If you're one of the millions of Americans who claim the Earned Income Tax Credit (EITC), you're likely familiar with Form 8862. This form is required by the IRS to verify your identity and ensure you're eligible for the EITC. If you're using TurboTax to file your taxes, attaching Form 8862 can seem daunting, but don't worry, we've got you covered. In this article, we'll walk you through the process of attaching Form 8862 to TurboTax easily and accurately.

Why Do I Need to Attach Form 8862 to TurboTax?

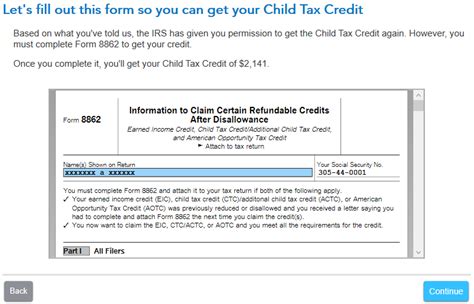

Form 8862, also known as the Information to Claim Earned Income Tax Credit After Disallowance, is a crucial document that verifies your identity and confirms your eligibility for the EITC. If you've claimed the EITC in the past and were audited or had your credit denied, you may need to complete Form 8862 to prove your eligibility.

The IRS requires you to attach Form 8862 to your tax return if you're claiming the EITC and:

- You were previously audited and denied the EITC

- You were previously denied the EITC due to a math error or incomplete information

- You're claiming the EITC for the first time

Gathering Required Information

Before you start attaching Form 8862 to TurboTax, make sure you have all the required information. You'll need:

- Your Social Security number or Individual Taxpayer Identification Number (ITIN)

- Your spouse's Social Security number or ITIN (if married filing jointly)

- Your dependent's Social Security number or ITIN (if claiming the EITC for a dependent)

- Your previous year's tax return (if you're claiming the EITC for the first time)

- Proof of income, such as W-2 forms or 1099 forms

Step-by-Step Guide to Attaching Form 8862 to TurboTax

Now that you have all the required information, it's time to attach Form 8862 to TurboTax. Follow these steps:

- Log in to your TurboTax account: Go to the TurboTax website and log in to your account. If you don't have an account, create one and start your tax return.

- Select the correct tax year: Choose the tax year for which you're claiming the EITC.

- Navigate to the EITC section: Click on the "Credits" tab and select "Earned Income Tax Credit (EITC)".

- Answer the EITC questions: TurboTax will ask you a series of questions to determine if you're eligible for the EITC. Answer these questions honestly and accurately.

- Upload Form 8862: Once you've completed the EITC questions, TurboTax will prompt you to upload Form 8862. Click on the "Upload Form 8862" button and select the completed form from your computer.

- Review and submit: Review your tax return and Form 8862 to ensure everything is accurate and complete. Submit your tax return and wait for the IRS to process it.

Tips and Tricks for Attaching Form 8862 to TurboTax

Attaching Form 8862 to TurboTax can be a breeze if you follow these tips and tricks:

- Make sure you have all required information: Before starting the process, ensure you have all the required information, including your Social Security number, proof of income, and dependent information.

- Use the correct form: Use the correct version of Form 8862 for your tax year. You can download the form from the IRS website or use TurboTax's built-in form.

- Double-check your answers: Double-check your answers to the EITC questions to ensure you're eligible for the credit.

- Upload the correct form: Make sure you upload the completed Form 8862 and not a blank or incomplete form.

Common Mistakes to Avoid When Attaching Form 8862 to TurboTax

When attaching Form 8862 to TurboTax, avoid these common mistakes:

- Uploading an incomplete form: Make sure you complete Form 8862 accurately and upload the completed form.

- Using the wrong form: Use the correct version of Form 8862 for your tax year.

- Missing required information: Ensure you have all required information, including your Social Security number and proof of income.

- Not reviewing your tax return: Review your tax return and Form 8862 to ensure everything is accurate and complete.

Conclusion

Attaching Form 8862 to TurboTax can seem daunting, but by following these steps and tips, you can ensure an easy and accurate process. Remember to gather all required information, use the correct form, and double-check your answers. If you're unsure about any part of the process, consider consulting a tax professional or contacting the IRS directly.

Frequently Asked Questions

What is Form 8862?

+Form 8862 is a document required by the IRS to verify your identity and confirm your eligibility for the Earned Income Tax Credit (EITC).

Do I need to attach Form 8862 to TurboTax?

+If you're claiming the EITC and were previously audited or denied the credit, you may need to attach Form 8862 to your tax return.

How do I upload Form 8862 to TurboTax?

+Log in to your TurboTax account, navigate to the EITC section, and click on the "Upload Form 8862" button. Select the completed form from your computer and follow the prompts.