Winning a significant prize in the Pennsylvania Lottery can be a thrilling experience, but it also comes with tax obligations. The PA Lottery W2G form is a crucial document that lottery winners must fill out to report their winnings to the Internal Revenue Service (IRS). In this article, we will explore five ways to fill out the PA Lottery W2G form, making it easier for winners to navigate the process.

Understanding the PA Lottery W2G Form

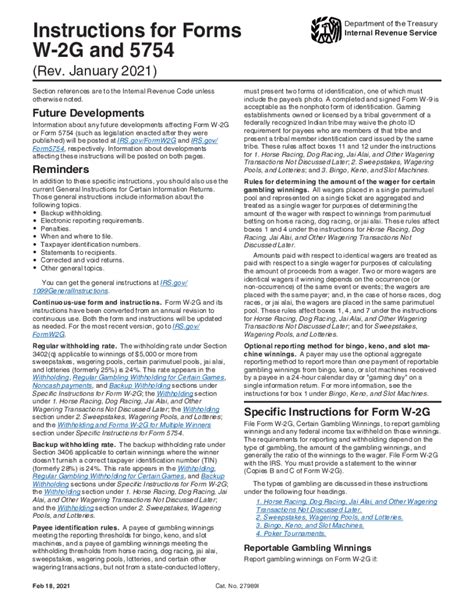

The PA Lottery W2G form, also known as the Certain Gambling Winnings form, is used to report lottery winnings that exceed a certain threshold. The form is typically provided by the Pennsylvania Lottery Commission, and winners must fill it out accurately to avoid any delays or penalties.

Who Needs to Fill Out the PA Lottery W2G Form?

Not all lottery winners need to fill out the PA Lottery W2G form. The IRS requires winners to report their winnings if they exceed $600. However, the Pennsylvania Lottery Commission may require winners to fill out the form for smaller prizes, depending on the specific game and rules.

5 Ways to Fill Out the PA Lottery W2G Form

Filling out the PA Lottery W2G form can seem daunting, but it's a straightforward process. Here are five ways to fill out the form accurately:

1. Gather Required Information

Before filling out the form, make sure you have all the necessary information. This includes:

- Your name and address

- Social Security number or Individual Taxpayer Identification Number (ITIN)

- The type of lottery game you played

- The date and amount of your winnings

- The Pennsylvania Lottery Commission's identification number

What If You Don't Have the Required Information?

If you're missing any of the required information, contact the Pennsylvania Lottery Commission or the IRS for assistance. You can also consult with a tax professional to ensure you're filling out the form correctly.

2. Choose the Correct Form

There are different versions of the PA Lottery W2G form, depending on the type of lottery game you played. Make sure you're using the correct form to avoid any delays or penalties.

3. Fill Out the Form Accurately

Fill out the form accurately and legibly. Make sure to include all the required information, and double-check your math calculations.

What If You Make a Mistake?

If you make a mistake on the form, don't panic. Simply correct the error and re-file the form with the Pennsylvania Lottery Commission.

4. Report Your Winnings

Report your winnings accurately on the form. Make sure to include the correct date and amount of your winnings.

5. Keep a Copy of the Form

Keep a copy of the completed form for your records. You may need to refer to it when filing your tax return.

What Happens After You Fill Out the PA Lottery W2G Form?

After you fill out the PA Lottery W2G form, the Pennsylvania Lottery Commission will review it to ensure accuracy. They will then report your winnings to the IRS and provide you with a copy of the form.

Conclusion

Filling out the PA Lottery W2G form is a crucial step in reporting your lottery winnings to the IRS. By following these five ways to fill out the form, you can ensure accuracy and avoid any delays or penalties. Remember to keep a copy of the completed form for your records, and don't hesitate to seek assistance if you have any questions or concerns.

What is the PA Lottery W2G form?

+The PA Lottery W2G form is a document used to report lottery winnings to the IRS.

Who needs to fill out the PA Lottery W2G form?

+Lottery winners who exceed a certain threshold, typically $600, need to fill out the form.

What information do I need to fill out the PA Lottery W2G form?

+You'll need your name and address, Social Security number or ITIN, the type of lottery game you played, the date and amount of your winnings, and the Pennsylvania Lottery Commission's identification number.