Tax season can be a stressful time, especially when dealing with complex tax forms like the Form 3922. However, with the right tools and guidance, navigating the process can become much more manageable. If you're looking to report exercise of incentive stock options and need to file Form 3922, TurboTax can be a valuable resource. In this article, we'll walk you through the process of entering Form 3922 in TurboTax easily and accurately.

Understanding Form 3922

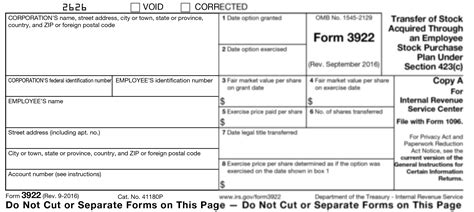

Before we dive into the process, let's take a moment to understand what Form 3922 is and why it's essential. Form 3922 is used to report the exercise of incentive stock options (ISOs) and the transfer of stock acquired through an employee stock purchase plan (ESPP). The form is typically provided by the employer and must be filed with the IRS by January 31st of each year.

Why is Form 3922 important? It helps the IRS track the exercise of ISOs and ESPPs, ensuring that employees are properly taxed on the income received. As an employee, it's crucial to accurately report this information to avoid any potential tax liabilities or penalties.

Preparing to Enter Form 3922 in TurboTax

Before entering Form 3922 in TurboTax, make sure you have the necessary information and documents:

- A copy of Form 3922 provided by your employer

- Your W-2 form

- Any other relevant tax documents

It's essential to review your Form 3922 carefully and ensure you understand the information reported. Take note of the following:

- The date of the transfer (Box 1)

- The number of shares transferred (Box 2)

- The fair market value of the shares on the date of transfer (Box 3)

- Any other relevant information reported on the form

Entering Form 3922 in TurboTax

Now that you have the necessary information, let's walk through the steps to enter Form 3922 in TurboTax:

Step 1: Open TurboTax and Select the Correct Form

- Open TurboTax and sign in to your account.

- Select the tax year you're reporting and click "Continue."

- Navigate to the "Wages & Income" section and click "Start" or "Revisit."

- Scroll down to the "Investments" section and click "Start" or "Revisit."

- Select "Stock Options" and click "Continue."

Step 2: Enter Form 3922 Information

- On the "Stock Options" page, click "Add a stock option transaction."

- Select "Form 3922" as the type of transaction and click "Continue."

- Enter the information from your Form 3922, including the date of transfer, number of shares, and fair market value.

- Click "Continue" to proceed.

Step 3: Review and Confirm the Information

- Review the information entered to ensure accuracy.

- Confirm that the information matches your Form 3922.

- Click "Continue" to proceed.

Tips for Accurate Entry

To ensure accurate entry of Form 3922 in TurboTax:

- Double-check the information on your Form 3922 and W-2.

- Use the correct dates and values.

- Review the TurboTax instructions carefully.

- Take your time and enter the information slowly and accurately.

Troubleshooting Common Issues

If you encounter issues while entering Form 3922 in TurboTax:

- Check the TurboTax support resources for guidance.

- Review the IRS instructions for Form 3922.

- Consult a tax professional if needed.

Conclusion

Entering Form 3922 in TurboTax can seem daunting, but with the right guidance, it can be a straightforward process. By following the steps outlined above and taking the time to review and confirm the information, you can ensure accurate entry and avoid potential tax liabilities. Remember to take advantage of TurboTax's support resources and consult a tax professional if needed.

What is Form 3922 used for?

+Form 3922 is used to report the exercise of incentive stock options (ISOs) and the transfer of stock acquired through an employee stock purchase plan (ESPP).

Who provides Form 3922?

+Form 3922 is typically provided by the employer.

What information do I need to enter Form 3922 in TurboTax?

+You'll need a copy of Form 3922, your W-2 form, and any other relevant tax documents.

Additional Resources

For more information on Form 3922 and TurboTax, visit the following resources:

- IRS Form 3922 Instructions

- TurboTax Support Resources

- Employee Stock Purchase Plan (ESPP) Information