The HUD Form 92051 is a crucial document in the mortgage industry, serving as the certificate of approval for condominiums and planned unit developments (PUDs) to participate in the Federal Housing Administration's (FHA) mortgage insurance programs. In this comprehensive guide, we will walk you through the intricacies of the HUD Form 92051, including the approval and certification process, benefits, and frequently asked questions.

Understanding the HUD Form 92051

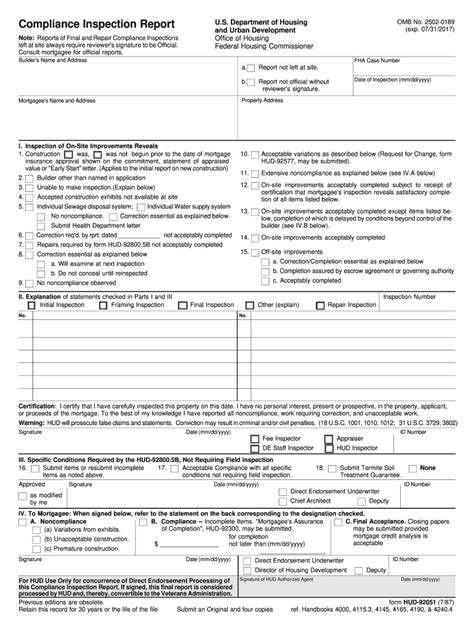

The HUD Form 92051 is a critical component in the condominium and PUD approval process. It certifies that the condominium or PUD project meets the FHA's requirements and guidelines, making it eligible for FHA mortgage insurance. The form is typically submitted by the condominium or PUD association, along with supporting documentation, to the FHA for review and approval.

Benefits of HUD Form 92051 Approval

Obtaining HUD Form 92051 approval offers numerous benefits for condominium and PUD associations, including:

- Increased marketability: FHA approval can make the condominium or PUD project more attractive to potential buyers, as it indicates that the project meets the FHA's strict guidelines.

- Access to FHA financing: With HUD Form 92051 approval, buyers can secure FHA-insured mortgages, which often offer more favorable terms, such as lower down payment requirements and competitive interest rates.

- Improved property values: FHA approval can contribute to increased property values, as it demonstrates that the condominium or PUD project meets rigorous standards.

The HUD Form 92051 Approval Process

The HUD Form 92051 approval process involves several steps, which are outlined below:

Step 1: Pre-Approval Review

Before submitting the HUD Form 92051, the condominium or PUD association should conduct a pre-approval review to ensure that the project meets the FHA's requirements. This review should include:

- Reviewing the condominium or PUD project's governing documents, such as the bylaws and CC&Rs (Covenants, Conditions & Restrictions)

- Verifying that the project is properly insured

- Ensuring that the project's financial statements are in order

Step 2: HUD Form 92051 Submission

Once the pre-approval review is complete, the condominium or PUD association can submit the HUD Form 92051, along with supporting documentation, to the FHA for review. The submission package should include:

- Completed HUD Form 92051

- Governing documents (bylaws, CC&Rs, etc.)

- Financial statements (balance sheet, income statement, etc.)

- Insurance certificates

- Other supporting documentation, as required

Step 3: FHA Review and Approval

The FHA will review the submission package to ensure that the condominium or PUD project meets its guidelines and requirements. If the project is approved, the FHA will issue a HUD Form 92051, certifying the project's eligibility for FHA mortgage insurance.

HUD Form 92051 Certification Process

Once the condominium or PUD project is approved, the FHA will issue a HUD Form 92051, certifying the project's eligibility for FHA mortgage insurance. The certification process typically involves:

- Reviewing the project's governing documents and financial statements to ensure compliance with FHA guidelines

- Conducting a site inspection to verify that the project meets FHA's property condition requirements

- Issuing the HUD Form 92051, which certifies the project's eligibility for FHA mortgage insurance

HUD Form 92051 Recertification

HUD Form 92051 certification is typically valid for a period of two years. To maintain certification, the condominium or PUD association must recertify the project every two years, or as required by the FHA. The recertification process typically involves submitting updated documentation, such as financial statements and insurance certificates, to the FHA for review.

Conclusion

Obtaining HUD Form 92051 approval and certification is a critical step for condominium and PUD associations seeking to participate in the FHA's mortgage insurance programs. By following the steps outlined in this guide, associations can navigate the approval and certification process with confidence. If you have any further questions or concerns, please do not hesitate to comment below or share this article with your peers.

What is the purpose of the HUD Form 92051?

+The HUD Form 92051 is a certificate of approval for condominiums and planned unit developments (PUDs) to participate in the Federal Housing Administration's (FHA) mortgage insurance programs.

What are the benefits of HUD Form 92051 approval?

+HUD Form 92051 approval offers numerous benefits, including increased marketability, access to FHA financing, and improved property values.

How long is the HUD Form 92051 certification valid?

+The HUD Form 92051 certification is typically valid for a period of two years, after which the condominium or PUD association must recertify the project.