Moving to a new state can be overwhelming, especially when it comes to navigating the complexities of tax laws. As a military spouse, you may be eligible for a tax exemption in North Carolina, which can help alleviate some of the financial burdens associated with relocating. In this article, we will walk you through the process of obtaining the NC military spouse tax exemption form and provide you with a simple guide to understand the requirements and benefits.

Understanding the NC Military Spouse Tax Exemption

The NC military spouse tax exemption is a state-specific tax benefit that allows eligible military spouses to exclude their income from North Carolina state income tax. This exemption is designed to help alleviate the financial burdens associated with military service and relocation. To qualify for this exemption, military spouses must meet specific requirements, which we will outline below.

Eligibility Requirements

To be eligible for the NC military spouse tax exemption, you must meet the following requirements:

- Be the spouse of an active-duty military member

- Have a valid military identification card

- Be a resident of North Carolina

- Have income from a job or self-employment

- File a joint tax return with your military spouse

It's essential to note that the NC military spouse tax exemption only applies to state income tax, not federal income tax. You will still be required to file a federal tax return and pay federal income tax on your earnings.

Obtaining the NC Military Spouse Tax Exemption Form

To obtain the NC military spouse tax exemption form, you can follow these steps:

- Visit the North Carolina Department of Revenue website at .

- Click on the "Individuals" tab and select "Tax Forms" from the drop-down menu.

- Scroll down to the "Military" section and click on "Military Spouse Tax Exemption."

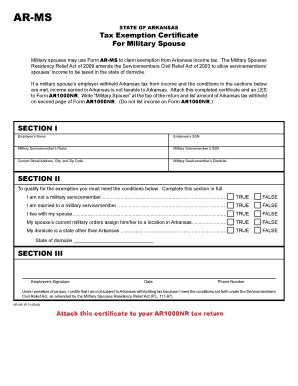

- Download and complete Form D-422, "Military Spouse Tax Exemption Certificate."

You will need to provide documentation to support your eligibility, including:

- A copy of your military spouse's identification card

- A copy of your marriage certificate

- Proof of North Carolina residency

Once you have completed the form and gathered the required documentation, you can submit it to the North Carolina Department of Revenue.

Benefits of the NC Military Spouse Tax Exemption

The NC military spouse tax exemption can provide significant financial benefits for eligible military spouses. By excluding your income from state income tax, you can reduce your tax liability and increase your take-home pay. This can be especially beneficial for military families who may be subject to multiple state tax jurisdictions due to frequent relocations.

How to Claim the NC Military Spouse Tax Exemption

To claim the NC military spouse tax exemption, you will need to follow these steps:

- File a joint tax return with your military spouse.

- Complete Form D-422, "Military Spouse Tax Exemption Certificate."

- Attach the completed form to your joint tax return.

- Submit your tax return to the North Carolina Department of Revenue.

It's essential to note that the NC military spouse tax exemption is only available for tax years in which you meet the eligibility requirements. You will need to reapply for the exemption each year to continue receiving the benefit.

Additional Resources

If you have questions or need additional assistance with the NC military spouse tax exemption, you can contact the North Carolina Department of Revenue at (877) 252-3052 or visit their website at .

You can also consult with a tax professional or financial advisor who is familiar with military tax benefits to ensure you are taking advantage of all the tax savings available to you.

Conclusion

The NC military spouse tax exemption is a valuable benefit that can help alleviate the financial burdens associated with military service and relocation. By understanding the eligibility requirements and following the steps outlined in this guide, you can take advantage of this exemption and reduce your state income tax liability. Remember to reapply for the exemption each year and consult with a tax professional or financial advisor if you have any questions or need additional assistance.

Don't forget to share this article with fellow military spouses who may be eligible for this benefit. If you have any questions or comments, please leave them below.

What is the NC military spouse tax exemption?

+The NC military spouse tax exemption is a state-specific tax benefit that allows eligible military spouses to exclude their income from North Carolina state income tax.

How do I obtain the NC military spouse tax exemption form?

+You can obtain the NC military spouse tax exemption form by visiting the North Carolina Department of Revenue website at and downloading Form D-422, "Military Spouse Tax Exemption Certificate."

What are the eligibility requirements for the NC military spouse tax exemption?

+To be eligible for the NC military spouse tax exemption, you must be the spouse of an active-duty military member, have a valid military identification card, be a resident of North Carolina, have income from a job or self-employment, and file a joint tax return with your military spouse.