In today's fast-paced digital world, managing employee salaries and benefits efficiently is crucial for any business. One of the most convenient and cost-effective ways to pay employees is through direct deposit. PNC Bank, a leading financial institution, offers a direct deposit service that enables employers to pay their employees quickly and securely. In this article, we will guide you through the process of obtaining a PNC direct deposit form for employers and provide valuable insights into the benefits and working mechanisms of this service.

What is a PNC Direct Deposit Form?

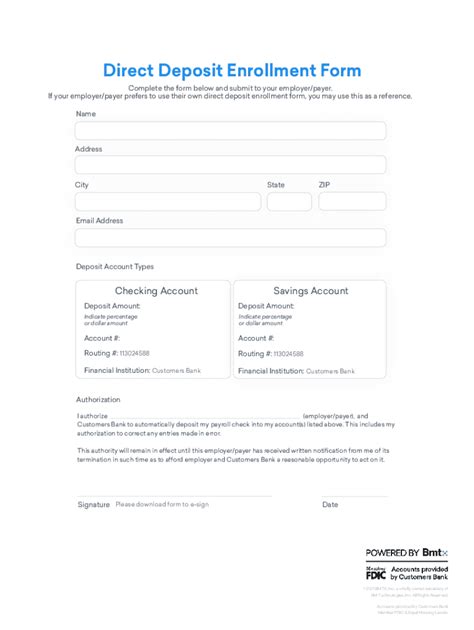

A PNC direct deposit form is a document that allows employers to set up direct deposit for their employees' paychecks. The form requires essential information, such as the employee's name, account number, routing number, and the amount to be deposited. By completing this form, employers can authorize PNC Bank to transfer funds directly into their employees' bank accounts.

Benefits of Using a PNC Direct Deposit Form

- Convenience: Direct deposit eliminates the need for paper checks, reducing the risk of lost or stolen checks.

- Time-saving: Employers can save time and effort by avoiding the need to print, sign, and distribute paper checks.

- Cost-effective: Direct deposit reduces the costs associated with printing and mailing paper checks.

- Security: Direct deposit transactions are secure and protected by the Automated Clearing House (ACH) network.

How to Obtain a PNC Direct Deposit Form

To obtain a PNC direct deposit form, employers can follow these steps:

- Visit the PNC Bank Website: Employers can visit the PNC Bank website () and navigate to the "Business" section.

- Search for Direct Deposit Forms: Employers can search for "direct deposit forms" or "employer direct deposit forms" on the PNC website.

- Download the Form: Employers can download the PNC direct deposit form in PDF format.

- Complete the Form: Employers must complete the form with the required information, including the employee's name, account number, routing number, and the amount to be deposited.

- Submit the Form: Employers can submit the completed form to PNC Bank via fax, email, or mail.

PNC Direct Deposit Form Requirements

- Employee's name and address

- Employee's account number and routing number

- Amount to be deposited

- Employer's name and address

- Employer's tax identification number (EIN)

Working Mechanisms of PNC Direct Deposit

The working mechanism of PNC direct deposit involves the following steps:

- Employer Initiation: Employers initiate the direct deposit process by completing the PNC direct deposit form and submitting it to PNC Bank.

- PNC Bank Processing: PNC Bank processes the direct deposit request and verifies the employee's account information.

- ACH Network: PNC Bank transmits the direct deposit transaction to the Automated Clearing House (ACH) network.

- Employee's Bank: The ACH network routes the transaction to the employee's bank, which credits the employee's account.

- Funds Availability: The funds are made available to the employee on the designated payday.

PNC Direct Deposit Security Features

- Encryption: PNC Bank uses encryption to protect sensitive information, such as account numbers and routing numbers.

- Authentication: PNC Bank authenticates the employer's identity and verifies the employee's account information.

- ACH Network Security: The ACH network provides an additional layer of security, protecting the transaction from unauthorized access.

Common Issues with PNC Direct Deposit

Common issues with PNC direct deposit include:

- Incorrect Account Information: Employers must ensure that the employee's account information is accurate to avoid rejected transactions.

- Insufficient Funds: Employers must ensure that they have sufficient funds in their account to cover the direct deposit amount.

- Technical Issues: Technical issues, such as network connectivity problems, can cause delays in the direct deposit process.

Troubleshooting PNC Direct Deposit Issues

- Contact PNC Bank Customer Support: Employers can contact PNC Bank's customer support team for assistance with resolving direct deposit issues.

- Verify Account Information: Employers must verify the employee's account information to ensure accuracy.

- Check for Technical Issues: Employers can check for technical issues, such as network connectivity problems, and resolve them promptly.

Best Practices for Using PNC Direct Deposit

Best practices for using PNC direct deposit include:

- Regularly Review Account Information: Employers should regularly review the employee's account information to ensure accuracy.

- Use Secure Communication Channels: Employers should use secure communication channels, such as encrypted email or fax, to transmit sensitive information.

- Monitor Direct Deposit Transactions: Employers should monitor direct deposit transactions to detect any errors or discrepancies.

By following these best practices, employers can ensure a smooth and secure direct deposit process using PNC Bank's direct deposit service.

Conclusion

In conclusion, PNC Bank's direct deposit service is a convenient and cost-effective way for employers to pay their employees. By obtaining a PNC direct deposit form and following the working mechanisms of direct deposit, employers can ensure a smooth and secure payment process. We encourage readers to share their experiences with PNC direct deposit and provide feedback on how to improve this service.

FAQ Section

What is the benefit of using PNC direct deposit?

+The benefit of using PNC direct deposit is that it eliminates the need for paper checks, reducing the risk of lost or stolen checks, and saves time and effort by avoiding the need to print, sign, and distribute paper checks.

How do I obtain a PNC direct deposit form?

+You can obtain a PNC direct deposit form by visiting the PNC Bank website, searching for "direct deposit forms" or "employer direct deposit forms," and downloading the form in PDF format.

What is the working mechanism of PNC direct deposit?

+The working mechanism of PNC direct deposit involves the employer initiating the direct deposit process, PNC Bank processing the request, transmitting the transaction to the ACH network, and the ACH network routing the transaction to the employee's bank.