The thrill of winning big on PrizePicks can be exhilarating, but as the tax season approaches, winners may start to wonder about the tax implications of their winnings. As a PrizePicks user, it's essential to understand the platform's 1099 form requirements to ensure you're in compliance with the IRS regulations. In this article, we'll break down the five ways to understand PrizePicks 1099 form requirements, so you can focus on what matters most - winning!

What is a 1099 Form, and Why is it Important?

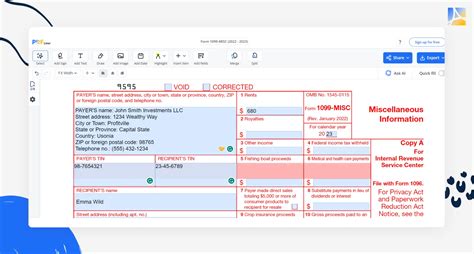

A 1099 form is a tax document used to report various types of income, including freelance work, interest, dividends, and, in this case, fantasy sports winnings. The IRS requires platforms like PrizePicks to issue 1099 forms to winners who exceed a certain threshold. This threshold is typically $600 or more in a calendar year. Understanding the 1099 form requirements is crucial, as it will help you report your winnings accurately on your tax return.

1. Understand the PrizePicks 1099 Form Threshold

To determine if you'll receive a 1099 form from PrizePicks, you need to understand the threshold. As mentioned earlier, the IRS requires PrizePicks to issue a 1099 form if your winnings exceed $600 in a calendar year. This means that if you win $601 or more on PrizePicks in a year, you can expect to receive a 1099 form. However, if your winnings are below this threshold, you won't receive a 1099 form, but you're still required to report your winnings on your tax return.

2. Know What's Reported on the 1099 Form

When you receive a 1099 form from PrizePicks, it will report the following information:

- Your name and address

- Your taxpayer identification number (TIN) or social security number (SSN)

- The amount of winnings you received from PrizePicks in a calendar year

- The type of income reported (in this case, "Other income" or "Prize and award income")

It's essential to review your 1099 form carefully to ensure the information is accurate. If you notice any discrepancies, contact PrizePicks' customer support immediately.

3. Understand the Tax Implications of Your Winnings

As a PrizePicks winner, you're required to report your winnings on your tax return. The tax implications of your winnings will depend on your individual tax situation. Generally, fantasy sports winnings are considered ordinary income and are subject to federal income tax withholding. You may also be required to pay state and local taxes on your winnings.

4. Keep Accurate Records of Your Winnings

To ensure you're in compliance with the IRS regulations, it's crucial to keep accurate records of your PrizePicks winnings. This includes:

- Dates and amounts of your winnings

- Corresponding 1099 forms (if applicable)

- Records of any taxes withheld or paid on your winnings

Keeping accurate records will help you report your winnings accurately on your tax return and avoid any potential issues with the IRS.

5. Seek Professional Tax Advice (If Necessary)

If you're unsure about the tax implications of your PrizePicks winnings or have complex tax situations, it's recommended to seek professional tax advice. A tax professional can help you navigate the tax laws and ensure you're in compliance with the IRS regulations.

In conclusion, understanding PrizePicks 1099 form requirements is essential to ensure you're in compliance with the IRS regulations. By knowing the threshold, what's reported on the 1099 form, and the tax implications of your winnings, you can focus on what matters most - winning! If you're unsure about any aspect of the tax laws, don't hesitate to seek professional tax advice.

Stay Ahead of the Game

We hope this article has helped you understand the PrizePicks 1099 form requirements. If you have any questions or concerns, please leave a comment below. Don't forget to share this article with your fellow PrizePicks enthusiasts to help them stay ahead of the game!

What is the threshold for receiving a 1099 form from PrizePicks?

+The threshold for receiving a 1099 form from PrizePicks is $600 or more in a calendar year.

What's reported on the 1099 form from PrizePicks?

+The 1099 form from PrizePicks reports your name and address, taxpayer identification number (TIN) or social security number (SSN), the amount of winnings you received from PrizePicks in a calendar year, and the type of income reported.

Are fantasy sports winnings subject to federal income tax withholding?

+Yes, fantasy sports winnings are generally considered ordinary income and are subject to federal income tax withholding.