Completing a Pennsylvania estate inventory form is a crucial step in the probate process, ensuring that the estate's assets are accurately accounted for and distributed according to the deceased's wishes or state laws. This task can be daunting, especially for those who are unfamiliar with the process. However, with a clear understanding of the requirements and a step-by-step approach, you can successfully complete the form and move forward with the estate's administration.

Understanding the Pennsylvania Estate Inventory Form

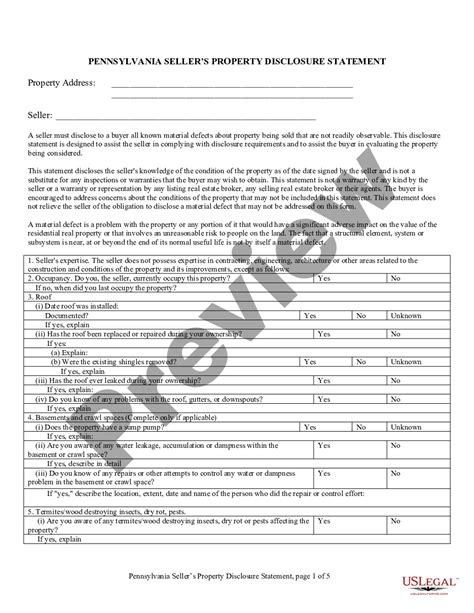

The Pennsylvania estate inventory form, also known as the "Decedent's Estate Information" or "Inventory of Estate," is a document that requires the executor or personal representative to list all of the deceased's assets, including real estate, personal property, and financial assets. The form is typically filed with the Register of Wills or the Orphans' Court in the county where the deceased lived.

Why is the Estate Inventory Form Important?

The estate inventory form serves several purposes:

- It provides a detailed account of the estate's assets, which helps to ensure that all assets are distributed according to the deceased's wishes or state laws.

- It helps to identify any outstanding debts or liabilities that need to be paid.

- It facilitates the calculation of inheritance taxes and other estate taxes.

Step 1: Gather Required Documents and Information

Before completing the estate inventory form, you will need to gather various documents and information, including:

- The deceased's will, if they had one

- Death certificate

- Identification documents, such as a driver's license or passport

- Financial statements, including bank accounts, investments, and retirement accounts

- Real estate deeds and titles

- Personal property appraisals, if necessary

- Outstanding debt and liability information

Tips for Gathering Information

- Review the deceased's financial records and statements to identify all assets and liabilities.

- Contact financial institutions and creditors to confirm account balances and outstanding debts.

- Consider hiring a professional appraiser to value real estate and personal property.

Step 2: Complete the Estate Inventory Form

Once you have gathered all necessary documents and information, you can begin completing the estate inventory form. The form will require you to list all of the deceased's assets, including:

- Real estate

- Personal property, such as vehicles, jewelry, and artwork

- Financial assets, including bank accounts, investments, and retirement accounts

- Outstanding debts and liabilities

Common Mistakes to Avoid

- Failing to list all assets, including small or insignificant items

- Overvaluing or undervaluing assets

- Failing to account for outstanding debts and liabilities

Step 3: Calculate the Estate's Total Value

After completing the estate inventory form, you will need to calculate the estate's total value. This involves adding up the value of all assets and subtracting any outstanding debts and liabilities.

Factors to Consider

- The value of assets may fluctuate over time, so it's essential to use current values.

- You may need to consult with a professional appraiser or accountant to ensure accurate valuations.

Step 4: File the Estate Inventory Form

Once you have completed and calculated the estate's total value, you will need to file the estate inventory form with the Register of Wills or the Orphans' Court in the county where the deceased lived.

Filing Requirements

- The form must be filed within a specified timeframe, typically 9-12 months after the deceased's passing.

- You may need to pay a filing fee, which varies by county.

Step 5: Distribute the Estate's Assets

After filing the estate inventory form, you can begin distributing the estate's assets according to the deceased's wishes or state laws.

Considerations for Distribution

- You may need to pay inheritance taxes and other estate taxes before distributing assets.

- You should consider consulting with a professional, such as an attorney or accountant, to ensure compliance with state laws and regulations.

By following these 5 steps, you can successfully complete the Pennsylvania estate inventory form and ensure that the estate's assets are distributed according to the deceased's wishes or state laws.

What is the purpose of the estate inventory form?

+The estate inventory form provides a detailed account of the estate's assets, which helps to ensure that all assets are distributed according to the deceased's wishes or state laws.

What documents do I need to gather to complete the estate inventory form?

+You will need to gather various documents, including the deceased's will, death certificate, identification documents, financial statements, and real estate deeds and titles.

How do I calculate the estate's total value?

+You will need to add up the value of all assets and subtract any outstanding debts and liabilities. You may need to consult with a professional appraiser or accountant to ensure accurate valuations.