Dealing with disputed transactions on your PNC bank account can be frustrating and overwhelming. Whether it's a unauthorized charge, incorrect posting, or a dispute with a merchant, navigating the dispute process can be a daunting task. However, with the right guidance, you can effectively resolve the issue and get your account back in order.

In this article, we will provide a comprehensive step-by-step guide on how to use the PNC dispute form to resolve disputed transactions. We will cover the importance of resolving disputes, the types of disputes that can be resolved using the PNC dispute form, and provide a detailed walkthrough of the dispute process.

Understanding the Importance of Resolving Disputes

Resolving disputed transactions on your PNC account is crucial for several reasons. Firstly, it ensures that your account is accurate and up-to-date, preventing any further errors or discrepancies. Secondly, it helps to protect your account from potential security threats, such as identity theft or unauthorized transactions. Finally, resolving disputes in a timely manner can help to prevent damage to your credit score and financial reputation.

Types of Disputes That Can Be Resolved Using the PNC Dispute Form

The PNC dispute form can be used to resolve a variety of disputes, including:

- Unauthorized transactions

- Incorrect postings

- Disputes with merchants

- ATM or debit card disputes

- Credit card disputes

Step 1: Gather Required Information

Before starting the dispute process, it's essential to gather all the necessary information. This includes:

- Your account number and type

- The date and amount of the disputed transaction

- A detailed description of the dispute

- Any supporting documentation, such as receipts or bank statements

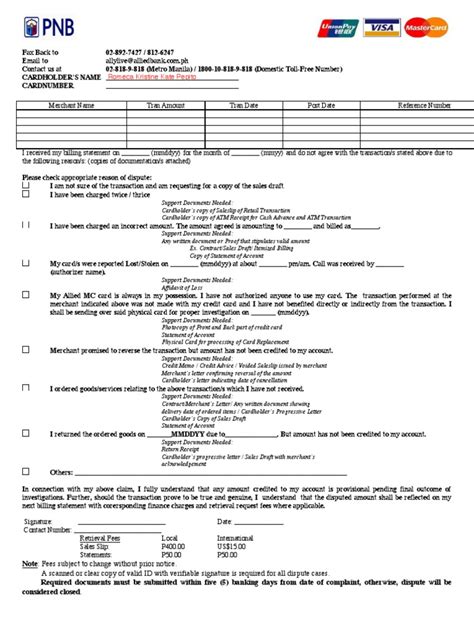

Step 2: Complete the PNC Dispute Form

The PNC dispute form can be obtained online or by visiting a PNC branch in person. Once you have the form, complete it carefully and accurately, making sure to provide all the required information. The form will typically ask for the following information:

- Your account information

- The details of the disputed transaction

- A description of the dispute

- Any supporting documentation

Step 3: Submit the Dispute Form

Once the form is complete, submit it to PNC for review. You can do this online, by mail, or in person at a PNC branch. Make sure to keep a copy of the form for your records.

Step 4: Wait for Review and Resolution

After submitting the dispute form, wait for PNC to review and resolve the issue. This may take several days or weeks, depending on the complexity of the dispute. You can track the status of your dispute online or by contacting PNC customer service.

Step 5: Follow Up

If the dispute is not resolved to your satisfaction, follow up with PNC to request further review. You can do this by phone, email, or mail. Make sure to provide any additional information or documentation that may be required to support your dispute.

Additional Tips and Considerations

- Make sure to act quickly when disputing a transaction, as there may be time limits for resolving disputes.

- Keep detailed records of all correspondence with PNC, including dates, times, and the names of representatives you speak with.

- Be prepared to provide additional information or documentation to support your dispute.

- If you are not satisfied with the resolution, consider escalating the issue to a supervisor or manager.

Conclusion

Resolving disputed transactions on your PNC account can be a complex and time-consuming process. However, by following the steps outlined in this guide, you can effectively resolve disputes and get your account back in order. Remember to act quickly, gather all necessary information, and follow up with PNC to ensure a successful resolution.

Take Action

If you have a disputed transaction on your PNC account, don't wait any longer to take action. Download the PNC dispute form today and start the resolution process.

FAQ Section

What types of disputes can be resolved using the PNC dispute form?

+The PNC dispute form can be used to resolve a variety of disputes, including unauthorized transactions, incorrect postings, disputes with merchants, ATM or debit card disputes, and credit card disputes.

How long does it take to resolve a dispute?

+The time it takes to resolve a dispute can vary depending on the complexity of the issue. It may take several days or weeks for PNC to review and resolve the dispute.

Can I dispute a transaction online?

+Yes, you can dispute a transaction online by submitting the PNC dispute form through the PNC website.