As a homeowner, receiving a 1098 tax form from your lender is a crucial part of the tax filing process. However, deciphering the information on this form can be overwhelming, especially for those who are new to homeownership or have never received a 1098 before. In this article, we will break down the Planet Home Lending 1098 tax form, explaining its importance, the information it contains, and how to use it to claim mortgage interest deductions on your tax return.

What is a 1098 Tax Form?

A 1098 tax form is a document provided by your lender that shows the amount of mortgage interest you paid on your primary residence or secondary home during the tax year. This form is essential for homeowners who itemize their deductions on their tax return, as it allows them to claim a deduction for the mortgage interest paid.

Why is the 1098 Tax Form Important?

The 1098 tax form is important because it provides the necessary information for homeowners to claim a mortgage interest deduction on their tax return. This deduction can significantly reduce your taxable income, resulting in a lower tax bill. Additionally, the 1098 form also reports other information, such as mortgage insurance premiums and points paid, which may be deductible.

What Information is Included on the 1098 Tax Form?

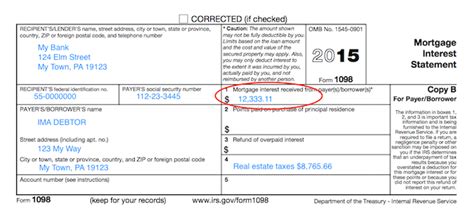

The Planet Home Lending 1098 tax form typically includes the following information:

- Lender's name and address: The name and address of your lender, which is Planet Home Lending in this case.

- Borrower's name and address: Your name and address as the borrower.

- Property address: The address of the property for which the mortgage interest was paid.

- Mortgage interest paid: The total amount of mortgage interest paid on the property during the tax year.

- Mortgage insurance premiums: The total amount of mortgage insurance premiums paid on the property during the tax year.

- Points paid: The total amount of points paid on the property during the tax year.

Understanding the Boxes on the 1098 Tax Form

The 1098 tax form has several boxes that contain specific information. Here's a breakdown of what each box typically includes:

- Box 1: Mortgage interest paid

- Box 2: Mortgage insurance premiums paid

- Box 3: Points paid

- Box 4: Other information, such as the lender's federal ID number

How to Use the 1098 Tax Form to Claim Mortgage Interest Deductions

To claim mortgage interest deductions on your tax return, follow these steps:

- Gather your 1098 forms: Collect all your 1098 forms from your lender, including the Planet Home Lending 1098.

- Complete Form 1040: Fill out Form 1040, which is the standard form for personal income tax returns.

- Itemize your deductions: Choose to itemize your deductions on Schedule A (Form 1040).

- Report mortgage interest: Report the mortgage interest paid, as shown on your 1098 forms, on Line 8 of Schedule A.

- Claim mortgage insurance premiums: If you paid mortgage insurance premiums, report them on Line 13 of Schedule A.

- Claim points paid: If you paid points, report them on Line 12 of Schedule A.

Tips and Reminders

- Keep your 1098 forms safe: Store your 1098 forms in a safe place, as you will need them to claim mortgage interest deductions on your tax return.

- Verify the information: Check the information on your 1098 forms for accuracy, including the lender's name, borrower's name, and property address.

- Consult a tax professional: If you're unsure about how to claim mortgage interest deductions or have complex tax situations, consult a tax professional.

Conclusion

Understanding your Planet Home Lending 1098 tax form is crucial for claiming mortgage interest deductions on your tax return. By following the steps outlined in this article, you can ensure you're taking advantage of the tax savings available to you. Remember to keep your 1098 forms safe, verify the information, and consult a tax professional if needed.

FAQ Section:

What is the purpose of the 1098 tax form?

+The 1098 tax form is used to report the amount of mortgage interest paid on a primary residence or secondary home during the tax year.

What information is included on the 1098 tax form?

+The 1098 tax form typically includes the lender's name and address, borrower's name and address, property address, mortgage interest paid, mortgage insurance premiums, and points paid.

How do I claim mortgage interest deductions on my tax return?

+To claim mortgage interest deductions, gather your 1098 forms, complete Form 1040, itemize your deductions on Schedule A, and report the mortgage interest paid, mortgage insurance premiums, and points paid on the corresponding lines.