can be daunting, with complex forms and strict eligibility requirements. To simplify the process, the fillable PSLF form has been introduced, making it easier for borrowers to apply for loan forgiveness.

What is the Public Service Loan Forgiveness (PSLF) Program?

The PSLF program is a federal program that offers loan forgiveness to borrowers who work in public service and meet specific eligibility requirements. The program was created in 2007 to encourage borrowers to pursue careers in public service, such as teaching, nursing, and government work. To qualify for PSLF, borrowers must have a qualifying loan, be employed by a qualifying employer, and make 120 qualifying payments.

Eligibility Requirements for PSLF

To be eligible for PSLF, borrowers must meet the following requirements:

- Have a qualifying loan: Borrowers must have a Direct Loan to qualify for PSLF. Other types of loans, such as Federal Family Education Loans (FFEL) and Perkins Loans, do not qualify.

- Be employed by a qualifying employer: Borrowers must be employed by a qualifying employer, such as a government agency, non-profit organization, or public school.

- Make 120 qualifying payments: Borrowers must make 120 qualifying payments while working for a qualifying employer.

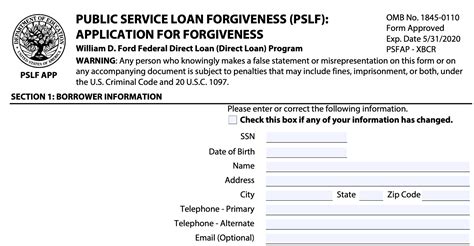

What is the Fillable PSLF Form?

The fillable PSLF form is a new application form that has been introduced to simplify the loan forgiveness process. The form is designed to be user-friendly and can be completed online. Borrowers can access the form on the Federal Student Aid website and submit it electronically.

Benefits of Using the Fillable PSLF Form

Using the fillable PSLF form has several benefits, including:

- Simplified application process: The form is designed to be easy to use and understand, making the application process simpler and faster.

- Reduced paperwork: The form is electronic, which means borrowers do not have to submit paper documents.

- Faster processing: The form is processed electronically, which means borrowers can receive a decision faster.

How to Complete the Fillable PSLF Form

To complete the fillable PSLF form, borrowers should follow these steps:

- Access the form on the Federal Student Aid website.

- Log in to your account using your FSA ID.

- Complete the form electronically.

- Submit the form online.

Common Mistakes to Avoid When Completing the Fillable PSLF Form

When completing the fillable PSLF form, borrowers should avoid the following common mistakes:

- Incomplete information: Make sure to complete all sections of the form.

- Inaccurate information: Double-check your information to ensure it is accurate.

- Missing documentation: Make sure to submit all required documentation.

What to Expect After Submitting the Fillable PSLF Form

After submitting the fillable PSLF form, borrowers can expect the following:

- Confirmation email: Borrowers will receive a confirmation email acknowledging receipt of their application.

- Processing time: The application will be processed electronically, and borrowers can expect a decision within 30-60 days.

- Approval or denial: Borrowers will receive an email notification of the decision, which will include instructions on next steps.

Conclusion

The fillable PSLF form has simplified the loan forgiveness application process for borrowers. By following the steps outlined above and avoiding common mistakes, borrowers can increase their chances of approval. If you are a borrower who is eligible for PSLF, take advantage of this opportunity to have your loans forgiven.What is the Public Service Loan Forgiveness (PSLF) program?

+The PSLF program is a federal program that offers loan forgiveness to borrowers who work in public service and meet specific eligibility requirements.

How do I complete the fillable PSLF form?

+To complete the fillable PSLF form, borrowers should access the form on the Federal Student Aid website, log in to their account using their FSA ID, complete the form electronically, and submit it online.

What happens after I submit the fillable PSLF form?

+After submitting the fillable PSLF form, borrowers can expect a confirmation email, processing time of 30-60 days, and a decision email that includes instructions on next steps.