Sales and use tax forms are an essential part of doing business in many states. These forms help businesses report and pay taxes on the sales they make, as well as on the goods and services they purchase. However, filling out these forms can be a daunting task, especially for small business owners or those who are new to the process.

Fortunately, there are several ways to fill out sales and use tax forms, and in this article, we will explore six of the most effective methods. Whether you're a seasoned business owner or just starting out, these tips will help you navigate the process with ease.

Understanding the Basics of Sales and Use Tax Forms

Before we dive into the ways to fill out sales and use tax forms, it's essential to understand the basics. Sales and use tax forms are used to report and pay taxes on the sales of goods and services, as well as on the goods and services purchased by a business.

There are two main types of sales and use tax forms: sales tax returns and use tax returns. Sales tax returns are used to report and pay taxes on the sales of goods and services, while use tax returns are used to report and pay taxes on the goods and services purchased by a business.

Method 1: Manual Filing

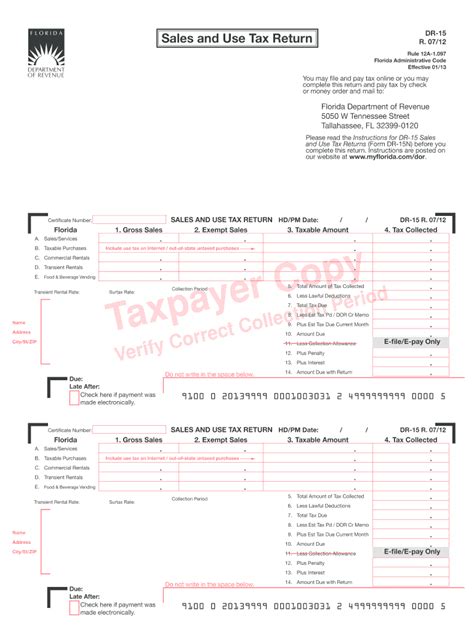

One of the most traditional ways to fill out sales and use tax forms is by manual filing. This method involves manually filling out the forms by hand or using a typewriter. This method can be time-consuming and prone to errors, but it's a cost-effective option for small businesses or those with simple tax needs.

To manually file sales and use tax forms, you'll need to obtain the necessary forms from your state's tax authority website or visit a local tax office. Once you have the forms, you can fill them out by hand or use a typewriter.

Tips for Manual Filing

- Make sure to use black ink and print clearly to avoid errors.

- Use a calculator to ensure accurate calculations.

- Keep a copy of your completed forms for your records.

Method 2: Online Filing

Online filing is a convenient and efficient way to fill out sales and use tax forms. Many states offer online filing options, which allow businesses to file their taxes electronically. This method reduces the risk of errors and saves time.

To file online, you'll need to create an account on your state's tax authority website. Once you have an account, you can log in and fill out the necessary forms. You'll need to provide your business information, sales data, and payment information.

Tips for Online Filing

- Make sure to create a strong password and keep it secure.

- Use a secure internet connection to protect your data.

- Take advantage of online resources and tutorials to help with the filing process.

Method 3: Tax Software

Tax software is another popular way to fill out sales and use tax forms. Tax software programs, such as QuickBooks or Xero, allow businesses to manage their finances and file their taxes electronically. These programs often include built-in tax forms and calculators, making it easier to file accurately.

To use tax software, you'll need to purchase a subscription or license. Once you have the software, you can input your business data and generate the necessary tax forms.

Tips for Using Tax Software

- Choose software that is compatible with your state's tax authority website.

- Take advantage of customer support and resources.

- Keep your software up to date to ensure compliance with changing tax laws.

Method 4: Outsourcing to a Tax Professional

Outsourcing to a tax professional is a great option for businesses that don't have the time or expertise to fill out sales and use tax forms. Tax professionals, such as CPAs or enrolled agents, have the knowledge and experience to navigate the complex tax laws and ensure compliance.

To outsource to a tax professional, you'll need to find a reputable and experienced professional. You can ask for referrals from colleagues or search online.

Tips for Outsourcing to a Tax Professional

- Choose a professional who is familiar with your state's tax laws.

- Provide clear and accurate information to ensure accurate filing.

- Ask questions and seek clarification if you're unsure about any part of the process.

Method 5: Using a Tax Preparation Service

Tax preparation services, such as H&R Block or Jackson Hewitt, offer a convenient and affordable way to fill out sales and use tax forms. These services often have experienced tax professionals who can guide you through the process and ensure compliance.

To use a tax preparation service, you'll need to visit a local office or schedule an appointment. Once you've provided the necessary information, the tax professional will prepare and file your taxes.

Tips for Using a Tax Preparation Service

- Choose a service that is familiar with your state's tax laws.

- Ask questions and seek clarification if you're unsure about any part of the process.

- Keep a copy of your completed forms for your records.

Method 6: Automating with Sales Tax Compliance Software

Sales tax compliance software, such as Avalara or TaxJar, is a modern and efficient way to fill out sales and use tax forms. These programs automate the tax filing process, reducing errors and saving time.

To use sales tax compliance software, you'll need to purchase a subscription or license. Once you have the software, you can input your business data and generate the necessary tax forms.

Tips for Using Sales Tax Compliance Software

- Choose software that is compatible with your state's tax authority website.

- Take advantage of customer support and resources.

- Keep your software up to date to ensure compliance with changing tax laws.

In conclusion, filling out sales and use tax forms doesn't have to be a daunting task. By choosing the right method for your business, you can ensure compliance and reduce errors. Whether you choose manual filing, online filing, tax software, outsourcing to a tax professional, using a tax preparation service, or automating with sales tax compliance software, there's a solution that's right for you.

Don't forget to comment below with your questions or experiences with filling out sales and use tax forms. Share this article with your colleagues or friends who may benefit from these tips.

What is the difference between sales tax and use tax?

+Sales tax is a tax on the sale of goods and services, while use tax is a tax on the goods and services purchased by a business.

How often do I need to file sales and use tax forms?

+The frequency of filing sales and use tax forms varies by state. Check with your state's tax authority to determine your filing schedule.

What are the penalties for not filing sales and use tax forms?

+The penalties for not filing sales and use tax forms vary by state, but can include fines, interest, and even business closure.