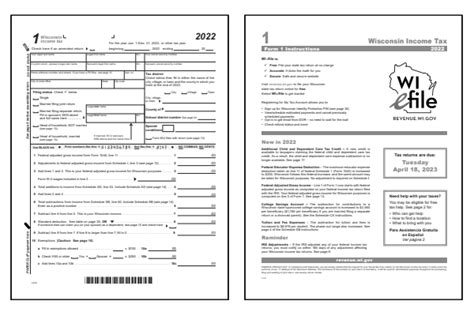

Filing taxes can be a daunting task, especially when it comes to navigating complex forms and regulations. In Wisconsin, the WI Tax Form 1 is a crucial document for individuals and businesses to report their income and claim deductions. To help you complete this form accurately and efficiently, we've broken down the process into 7 manageable steps.

Step 1: Gather Necessary Documents

Before starting the WI Tax Form 1, ensure you have all the necessary documents and information at your disposal. This includes:

- W-2 forms from your employer(s)

- 1099 forms for freelance or contract work

- Interest statements from banks and investments (1099-INT)

- Dividend statements (1099-DIV)

- Charitable donation receipts

- Medical expense receipts

- Any other relevant tax-related documents

Why is this step important?

Having all the necessary documents will save you time and reduce errors when completing the form. It's essential to review and organize your documents before starting the tax filing process.

Step 2: Determine Your Filing Status

Your filing status affects the tax rates and deductions you're eligible for. Wisconsin recognizes the following filing statuses:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

How to determine your filing status:

Review the Wisconsin Department of Revenue's guidelines to determine your filing status. If you're unsure, consult with a tax professional or contact the Wisconsin Department of Revenue for guidance.

Step 3: Report Income

Report all income earned during the tax year, including:

- Wages, salaries, and tips

- Self-employment income

- Interest and dividends

- Capital gains and losses

- Unemployment compensation

What to include:

- All income reported on W-2 and 1099 forms

- Self-employment income from Schedule C (Form 1040)

- Interest and dividends from Schedule B (Form 1040)

Step 4: Claim Deductions and Credits

Deductions and credits can significantly reduce your tax liability. Claim the following:

- Standard deduction or itemized deductions

- Personal exemptions

- Earned Income Tax Credit (EITC)

- Child Tax Credit

- Education credits

What to consider:

- Review the Wisconsin Department of Revenue's guidelines for deductions and credits

- Keep receipts and documentation for all deductions and credits claimed

Step 5: Complete Schedules and Attachments

Complete the necessary schedules and attachments, including:

- Schedule A (Itemized Deductions)

- Schedule B (Interest and Dividend Income)

- Schedule C (Business Income and Expenses)

- Schedule D (Capital Gains and Losses)

What to include:

- Complete the relevant schedules and attachments

- Attach supporting documentation, such as receipts and invoices

Step 6: Review and Sign the Form

Carefully review the WI Tax Form 1 for accuracy and completeness. Ensure you've signed and dated the form.

What to check:

- Review all entries for accuracy

- Ensure all necessary schedules and attachments are included

- Sign and date the form

Step 7: Submit the Form

Submit the completed WI Tax Form 1 to the Wisconsin Department of Revenue by the designated deadline.

What to do:

- Mail the form to the address listed on the Wisconsin Department of Revenue's website

- Submit the form electronically through the Wisconsin Department of Revenue's online portal

By following these 7 steps, you'll be able to complete the WI Tax Form 1 accurately and efficiently. Remember to stay organized, review the form carefully, and seek guidance if needed.

Now that you've completed the WI Tax Form 1, take a moment to share your experience and any tips you have for fellow taxpayers in the comments below. Don't forget to share this article with friends and family who may find it helpful.