As a business owner, you're likely familiar with the numerous forms and filings required by the government. One such form is the Form 940, which is used to report annual federal unemployment (FUTA) tax. In this article, we'll explore the ins and outs of Form 940, its importance, and how to complete it easily online.

What is Form 940?

Form 940, also known as the Employer's Annual Federal Unemployment (FUTA) Tax Return, is a yearly report filed by employers to the Internal Revenue Service (IRS). The form is used to calculate and report the FUTA tax liability for the previous year. FUTA tax is a federal tax that funds state unemployment insurance programs, which provide financial assistance to workers who lose their jobs through no fault of their own.

Who Needs to File Form 940?

Most employers are required to file Form 940 annually, including:

- Businesses with employees who are subject to FUTA tax

- Non-profit organizations with employees

- Government agencies with employees

- Household employers with a total cash wages of $1,000 or more in any calendar quarter

- Agricultural employers with a total cash wages of $20,000 or more in any calendar quarter

Importance of Filing Form 940

Filing Form 940 is crucial for several reasons:

- Compliance with federal law: Failing to file Form 940 can result in penalties, fines, and interest on unpaid taxes.

- Accurate tax calculation: Form 940 helps employers calculate their FUTA tax liability, ensuring they pay the correct amount of taxes.

- Record-keeping: Form 940 serves as a record of an employer's FUTA tax payments, which can be useful for future reference.

How to Complete Form 940 Easily Online

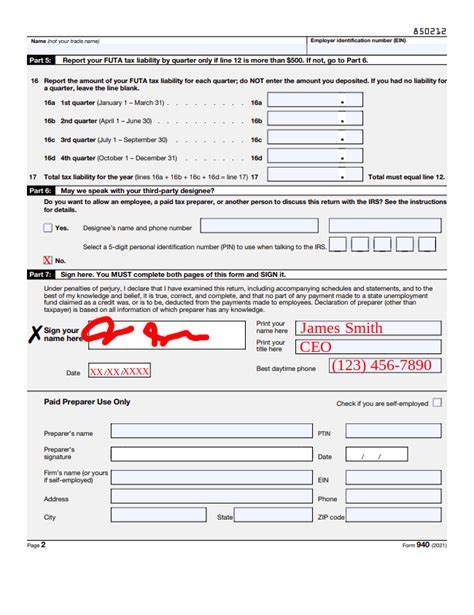

While Form 940 can be completed manually, filing online is a more efficient and accurate way to report your FUTA tax liability. Here's a step-by-step guide to completing Form 940 online:

- Gather necessary information: Before starting the filing process, gather the following information:

- Employer Identification Number (EIN)

- Total wages paid to employees

- Total FUTA tax paid

- State unemployment tax rate (if applicable)

- Choose an online filing platform: The IRS offers free online filing options, including the Electronic Federal Tax Payment System (EFTPS) and the IRS Online Account. You can also use third-party tax software, such as TurboTax or QuickBooks.

- Create an account or log in: If you're using the IRS Online Account or EFTPS, create an account or log in to your existing account.

- Fill out Form 940: Follow the online prompts to fill out Form 940. You'll need to provide the necessary information gathered in step 1.

- Calculate FUTA tax liability: The online platform will calculate your FUTA tax liability based on the information provided.

- Submit Form 940: Once you've completed the form, submit it online. You'll receive a confirmation email or receipt.

Tips for Filing Form 940 Online

- File on time: The deadline for filing Form 940 is January 31st of each year. Filing on time can help avoid penalties and interest.

- Double-check information: Ensure the information provided is accurate and complete to avoid errors or delays.

- Take advantage of online resources: The IRS and online filing platforms offer resources and support to help with the filing process.

Common Mistakes to Avoid When Filing Form 940

- Inaccurate or incomplete information: Double-check the information provided to avoid errors or delays.

- Missing deadlines: File Form 940 on time to avoid penalties and interest.

- Incorrect calculation: Use the online platform's calculation tool to ensure accurate FUTA tax liability.

Benefits of Filing Form 940 Online

- Convenience: Filing online is quick and easy, saving you time and effort.

- Accuracy: Online platforms help reduce errors and ensure accurate calculations.

- Security: Online filing platforms provide secure and encrypted transmission of sensitive information.

Conclusion

Filing Form 940 is a crucial task for employers, and doing it online is a convenient and accurate way to report your FUTA tax liability. By following the steps outlined in this article, you can complete Form 940 easily online and avoid common mistakes. Remember to file on time, double-check information, and take advantage of online resources to ensure a smooth filing process.

If you have any questions or concerns about Form 940 or the filing process, feel free to comment below or share this article with others who may find it helpful.

What is the deadline for filing Form 940?

+The deadline for filing Form 940 is January 31st of each year.

Who is required to file Form 940?

+Most employers are required to file Form 940, including businesses with employees, non-profit organizations, government agencies, household employers, and agricultural employers.

Can I file Form 940 manually?

+Yes, you can file Form 940 manually, but filing online is a more efficient and accurate way to report your FUTA tax liability.