Employers who pay state or federal unemployment taxes are required to file Form 940, the Employer's Annual Federal Unemployment (FUTA) Tax Return, with the IRS. Additionally, they must also file Schedule A, which provides detailed information about the state unemployment taxes paid. In this article, we will delve into the Form 940 Schedule A filing instructions and requirements.

Why is Form 940 Schedule A Important?

The IRS requires employers to file Form 940 to report their federal unemployment tax liability. However, this form does not capture the state unemployment taxes paid by employers. That's where Schedule A comes in. By filing Schedule A, employers provide a detailed breakdown of the state unemployment taxes they paid during the year. This information is crucial for the IRS to verify the accuracy of the federal unemployment tax liability reported on Form 940.

Who Needs to File Form 940 Schedule A?

Employers who pay state or federal unemployment taxes are required to file Form 940 and Schedule A. This includes:

- Employers who paid wages of $1,500 or more in any calendar quarter, or

- Employers who had one or more employees who worked at least some part of a day in each of 20 different weeks in the calendar year.

Form 940 Schedule A Filing Requirements

To file Schedule A, employers must provide the following information:

- State unemployment tax rates: Employers must report the state unemployment tax rates they paid during the year.

- State unemployment tax paid: Employers must report the total amount of state unemployment taxes paid during the year.

- State unemployment tax credit: Employers may claim a credit for state unemployment taxes paid. The credit is limited to the amount of state unemployment taxes paid, but not to exceed 5.4% of the employer's FUTA tax liability.

Form 940 Schedule A Filing Instructions

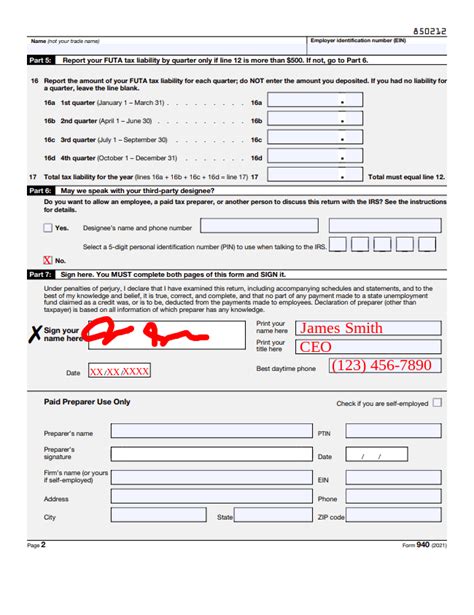

To file Schedule A, employers must follow these steps:

- Complete Form 940: Employers must first complete Form 940, reporting their federal unemployment tax liability.

- Complete Schedule A: Employers must then complete Schedule A, providing the required information about state unemployment taxes paid.

- Attach Schedule A to Form 940: Employers must attach Schedule A to Form 940 and submit both forms to the IRS.

Common Errors to Avoid When Filing Form 940 Schedule A

When filing Form 940 Schedule A, employers must avoid common errors, such as:

- Inaccurate state unemployment tax rates: Employers must ensure that they report the correct state unemployment tax rates.

- Incorrect state unemployment tax paid: Employers must accurately report the total amount of state unemployment taxes paid.

- Overclaiming state unemployment tax credit: Employers must ensure that they do not overclaim the state unemployment tax credit.

Penalties for Late or Inaccurate Filing of Form 940 Schedule A

Employers who fail to file Form 940 Schedule A on time or inaccurately report state unemployment taxes paid may face penalties and interest. The IRS may assess a penalty of up to 5% of the unpaid taxes for each month or part of a month, up to a maximum of 25%.

Best Practices for Filing Form 940 Schedule A

To ensure accurate and timely filing of Form 940 Schedule A, employers should follow these best practices:

- Keep accurate records: Employers must maintain accurate records of state unemployment taxes paid.

- Verify state unemployment tax rates: Employers must verify the state unemployment tax rates they report.

- Consult with a tax professional: Employers may want to consult with a tax professional to ensure accurate filing of Form 940 Schedule A.

Conclusion

Filing Form 940 Schedule A is a critical requirement for employers who pay state or federal unemployment taxes. By following the filing instructions and requirements, employers can ensure accurate and timely reporting of state unemployment taxes paid. Employers who fail to file Form 940 Schedule A on time or inaccurately report state unemployment taxes paid may face penalties and interest. To avoid common errors and ensure accurate filing, employers should follow best practices, such as keeping accurate records and verifying state unemployment tax rates.

We encourage you to share your thoughts and experiences with filing Form 940 Schedule A in the comments section below. If you have any questions or concerns, feel free to ask. We are here to help.

Frequently Asked Questions

Do I need to file Form 940 Schedule A if I am a small business owner?

Yes, you need to file Form 940 Schedule A if you are a small business owner who pays state or federal unemployment taxes.

What is the deadline for filing Form 940 Schedule A?

The deadline for filing Form 940 Schedule A is typically January 31st of each year.

Can I e-file Form 940 Schedule A?

Yes, you can e-file Form 940 Schedule A through the IRS website or through a tax software provider.

What are the penalties for late or inaccurate filing of Form 940 Schedule A?

The penalties for late or inaccurate filing of Form 940 Schedule A can range from 5% to 25% of the unpaid taxes, depending on the severity of the error.

How do I correct errors on Form 940 Schedule A?

You can correct errors on Form 940 Schedule A by filing an amended return, Form 940-X.

Do I need to file Form 940 Schedule A if I am a small business owner?

+Yes, you need to file Form 940 Schedule A if you are a small business owner who pays state or federal unemployment taxes.

What is the deadline for filing Form 940 Schedule A?

+The deadline for filing Form 940 Schedule A is typically January 31st of each year.

Can I e-file Form 940 Schedule A?

+Yes, you can e-file Form 940 Schedule A through the IRS website or through a tax software provider.

What are the penalties for late or inaccurate filing of Form 940 Schedule A?

+The penalties for late or inaccurate filing of Form 940 Schedule A can range from 5% to 25% of the unpaid taxes, depending on the severity of the error.

How do I correct errors on Form 940 Schedule A?

+You can correct errors on Form 940 Schedule A by filing an amended return, Form 940-X.